Cosmopolitan Civil Societies: An Interdisciplinary Journal

Vol. 15, No. 3

2023

ARTICLE (REFEREED)

Diversionary Post-Coal Politics in South Africa: A Chinese Solar-Powered Industrial Zone Controversy

Patrick Bond

University of Johannesburg Centre for Social Change, Johannesburg, South Africa

Corresponding author: University of Johannesburg Centre for Social Change, Cnr Kingsway & University Roads, Auckland Park, Johannesburg, 2092, South Africa, pbond@mail.ngo.za

DOI: https://doi.org/10.5130/ccs.v15.i3.8864

Article History: Received 14/10/2023; Revised 26/12/2023; Accepted 09/02/2024; Published 28/03/2024

Citation: Bond, P. 2023. Diversionary Post-Coal Politics in South Africa: A Chinese Solar-Powered Industrial Zone Controversy. Cosmopolitan Civil Societies: An Interdisciplinary Journal, 15:3, 110–130. https://doi.org/10.5130/ccs.v15.i3.8864

Abstract

In September 2021 at a United Nations climate summit in New York, Xi Jinping announced that there would be no further Chinese coal-fired power plants along the Belt and Road Initiative, which stretches as far as South Africa. Instead, the Chinese operator of South Africa’s single largest Special Economic Zone proposal – in rural Makhado – and his local allies suggested that solar power could supply energy for the $10 billion project, including high-emissions industrial projects. This raised the question of whether firms engaged in mining, smelting, processing and other carbon-intensive activities would pick ‘low-hanging fruits’ within the renewable energy sector (instead of that power going into the grid for broader consumption). Their incentive is to do so, in order to safeguard the so-called Minerals-Energy Complex from Western climate sanctions – threatened, on grounds of high CO2-inputs to export products including steel, aluminium and petrochemicals. In spite of a 2022 United Nations Development Programme endorsement of the project, social and environmental resistance has intensified, but the introduction of solar power for high-emissions metal manufacturing presents a special challenge. Two techniques associated with ecological modernisation – natural capital accounting and the Social Cost of Carbon – may prove relevant to civil society critics of ‘extractivism’, in shifting the narrative further across space, time and scale.

Keywords

Climate Justice; Coal; Solar; South Africa; Special Economic Zone

Introduction

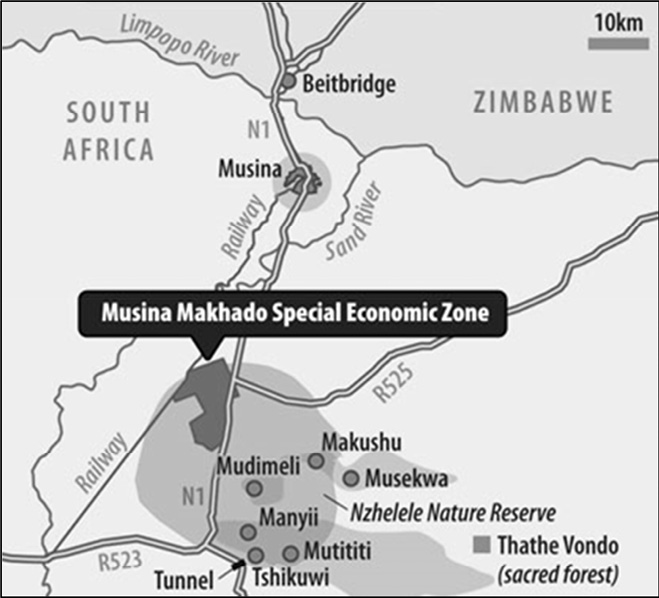

The difficulty of forging a post-carbon political project is no more evident than in a South Africa where community, environmental and other social movements have found themselves compelled to partially celebrate the Chinese government’s 2021 intervention against international coal-fired power plant financing, on the one hand. On the other, they remain profoundly opposed to the replacement strategy for coal, namely high-intensity solar electricity generation, which in a particularly important case, will power a major industrial, minerals-beneficiation complex near the northern border with Zimbabwe (Figure 1). The Musina-Makhado Special Economic Zone (MMSEZ) proposed for Limpopo Province would be South Africa’s most ambitious industrialisation project ever, with potential investment valued at $10 billion.

Figure 1. Musina-Makhado Special Economic Zone near the SA-Zimbabwe border

But the MMSEZ has been bound up in intense controversies. Civil society opposition to high-carbon mega-projects, including offshore oil and gas drilling, left minerals and energy minister Gwede Mantashe so furious that he accused critics of having U.S. Central Intelligence Agency connections (Nyathi 2023). In reality, the agenda of climate justice activists (D’Sa & Bond 2021) – as witnessed in many protest sites and also courtrooms – has, contrary to Mantashe’s assertion, been decidedly opposed to mainly Western-imperialist state and corporate interests. But there are also Chinese sub-imperialist interests active in South Africa that feed local minerals and metals into a global value chain rife with super-exploitation (Bond 2021).

The MMSEZ debate takes the contradictions to a new height, because an allegedly post-coal industrial development project has far greater implications beyond Limpopo Province, given that many multinational corporate firms operating in South Africa are increasingly aware that inclement Western climate sanctions on trade require them to embed clean energy in their export products. The sanctions take the form of a Carbon Border Adjustment Mechanism which was launched in Europe in 2023, and which in 2026 will include punitive tariffs against high-carbon imports. In late 2023, British leaders announced similar tariffs on imported steel, starting in 2027. The result, already, is a desperate search for solar power augmentation or even replacement of coal-fired generation, by major transnational corporations within the Energy Intensive Users Group (EIUG), led by BHP Billiton, Sasol, Arcelor Mittal and others.

The EIUG’s 27 member companies consume 42 percent of South Africa’s electricity while generating only 21 percent of GDP. According to the Department of Energy’s (2016, p.88) record of energy demand, industrial users – mining, iron and steel, chemicals, non-ferrous metals, non-metallic minerals, pulp and paper, food and tobacco, and other manufacturing – alone use more than 40 percent of South Africa’s electricity: ‘The largest of these consumers is iron and steel at ~27 percent of the total energy used by the sector, followed by mining which consumes ~26 percent. Within the industrial sector, most energy is used for process heating. In energy intensive industrial sub-sectors such as iron and steel and chemicals, process heating accounts for 90 percent and 88 percent respectively of total energy consumed.’ (Process heating includes agglomeration, sintering, calcining, curing and forming, drying, forming, fluid heating, melting, heat treating, incineration, thermal oxidation, metals reheating, separating and smelting.)

As for the economic benefits resulting from such high industrial consumption of scarce electricity, when the EIUG asserts that its firms generate 21 percent of GDP, this is in reality a vast exaggeration, if we consider more realistic net measurements of EIUG contributions to the country’s wealth and future generations’ interests. Given that corporate reinvestment of extractive-industry profits in productive, human and financial capital within South Africa is currently below the value of the depleted minerals, future generations would logically advocate slowing current extraction of non-renewable resources, so there are more left for sensible utilisation.

Indeed, the EIUG is responsible for draining the country’s economic wealth given that deep mining, smelting and process heating are net-negative activities once broader socio-ecological-economic factors are calculated and a longer timeframe is adopted. According to the World Bank, dating to at least 2012, both the depletion of South Africa’s ‘natural capital’ – especially non-renewable mineral resource wealth – and the associated local pollution and greenhouse gas emissions have resulted in a below-zero outcome in what is a (very conservative) assessment of ‘Adjusted Net Savings’ (ANS), i.e., Gross National Income (GNI) corrected for environmental and other factors, as shown in Figure 2. As discussed below, this net negative contribution to wealth measured as ANS should be incorporated into any cost-benefit analysis.

Figure 2. Adjusted net savings (% of GNI), 1970-2021: world (top) and South Africa (bottom)

Source: https://data.worldbank.org/indicator/NY.ADJ.SVNG.GN.ZS?view=chart&locations=ZA-1W

Special Economic Zone supporters and critics

This article makes such assessments in relation to what is advertised as the largest Special Economic Zone in South Africa, at the far northern tip of the country. Like others, it would be anchored by a China-funded facility, in this case centred on metals manufacturing. The smaller, northern part of the MMSEZ corridor is just 50 km from the Zimbabwean border post of Beit Bridge, on the outskirts of the city of Musina (a site of ancient copper works). Just under 100 km south, is the rural Makhado section that Chinese entrepreneur Ning Yat Hoi and his Shenzhen Hoi Mor Resources Holding Company chose for an 8000-hectare mega-project, bordering the main highway heading north.

After an initial period of unconstrained hype, there have been many more recent controversies associated with the MMSEZ. In 2018, South African president Cyril Ramaphosa co-chaired the Forum on China-Africa Cooperation along with Chinese leader Xi Jinping, announcing the project in highly glorified terms, along with a further $1.1 billion loan from the Bank of China for South African SEZs. As reported in the Times:

The deal would include the construction of a 4‚600MW coal-fired power plant over six years and a cement production plant over three years. It would also include investments in stainless steel plants and ferro-chromium/manganese plants. Limpopo premier Stan Mathabatha‚ who is part of the delegation accompanying Ramaphosa in Beijing‚ said the investment was worth around $10-billion. ‘It’s beneficial to the people of South Africa as a whole because this special economic zone is going to employ a maximum of about 21‚000 people‚ it covers a space of 60km‚ and the companies that we’ve signed with are big companies‚ they are conglomerates‚ all of them from China’‚ said Mathabatha. ‘But we’re starting to see other South African companies coming on board. For example‚ we’ve got Coal of Africa here with us as part of the delegation led by the president.’ (Mokone 2018)

The South African minister of trade and industry, Rob Davies, signed the agreement (DTI 2018) in spite of Ning having spent much of 2017-18 (unsuccessfully) defending himself in court from corporate fraud charges in both Zimbabwe and Britain. He was even on the Interpol ‘Red List’ – about which the DTI claimed ignorance (Allix 2018). Further controversies arose over anticipated MMSEZ damage to local residents and ecotourism. Several thousand Environmental Impact Assessment (EIA) complaints were filed in 2020-23, since vast amounts of local pollution as well as greenhouse gas emissions would emanate from the industrial plants. These emissions would be far beyond limits agreed to in the South African government’s official Nationally Determined Contributions to cutting emissions mandated in the 2015 Paris Climate Agreement. Moreover, water for the MMSEZ’s guzzling plants was not immediately available, and so would require an international transfer from deep aquifers in water-starved western Zimbabwe and Botswana. While displacement of Limpopo residents was a relatively minor consideration, nevertheless substantial political, social and environmental resistance rose. By 2022, the initially-proposed coal-fired power plant was derailed, in part also due to Xi’s September 2021 announcement to the United Nations General Assembly, ending Chinese-built BRI coal-fired power plants.

But even without that facility, many other sources of MMSEZ greenhouse gas emissions remained even as ground breaking began. In coming years, the extent to which the MMSEZ would move forward, would reflect both the overall value system of South Africa’s elite, and external pressures such as imminent climate sanctions against carbon-intensive exports to Western markets. The potential for a solar-powered 400MW supply to the MMSEZ – the Mutsho Solar PV2 power plant (‘Mutsho’) – to deter such critique, at least for the MMSEZ’s earliest components, arose in 2023. Likewise, given the decrepit state of the national electricity grid and dubious locational factors, the Mutsho initiative was not optimal for the broader public interest (even if the MMSEZ were never built), even as more solar, wind and non-invasive energy storage systems were absolutely vital to install.

The analysis below assumes that many of the political-ecological criticisms of the MMSEZ that have been offered by concerned community and environmental groups are important – but that they stand on their own (Liebenberg 2022; Thompson 2022; Thompson, Shirunda, & Mbangula 2023). The critics include grassroots activists in Earthlife Africa, Save Our Limpopo Environment, Dzomo La Mupo, Pepperbark Environmental, and the Mulambwane Women’s Organisation, as well as conservationists in Living Limpopo, Baobab Foundation, and the Philip Herd Private Nature Reserve, as well as several thousand others who comment on EIAs on the basis of either public or private interests.

Given the profusion of considerations, the analysis below focuses on post-coal energy generation and mineral beneficiation, since one of the central questions associated with South Africa’s ‘Just Transition’ and decarbonisation, is whether renewables will suffice for ongoing Minerals-Energy Complex demand (e.g., ‘baseload’ for major smelters). Specifically, the analysis below considers how – assuming it is approved – the four-part Mutsho 400MW solar power plant will support the southern (Makhado) industrial operations of the MMSEZ, and if so, whether a broader cost-benefit analysis sheds light on how to address the country’s energy crisis given that there are crucial environmental-economic reasons not to proceed with the MMSEZ. The central claim below is that the MMSEZ illustrates the South African government’s failure to incorporate a full range of environmental – and resulting socio-economic costs – in resource-governance decision making. This is true for both mega-projects like the MMSEZ as well as discrete fossil-energy sourcing projects.

These projects include extensive new oil and gas exploration offshore the Indian and Atlantic coastlines as well as onshore fracking prospects, plus further proposals for energy generated from three gas-powered harbour-based Turkish Karpowership operations, a national gas pipeline, renovation of a Mossel Bay refinery to utilise the TotalEnergies’ newly-found gas fields, a Transnet-World Bank-Vopak Liquefied Natural Gas terminal at Richards Bay, and Eskom’s proposed 4000 MW of new methane gas generators at Richards Bay and Komati. The closest major supplier of gas for South Africa’s grid, moreover, is the Northern Mozambique warzone where ‘blood methane’ entails more than 1000 SA National Defence Force troops (nearly all black men) defending the facilities of TotalEnergies (worth at least $10 billion), ENI, ExxonMobil and China National Petroleum Corporation against local Islamic militants. There, not only major climate-related damage – Cyclone Kenneth’s 225 kph winds in April 2019 – but 6000 war-related deaths and around one million displaced local residents testify to the contradictions associated with a South African ‘decarbonisation’ that is in reality also a gasification, in spite of methane being 85 times more potent a greenhouse gas than CO2 over the 20-year period ahead (Bond 2024).

It was remarkable that, in this context of extreme turn to new carbon and methane-based energy, four proposals for MMSEZ coal-fired power generation – at 4600, 3300, 1300 and 600 MW – were removed from consideration in early 2022. This was partly due to local opposition but also as a result of Chinese leader Xi Jinping coming under Western pressure to lower Belt and Road Initiative emissions associated with Chinese-made coal-fired power plants six months earlier. Nevertheless, it is striking that even without coal-fired power, the industrial facilities anticipated to invest in the MMSEZ would still generate more than 33 million tons of CO2 annually by the early 2030s. This was the time South Africa’s overall emissions were expected to decline, given the economy’s extremely high ratio of greenhouse gas emissions per unit of output per capita (third worst country among those with at least 10 million residents, after Kazakhstan and the Czech Republic) and tightening climate sanctions (Bond 2024).

Tellingly, in refusing to grapple with this legacy, the United Nations Development Programme (UDNP) came under critical scrutiny when in 2022 it uncritically offered a partnership to the MMSEZ leadership. Two organisations – Earthlife Africa and Living Limpopo (2022) – and their lawyers filed a formal complaint with the UNDP head office against the MMSEZ’s adverse “impacts on water use, air pollution, climate change, biodiversity loss, sacred and heritage sites, and many other aspects of life for people living in the area.” In late 2023, the Limpopo Economic Development Agency’s (2023) report on the MMSEZ recognised this opposition:

The teething challenges of environmental authorisation battles have created a conducive environment for the entity to fully embrace stakeholder engagements at every step of the way as a normal way of doing business. Despite the robust engagements, which might at times appear hostile… the UNDP deemed it fit to support the MMSEZ to contribute towards the growth of the economy of the Limpopo Province and, by extension, assist in improving the quality of life among our people. The good intentions of this partnership notwithstanding, some stakeholders deemed it fit to report the local UNDP office to the UN headquarters in New York.

The UNDP is likely to prove a disappointment to civil society, not only because of the role of its local resident representative, neoliberal economist Ayodele Odusola, but also because the investigator into the complaint, Daniel Bradlow, has argued that South Africa should be considered “a gateway to Africa for China” (Xinhua 2018), which is one of the main advertised benefits of the MMSEZ, given its proximity to the Zimbabwe border.

In addition, the MMSEZ hired as its EIA consultancy Savannah Environmental (‘Savannah’, the third such firm chosen by the MMSEZ given difficulties with getting credible approvals from the first two) As discussed below, two critical areas associated with standard sustainable development analysis were not addressed in the 2023 EIA associated with Mutsho. First, there are the MMSEZ’s greenhouse gas ‘Scope 3’ emissions that can be associated with anticipated electricity supply (even if that supply is zero-carbon solar). Second, there is another negative externality associated with the MMSEZ’s processing of local minerals: the anticipated decline in natural capital when non-renewable resources are depleted, hence leading to a decline in South Africa’s net wealth.

These costs are downstream, geographically diverse and intergenerational in character, but there are many reasons why they should have been taken seriously even at the EIA stage of renewable energy generation. Neglect of these processes – whose adverse economic impact will be potentially formidable – reflects the overall misleading approach associated with the MMSEZ, given that Savannah also made claims of Mutsho’s downstream economic benefits.

The purpose of Mutsho solar power is to provide electricity to the MMSEZ

One aspect of the misleading character of Savannah’s (Savannah Environmental, Geyer, & Thomas 2023a) EIA for Mutsho was its failure to recognise that the location and timing of the project is entirely associated with the MMSEZ. Mutsho is not placed within South Africa’s most favourable solar area (measured by Global Horizontal Irradiance), and as a result, is only anticipated to provide 5.6 to 5.8 kWh/square meter daily, as opposed to the Northern Cape’s 6.2-6.4 (Figure 3). The vast majority of Limpopo Province, ranging from Polokwane southwest to Gauteng, offers better locational advantages to serve the national grid for more hours/day and in proximity to consistent, high demand, so the placement of Mutsho has an immediate (not national) rationale.

Figure 3. South Africa’s optimal Global Horizontal Irradiance (GHI)

Source: Savannah, Geyer, & Thomas 2023a

It is obvious that Mutsho is not truly aimed at Eskom grid provision, but instead at a very specific customer: the MMSEZ. The UNDP (2022) itself noted “that MMSEZ jettisoned plans to include a coal-fired power plant in favour of a renewable energy project.” But dishonestly, Savannah’s (Savannah Environmental, Geyer, & Thomas 2023a, pp. xv, 116, 223) EIA statement only hints at this vaguely, twice making claims of ‘important economic benefits at the local and regional scale through job creation, income and other associated downstream economic development’.When confronted with the arguments below (in an EIA critique) in February-May 2023, Savannah (Savannah Environmental, Geyer, & Thomas 2023b) simply denied their relevance, on grounds that ‘The application for Mutsho Solar PV 2 Facility is entirely independent of previous applications for Environmental Authorisation on Farm Vrienden 589MS. The project has no affiliation with MC Mining Ltd or the MMSEZ.’ Yet it is impossible to disguise the true purpose of Mutsho, because on March 3, 2022, News24 (2022) reported:

MMSEZ CEO Lehlogonolo Masoga said plans to build a coal-fired power plant to provide electricity for the hub’s proposed steel, coking and pig iron plants had been ditched. ‘Environmentalists said no. World leaders said no – [saying instead] let’s reduce our carbon footprint and stop producing energy through coal’, said Masoga. ‘We have abandoned that part of the project. We are now focusing on solar.’ Masoga said a Chinese company had shown interest in building a 1 000 MW solar plant in place of the coal power station, which he said would produce ‘cheap electricity’.

There is an obvious problem with Savannah’s neglect to disclose the ultimate purchaser of the solar power: the MMSEZ is itself highly CO2-intensive, even without coal-fired power. And the firm building the power plant – Johannesburg-based Mutsho Power Pty Ltd – has two directors, one of whom (Yi He) is Chinese and also a major shareholder in MC Mining, a coal specialist which had earlier applied for permission to build the 600MW coal-fired power plant, prior to the 2022 cancellation of coal.

MMSEZ emissions in context

If built as specified, the MMSEZ’s industrial output will raise South Africa’s CO2 emissions profile dramatically at a time that extreme cuts are needed to both limit global temperature rise this century, and to prevent climate sanctions on South African exports to Western markets. A prior MMSEZ EIA statement conducted by the consultancy Delta BEC in 2021-22 identified 33.7 megatons (mt) of CO2 equivalent emissions from the MMSEZ’s ferrochrome, carbon steel, silicon-manganese, stainless steel and ferromanganese smelters (Table 1).

Because of high CO2 emissions associated with extracting, smelting and processing minerals – typically at a net national-wealth loss as a result of natural capital depletion, as explained below – the South African economy is an extremely high greenhouse gas emitter, measured as a share of economic output, per capita (Bond 2024). There has been a decline in South Africa’s absolute level of emissions – including agriculture-related – from the 2014 peak of 535 mt, at the time the commodity super-cycle also peaked. Since then, 2020-21 reductions from Covid lockdowns and demand constraints, plus the 2022-23 (and future) electricity load-shedding crisis, are anticipated to reduce emissions to closer to 450 mt in coming years, with energy, transport and cement emissions having fallen fastest in part due to load-shedding (Figure 4).

Figure 4. South Africa’s energy-transport-cement CO2 emissions, million tons/year, 1990-2021

Source: https://tradingeconomics.com/south-africa/co2-emissions

Source: Delta BEC 2021

Still, that degree of emissions reductions will not be sufficient – even added to South Africa’s carbon tax (one of the world’s lowest with most of the country’s emissions costed through 2025 at $0.30/ton) – to reduce the economy’s CO2 output to a reasonable level, on track with international obligations. Energy generation is certainly the main greenhouse gas emissions source, but so too are there high CO2 and methane pollution from the three categories Energy, Industrial Processes and Product Use (IPPU); Agriculture, Forestry and Other Land Use; and Waste (Table 2). That, in turn, is why it is vital for the society to assess not only the most rapid possible transition to renewable generation of electricity, but also the character of electricity demand, typically termed Scope 3.

| Sector | 2000 Emissions (Gg CO2e)1 | 2000 % Contribution by Sector | 2017 Emissions (Gg CO2e)# | 2017 % Contribution by Sector | Change Gg CO2e# | % Change 2000 to 2017 |

|---|---|---|---|---|---|---|

| Energy | 349 099,70 | 78% | 410 685,30 | 80.1% | 61 585,60 | 17.6% |

| IPPU | 32 987,30 | 7% | 32 084,60 | 6.3% | -902,70 | -2.7% |

| AFOLU (excluding. FOLU) | 53 229,40 | 12% | 48 641,80 | 9.5% | -4 587,60 | -8.6% |

| AFOLU (incl. FOLU) | 41 088,7011 | - | 17 997,50 | - | -23 091,20 | -56.2% |

| Waste | 13 557,80 | 3% | 21 249,00 | 4.1% | 7 691,10 | 56.7% |

| Total (excluding. FOLU) | 448 874,20 | - | 512 660,70 | - | 63 786,50 | 14.2% |

| Total (incl. FOLU) | 436 733,50 | - | 482 016,40 | - | 45 282,90 | 10.4% |

Source: https://bit.ly/3kkaCco

The U.S. Environmental Protection Center for Corporate Climate Leadership (2023) explains:

Scope 3 emissions are the result of activities from assets not owned or controlled by the reporting organization, but that the organization indirectly affects in its value chain… Scope 3 emissions, also referred to as value chain emissions, often represent the majority of an organization’s total greenhouse gas (GHG) emissions… To fully meet GHG Protocol standards, an organization must report emissions from all relevant scope 3 categories… Because scope 3 sources may represent most of an organization’s GHG emissions, they often offer emissions reduction opportunities. (emphasis added)

The main source of major corporations’ greenhouse gas emissions reporting – the Carbon Disclosure Project (2023) – mandates such Scope 3 disclosure. Indeed most South African mining and smelting corporations are engaged in Scope 3 analysis (although such work is often inadequate). It is a reflection of the way the EIA consultancy system operates in South Africa that Savannah failed to provide this analysis for government and the broader society.

With Mutsho and other energy generation sources supplying electricity to the MMSEZ, these Scope 3 emissions will not be reduced sufficiently in the coming decade, to satisfy South Africa’s climate commitments. Indeed in 2021, Delta BEC’s (2021, p. 802) internal assessment of the MMSEZ’s climate implications even included the following concession about the project’s untenable contribution to greenhouse gas emissions:

The emissions over the lifetime of the project will consume as much as 10 percent of the country’s carbon budget. The impact on the emission inventory of the country is therefore HIGH. The project cannot be implemented in the current regulatory confines when considering:

• The Nationally Determined Contribution in terms of South Africa’s commitment in terms of the Paris Agreement;

• The Peak Plateau Decline emission trajectory;

• The Integrated Resource Plan, which sets out the planned electricity production capacity of the country;

• When considered on an international level, the project could reduce emissions by as much as 10 million tons CO2e per year, if the plants are built to the recommended emissions intensity specifications.

The dilemma is that the MMSEZ’s impact on emissions (without coal-fired power), fuelled from the Mutsho solar plant, could be devastating not only for South Africa’s aggregate contribution to the climate crisis, but to the specific accounting category in which smelters and processing operations are located. The latest Department of Environment census of greenhouse gases (August 2021) reveals much lower estimates of emissions in 2017 from the Energy, Industrial Processes and Product Use (IPPU), Agriculture, Forestry and Other Land Use (AFOLU) and Waste sectors. From a gross emissions level of 513 mt, sequestration associated with the AFOLU sector (about 30.5 mt) allows a net of 482 mt (Table 2). (It may be significant that Sulphur hexafluoride SF6 emissions are still not in the census.) However, to add the MMSEZ’s anticipated 30+ mt/year to the IPPU category will double that sector’s contribution to the climate crisis. It will far exceed the available space within South Africa’s carbon budget, and add both massive new climate liabilities at very high cost, and contribute to Carbon Border Adjustment Mechanism sanctions.

Taking seriously Scope-3 emissions and their ‘Social Cost of Carbon’

There is an additional problem, insofar as economies will eventually be assessed for their greenhouse gas emission liabilities, with demands for climate debt and reparations consistent with the ‘Polluter Pays’ principle. Carbon accounting and taxation systems are already being developed and estimates introduced into state policies. How expensive to the economy, environment and society are Mutsho’s Scope 3 emissions? Recent estimates of the Social Cost of Carbon associated with such Scope 3 emissions now reach as high as $3000/ton (Kikstra et al. 2021). The analysis of the emissions from MMSEZ activities above suggest that for the project’s estimated (non-coal) GHG emissions (30+ megatons/year), additional MMSEZ-attributed climate-change liabilities of $90 billion annually, costs which are obviously far in excess of any net benefits.

It is important for any EIA to incorporate such rudimentary environmental economics, to assess how damage associated with the climate catastrophe is best costed and disincentivised, given that CO2 emissions stay in the atmosphere for hundreds of years. A widely-accepted way to assess such damage is termed the Social Cost of Carbon (SCC), a concept being continually updated, and a widely-accepted form of disincentive is the Carbon Border Adjustment Mechanism. South Africa stands badly exposed in both categories, and the associated liabilities will worsen if the MMSEZ is approved, even if Mutsho is its primary source of electricity.

The SCC concept has, for at least 15 years, become the central variable in assessing notional climate debt, for example. In South Africa, assuming that on average during the 2010s, the economy’s annual emissions were around 500mt, we can make rough estimates of climate debt, i.e., what the National Environmental Management Act considers to be Polluter Pay liabilities owed by those who benefited from these emissions. Such costs are typically defined as the marginal social damage caused by emitting one metric ton of CO2-equivalents. This is equivalent, as Tom Erb (2021) reports, to assessing how ordinary property owners ‘buy home insurance to prevent financial ruin in event of a catastrophic fire, even if the risk of such a fire is small. Given the significant uncertainty in the SCC’s calculation – could additional emissions have a larger impact than predicted? Are there unknown extreme risks? – valuing uncertainty in the next SCC will increase its price, perhaps significantly’. The ‘next SCC’ he referred to was the rise in the estimated damage from the $51 used by the Biden Administration starting in early 2021, to $187 suggested by the U.S. Environmental Protection Agency (2022) in 2022.

There is no estimate as to how much the ‘significant’ uncertainty can be reconciled with the younger generation’s greater suffering due to climate catastrophe (and hence greater risk-averse interests). There is also a much lower rate of commercial insurance to defend against Loss and Damage. In 2020, Christian Aid (Kramer & Ware 2020) estimated that the Global North’s climate damage that year was 60 percent insured, compared to only 4 percent in the Global South. Nevertheless, Erb (2021) continues, ‘the SCC should consider how future climate damages will impact some people more than others, such as by giving greater weight to damages that occur in poorer communities or nations. A focus on environmental justice would demand consideration of disproportionate impacts in the SCC’. David Anthoff and Johannes Emmerling (2016) suggests a rise in SCC valuation ‘by a factor of 2.5 from a U.S. perspective when our disentangled equity weighting approach is used’. To illustrate with South Africa, suffering far higher inequality (a Gini income coefficient of 0.63 compared to the U.S. 0.48), a numeric 31 percent adjustment would mean the SCC should be 3.75 times higher than standard measures.

It is also vital to acknowledge 2021 innovations in measurement addressing not just the physical, environmental and narrowly ‘economic’ aspects of Loss and Damage, but also the costs of rising mortality that can be traced to emissions. R. Daniel Bressler’s (2021) ‘Mortality Cost of Carbon’ predicts that for 2020-2100, when 83 million additional deaths are anticipated to result from the climate crisis, one additional average human death results from ‘adding 4,434 metric tons of carbon dioxide in 2020, equivalent to the lifetime emissions of 3.5 average Americans.’ The annual U.S. average emissions is 15.5 tons, while South Africa’s is 8.3 tons (albeit with much worse inequality disparity). With U.S. life expectancy longer than South Africa’s, and nearly double the per capita output, it is likely that South Africans emit on average only 2000 metric tons per person over the course of a lifetime – an estimate whose damage becomes debilitating once updated SCC data are used (especially to assess the full costs of the MMSEZ’s addition to CO2 emissions). On ethical grounds, Bressler (2021) argues that the value of a human life in the United States should not be considered higher than a low-income African:

Alternative methodologies give greater weight to richer individuals who die compared to poorer individuals based on their willingness to pay to avoid a higher probability of death. Because richer individuals have more financial resources, they have a higher willingness to pay to avoid a higher probability of death. The implication of these alternative methodologies is that lives in richer countries (e.g. in Western Europe, North America) are weighed more than lives in poorer countries (e.g. in Africa, South Asia) … although there are often significant regional heterogeneities in incomes within countries, no national governments currently assign higher values to the statistical lives of richer citizens or lower values to the statistical lives of poorer citizens in cost-benefit analyses.

In that case, Bressler continues, the calculation of a Mortality Cost of Carbon would average an additional $221 above prevailing SCC estimates. However, in September 2021 a new SCC was estimated by a European research team, of $3000/ton, or R54 000/ton (Kikstra et al. 2021). The University College London (2021) summarized:

The researchers updated the model to take advances in climate science over the past decade into account, as well as the effect of climate change on the variability of annual average temperatures – both of which increased the projected cost of climate change. The authors calculated the effect of these changes on the ‘social cost of carbon’, a crucial indicator of the level of urgency for taking climate action that calculates the economic cost of greenhouse gas emissions to society. Expressed in US dollars per ton of carbon dioxide, estimates currently vary greatly between $10 to $1,000. However, when taking more robust climate science and updated models into account, this new study suggests that the economic damage could in fact be over $3,000 per ton of CO2 … The jump in cost to the economy is mainly due to higher economic damages in the global South, the study found, and the consequences of slow and lacking adaptation to a changing climate. The authors of the paper also focused their research on longer-term consequences of climate change, such as the effects of extreme weather events – droughts, fires, heatwaves, storms – on health, savings and labour productivity.

The $3000/ton social cost of carbon should be used by African climate justice advocates, alongside awareness of factors such as mortality (using equal-life valuations not biased to price a Northern life higher than a Southern life as a commercial insurer or Northern economist might), inequality and a more appropriate discount rate. That would lead to a higher level of Loss and Damage calculations, and in addition should incorporate expenses associated with adaptation and resilience.

What, then, are the cost implications for South Africa, especially for the MMSEZ? If the lower-bound amount of annual emissions is used, 30 mt would amount to a $90 billion/year SCC at the $3000/ton rate. South Africa’s GDP in 2022 was approximately $406 billion. So by doing even a rudimentary costing of the greenhouse gas-emissions within the MMSEZ, using the project’s own estimates, it should be clear that the MMSEZ is uneconomic, and will burden all South Africans with an unacceptably high level of carbon debt to other countries and future generations.

Greenhouse gas emissions’ implications for climate sanctions based on trade

There are additional costs associated with this mega-project. The SCC will be increasingly used in civil litigation on climate crisis, based on the Polluter Pays principle that is widely accepted in both South African and international law. In addition, the European Commission introduced the Carbon Border Adjustment Mechanism (CBAM) in October 2023, first in order to measure the climate implications of importing certain goods produced in countries with lower environmental standards, and then to apply punitive tariffs in 2026.

Indeed, one major reason to consider Mutsho’s Scope 3 emissions – specifically the MMSEZ’s emissions directly resulting from the 400 MW of proposed power supply – is that the wider economy will soon be subject to such CBAM climate sanctions (and potential other ‘climate debt’ liabilities). These sanctions and liabilities will result from the state’s failure to internalise the costs of emissions and pollution externalities emanating from energy, industrial, commercial agriculture and other facilities.

This threat has been articulated repeatedly, e.g. by Ramaphosa (2021) in his major statement on climate to the South African society in October 2021: ‘As our trading partners pursue the goal of net-zero carbon emissions, they are likely to increase restrictions … We need to act with urgency and ambition to reduce our greenhouse gas emissions and undertake a transition to a low-carbon economy’. Likewise, South African Environment Minister Barbara Creecy (2023) told the African Mining Indaba on 2 February 2023, that trade sanctions due to not only fossil-fuel generation of electricity but also industrial production (such as is proposed at MMSEZ) are of acute concern:

If we fail to mitigate greenhouse gas emissions and build domestic resilience to extreme weather events, we risk damage to human health and wellbeing, built infrastructure, and food and water security. Equally significant will be ensuring that, as our major trading partners transition to greener forms of energy generation and industrial production, South African goods and services — all of which have a high carbon footprint — remain competitive. The European Union, a major trade partner, is already introducing carbon border tariffs to protect investments in greener production from goods and services produced in carbon-intensive economies.

To be sure, climate-sanctions tariffs on South African exports (including from the MMSEZ) can be mitigated if a sufficiently strong carbon-pricing regime is imposed in the exporting economy. And there is, indeed, a carbon tax in South Africa. But thanks to the 2022 decision by Finance Minister Enoch Godongwana to delay raising that tax appropriately, at least through 2025 it will remain as low as $0.30/ton for the main emitters (in comparison to Sweden’s $120/ton and the European Union Emissions Trading Scheme’s $85/ton in late 2023), so is generally considered tokenistic. As a result, South Africa’s main Western trading partners are likely to impose severe CBAM climate sanctions on especially high-carbon exports.

Initially the EU will target five sectors considered at high-risk of carbon leakage: iron and steel, cement, fertiliser, aluminium, and electricity generation (i.e. including many anticipated MMSEZ products). Other sectors will follow. Moreover, the United Kingdom adopted the same approach in late 2023 and the United States is expected to do so. If the 2024 U.S. election returns the presidency to a conservative Republican, there is little question that the protectionist aspects of such taxes will prove attractive to even a climate-denialist like Donald Trump, who had already imposed numerous irrational, unjust tariffs on imported base metals and other products from South Africa.

It is unfortunate that the low level of climate awareness in South Africa, even among EIA consultants, leads to these factors being completely neglected, as for example by Savannah (Savannah Environmental, Geyer, & Thomas 2023a). Many Northern companies are committing to ‘net-zero’ or ‘carbon neutral’ in their carbon emissions to bring them in line with the Paris Agreement, and therefore to make the case that their competitors (e.g. from South Africa) are trading unfairly. For example, ‘The Climate Pledge’ movement, supported by Amazon, or other affiliated schemes like Business Ambition for 1.5°C, state their objective of reaching the Paris Agreement target of net-zero carbon emissions by 2040.

Moreover, South Africa is the economy in Africa that will be most subject to protectionist penalties. Once Scope 3 emissions are considered, the costs of Mutsho are multiple times more than any climate finance provided by the West. For example, there is $8.5 billion in slightly concessional loans on offer to Eskom and the South African government, whose aim is to retire coal-fired power plants early and to pursue ‘non-fossil-fuel development’ in the main coal-mining region of the country.

In all these respects, the MMSEZ is out of step with the current trends – e.g. the reduced emissions in government’s Nationally Determined Contribution commitment to the United Nations (420 mt by 2030). Ironically, it was South Africa – the African government owing the highest amount of climate debt to the continent – which in March 2021 suggested an appropriate strategy, against the logic of the MMSEZ. The government’s Nationally Determined Contribution offer was clear: ‘The just transition in South Africa will require international cooperation and support… by the international climate and development and finance community for non-fossil-fuel development in Mpumalanga…’ (Republic of South Africa 2021, p. 28).

Hence, while it is absolutely vital for the South African energy grid to replace coal with solar, wind and non-invasive energy storage (such as molten salt and pumped storage, e.g. the unbuilt Tubatse hydropower scheme near the Mpumalanga border of Limpopo), it is also vital to ensure that locational attributes are optimal (proximity to solar potential as well as to a source of demand that is not itself a major CO2 emitter). Mutshe fails on both those climate-related considerations, as well as another environmental factor that should have been factored into Savannah’s cost-benefit analysis but was not: mineral resource depletion measured in rudimentary natural capital accounts.

MMSEZ implications for South African resource wealth depletion

The final point of this analysis is that in addition to full-cost accounting of the vast penalties that should be imposed on the MMSEZ’s GHG emissions, hence profoundly affecting Mutsho’s cost-benefit calculations, there is an additional aspect: resource wealth (natural capital) depletion associated with the MMSEZ production made feasible by Mutsho’s energy. This is vital in part to assess whether there is truth in the Savannah (Savannah Environmental, Geyer, & Thomas 2023a, p. iv) EIA claim that the project will supply ‘socio-economic benefits’ in Limpopo Province. There may well be such benefits, but there are also enormous environmental costs associated with that very economic activity, especially the depletion of Limpopo’s mineral wealth.

This is a factor that, in September 2021, the Delta BEC’s (2021) EIA authors admit they did not take seriously when assessing the MMSEZ:

While this cost benefit analysis study does take social, economic and environmental issues into consideration through the inclusion of externalities, it does include the value the community attaches to the potential loss of a natural asset (if unmitigated), as could for instance potentially be done through direct approaches such as the Contingent Valuation Methods where the community is surveyed directly. These approaches are however still relatively unexplored in South Africa and pose their own shortcomings in determining the value of natural resources.

The need for stronger EIA efforts when assessing net benefits (i.e., including natural capital depletion costs) should be obvious. The ‘community’ writ large would include all South Africans worried about a much wider range of externalities than addressed by the MMSEZ EIA consultants. All South Africans, according to 2002 mining legislation, have the right to consider the minerals beneath the soil as sovereign wealth, which also needs conserving for future generations. The ‘relatively unexplored’ natural capital accounts of South Africa are indeed provided by the World Bank and StatsSA, with certain important exceptions in the former case. The Bank’s methodology for counting metals and minerals is very conservative, for it includes only bauxite, copper, gold, iron ore, lead, nickel, phosphate, silver, tin and zinc. The Bank does not include the platinum group metals (especially platinum, rhodium and palladium), manganese, chrome, zirconium, vanadium, titanium and diamonds (whereas coal as a fossil fuel is counted elsewhere). South Africa ranks among the world’s top producers for most of these minerals so wealth depletion is far greater than the Bank’s partial estimates, but their data are still the most relied upon, e.g. by the UNDP.

On 25 May 2012, South Africa became a signatory to an important international agreement, the Gaborone Declaration, facilitated by the World Bank and Conservation International. That document makes very clear the responsibility that the South African government and private sector actors – including EIA consultants – have to engage in full-cost accounting that includes the depletion of natural capital in projects such as the MMSEZ. The language mandates the integration of natural capital accounting into state and corporate planning. Savannah should have attempted this, given the availability of data in South Africa regarding natural resource depletion.

It is important to consider why the omission of natural capital accounting affects not only overall MMSEZ analysis but also the Mutsho EIA. There is such a vast share of South Africa’s mineral wealth under the MMSEZ and surrounding areas, and much of it will be extracted and processed at the proposed energy and metallurgical complex. Hence to neglect even a rudimentary natural capital accounting renders the EIA document incapable of a full-cost assessment.

The general problem of unequal ecological exchange occurs across time and space, with a siphoning of wealth from future generations to current, and from the poorer resource-dependent regions to wealthier parts of the world economy. The latter include the east coast of China (from Shanghai to Hong Kong), which host what are becoming the world’s leading extractive-industry corporations, and their state and private shareholders. Those who benefit most from extractivism typically have a higher carbon footprint and come from the Global North (including the wealthy areas of China’s East Coast), versus those in the Global South (i.e., Limpopo Province’s majority), who not only did not cause the crisis but are least able to finance adaptation and resilience, or to cover loss and damage (Bond 2012).

Those are spatial injustices, but sustainability is mainly a temporal challenge, insofar as the 1987 World Commission on Environment and Development (1987) defined the concept as meeting ‘the needs of the present without compromising the ability of future generations to meet their own needs.’ Nobel Prize winning economist Robert Solow (1974) recognised the temporal inequalities associated with resource extraction, and along with his student John Hartwick (1977, p. 972) suggested that withdrawing non-renewable natural capital from a particular economy made sense only if the proceeds were reinvested locally in productive capital (machinery) or human capital (education). During the 1980s, Robert Costanza and Herman Daly (1992, p. 38) compared resource depletion to liquidation of a firm’s inventories, with Daly (1996) therefore suggesting that economists ‘stop counting natural capital as income’ without a corresponding debit to account for depletion. In 1993, summing up the evolution of the environmental-economics subdiscipline, Solow (1993, p. 170) asked, ‘What should each generation give back in exchange for depleted resources if it wishes to abide by the ethic of sustainability? ... we owe to the future a volume of investment that will compensate for this year’s withdrawal from the inherited stock.’

As a result of such insights – and Daly’s employment – the World Bank (2011, 2018, 2021) began a ‘Wealth Accounting and the Valuation of Ecosystem Services’ and helped a Committee for Mineral Reserves International Reporting Standards (2020) ‘to standardise market-related reporting definitions for mineral resources and mineral reserves.’ This they took on the road alongside Conservation International, e.g. to Botswana in 2012 where the Gaborone ‘Declaration for Sustainability in Africa’ acknowledged ‘limitations that GDP has as a measure of well-being and sustainable growth,’ in turn leading African signatories (including South Africa) to begin ‘integrating the value of natural capital into national accounting and corporate planning’ (World Bank 2018).

In Limpopo Province’s case, the MMSEZ could become a crucial source of unsustainability, especially if a disproportionate share of natural capital is channelled offshore to China via Hoi Mor. The project’s leading entrepreneur, Ning Yat Hoi, was accused in Zimbabwe of corporate fraud and Illicit Financial Flows in 2017. Ning is still wanted for asset stripping Bindura Nickel Corp and Freda Rebecca gold mine, within ASA Resources (then Mwana Africa). In 2023, he not only again visited the MMSEZ (2023) but the nearby platinum-oriented proposed Fetakgoma Special Economic Zone. Savannah and the other EIA practitioners failed to account for the MMSEZ’s net depletion of natural capital (Savannah Environmental, Geyer, & Thomas 2023a), while still claiming downstream economic benefits.

In 2021, the World Bank updated the analysis. Due to commodity price volatility and non-renewable resource depletion, the Bank (2021, 203-04) observed, ‘mineral wealth in South Africa went from $60 billion in 1995 to $100 billion in 2010 but dropped to $45 billion in 2018, driven in part by a decline in the country’s gold production’ (Figure 5).

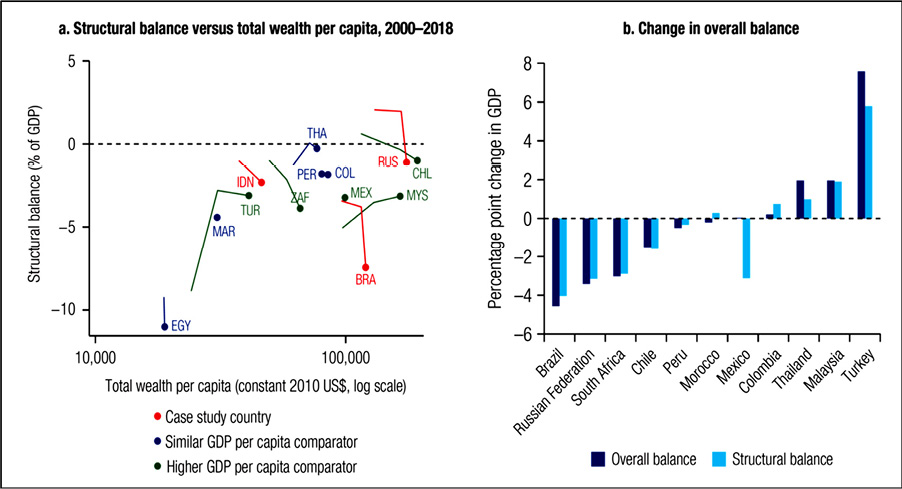

Even without counting many of its most valuable minerals and metals, South Africa is a major net loser of non-renewable resource wealth: only Zimbabwe, Botswana and the Republic of Congo have worse records over the past 25 years, with the Central African Republic in the same category, as shown in Figure 5. Indeed, South Africa also scores very poorly in relation to peers when it comefs to managing commodity price booms and busts, as revealed in Figures 6 and 7. Hence, over time, as the commodity bubble burst in the 2015-18 period, South Africa’s net wealth shrunk markedly.

Figure 5. Change in metals and minerals wealth, 1995-2018

Source: World Bank 2021

Figure 6. Overall balance versus total wealth; change in non-renewable natural capital rent

Source: World Bank 2021

Figure 7. Structural balance versus total wealth per capita; change in the overall balance

Source: World Bank 2021

The World Bank stresses the need for an economy’s resilience – especially through better state budgetary management – when the downside of a commodity price cycle emerges:

The cyclicality of commodity prices has affected the overall balance of countries with higher shares of natural capital in total wealth. The structural balance or cyclically adjusted balance is defined as the general government cyclically adjusted balance for non-structural elements beyond the economic cycle (percentage of potential GDP). After the most recent commodity boom of 2004–14, there was a greater impact on the overall and structural balances of countries with relatively higher shares of natural capital in total capital… [but] when the commodity boom ended and oil prices dropped, countries that depended on these oil rents experienced an impact on their public finances. This negative impact also had consequences for the net interest on that debt, increasing the deficit of the primary balance in countries including Russia and South Africa.

Savannah (Savannah Environmental, Geyer, & Thomas 2023a) failed to follow Gaborone Declaration guidelines and to calculate the trajectory of natural capital depletion associated with the MMSEZ project’s anticipated drawdown of mineral resources, a major shortcoming. The MMSEZ will not only contribute to climate catastrophe, but will also impoverish South Africa by depleting sovereign wealth – and prospects for future generations’ prosperity – without adequate reinvestment. The EIA’s failure to properly acknowledge, much less calculate, this damage is a profound reflection of the practitioners’ limited environmental skills, ecological consciousness and intergenerational responsibility. For any current residents of South Africa, and future generations dependent upon a stable climate and well-managed resource extraction, the MMSEZ EIA will have to be redone to take these vital factors into account.

It is here that the UNDP was most disappointing, insofar as its officials provided no indication they would challenge the underlying unsustainability of the MMSEZ (Thompson, Shirunda & Mbangula 2023). Ironically, the agency’s Human Development Reports database on sustainability includes ANS as its first dashboard column: ‘The six indicators on economic sustainability are adjusted net savings, total debt service, gross capital formation, skilled labour force, export concentration index and research and development expenditure.’ To be sure, ANS is highly conservative, as it is based upon an incomplete assessment of especially South Africa’s valuable nonrenewable mineral resources; not all forms of serious pollution are measured (e.g. water despoliation); and the SCC the World Bank chose is only $30 per ton. Bearing such constraints in mind, South Africa’s ANS reported by the UNDP was -2.5% of national income (in 2020, the year of the last available data). Given that the MMSEZ will make matters worse, it appears impossible for the UNDP to incorporate either damage done by greenhouse gas emissions (and local pollution) or natural capital depletion into its approach; hence there was no reason for the agency not to partner with the MMSEZ, until challenged. (Even then, an internal UNDP investigation had come to no conclusion 18 months later.)

Conclusion

At first blush, a solar-powered industrialisation such as proposed for the MMSEZ would be an ideal strategy for a South Africa having difficulties with decarbonisation and requiring rapid job creation. As Ramaphosa announced at a political party celebration on 12 January, with an eye to the mid-2024 elections,

‘we are tired of being a country that exports all our mineral resources… without beneficiating them…. too many of our natural resources are still exported in raw form and then imported back into South Africa as manufactured goods. The jobs and profits involved in manufacturing these goods are passed on to other countries, yet we need these here in South Africa’ (Stoddard 2024).

But too many controversies arise on closer examination, not least of which concern intergenerational and international unequal ecological exchange and uneven development, even if many politicians and experts would prefer to ignore the contradictions. As shown above, solar-energy project analysis as witnessed in Savannah Environmental’s (Savannah Environmental, Geyer, & Thomas 2023a) EIA statement appears to be incomplete in two ways: the lack of attention to greenhouse gas emissions – especially crucial Scope 3 emissions and the associate Social Cost of Carbon – in spite of extraordinary, rapidly-worsening climate crisis conditions; and natural capital account calculations associated with claims that Mutsho will bring net downstream economic benefits. In turn, this implies that establishment logic has little regard for the rights of future generations or unequal ecological exchange, as witnessed in Savannah’s (Savannah Environmental, Geyer, & Thomas 2023a) analysis.

‘It is tempting to just dismiss the whole thing as fatuous,’ as Living Limpopo conservationist Lauren Liebenberg (2022) summed up the critique of post-coal industrial development:

except that China shares the motive, has the means and has agreed to back the MMSEZ under the Framework Agreement between the DTIC and China’s National Development and Reform Commission on Production Capacity Cooperation … China is the world’s biggest steel exporter, frequently accused of dumping tons of its unwanted steel output on global markets, including South Africa, and that capacity cooperation is a policy to absorb over-capacity in China’s domestic manufacturing and construction industries. … At the groundbreaking ceremony held at the North Site in June [2022], a deal with an Australian company was also announced to develop a ‘large-scale coal-to-hydrogen project’ to produce what was incredulously referred to as ‘green hydrogen’ for electricity generation to supplement the power supplied from what will be the biggest solar farm on the African continent.

But, continues Liebenberg (2022), the desired post-coal character of energy supply to the MMSEZ should not disguise the fact that nearby, coal fields are being prepared for exploitation ‘for the benefit of MC Mining (formerly Coal of Africa), the two-bit Aussie-listed mining house bankrolled by the Industrial Development Corporation which holds the rights to the Soutpansberg coalfields’.

In short, if the solar energy from Mutsho does go directly into the next-door neighbour MMSEZ, then the result could well be an unjust non-transition, one that will adversely affect future generations here and everywhere, as well as South Africans who will insist that in future, their mineral wealth must be properly accounted for and beneficiated. There is, as well, a greater likelihood of climate sanctions insofar as the Carbon Border Adjustment Mechanism will be applied, in future years, to products with embedded emissions from industrial products (such as smelted metals) even when the original energy source is solar.

What the analysis above suggests, is that a post-coal politics in a site like Limpopo Province will be continually tested by community, environmental and social movements not only with respect to energy generation – as has been the case to date – but also across a broader, deeper value chain. The Scope 3 emissions now under investigation, given the MMSEZ’s extensive industrial ambitions, can also be joined by the agenda of today’s youth: ensuring that intertemporal analysis of natural capital is part of all our calculations. In these ways, contributions can be made to a more durable, climate-just post-coal politics. Without them, the principles, analyses, strategies, tactics and alliances associated with opposition to major polluting projects like MMSEZ, will not be as strong as conditions demand.

Acknowledgements

The activist groups cited above are due my thanks, for producing much of the knowledge about the MMSEZ and its controversies.

References

Allix, M. 2018, ‘Fugitive nets mega-DTI deal’, Business Day, 10 May. https://www.businesslive.co.za/fm/features/2018-05-10-fugitive-nets-mega-dti-deal/

Anthoff, D. & Emmerling, J. 2016, ‘Inequality and the social cost of carbon’, Fondazione Eni Enrico Mattei, Working Paper 54. https://www.feem.it/en/publications/feem-working-papers-note-di-lavoro-series/inequality-and-the-social-cost-of-carbon/. https://doi.org/10.2139/ssrn.2821056

Bond, P. 2012, Politics of Climate Justice: Paralysis Above, Movement Below, University of KwaZulu-Natal Press, Pietermaritzburg.

Bond, P. 2021, ‘Pros and cons of China’s roles in southern Africa’, In: Vasiliev, A. M., Degterev, D. A., & Shaw, T. (eds.), Africa and the Formation of the New System of International Relations: Rethinking Decolonization and Foreign Policy Concepts, Springer Nature, London, pp. 139-156. https://doi.org/10.1007/978-3-030-77336-6_10

Bond, P. 2024, ‘Climate financing carrots and sticks in South Africa’, In: Jäger, J. & Dziwok, E. (eds.), Understanding Green Finance, Edward Elgar Publishing, Ashgate, pp. 200-214.

Bressler, R. D. 2021, The mortality cost of carbon’, Nature Communications, vol. 12, article 4467. https://doi.org/10.1038/s41467-021-24487-w

Carbon Disclosure Project 2023, ‘Relevance of Scope 3 Categories by Sector’, CDP Climate Change Questionnaire, Washington, DC. https://cdn.cdp.net/cdp-production/cms/guidance_docs/pdfs/000/003/504/original/CDP-technical-note-scope-3-relevance-by-sector.pdf?1649687608

Costanza, R. & Daly, H. E. 1992, ‘Natural capital and sustainable development’, Conservation Biology, vol. 6, no. 1, pp. 37-46. https://doi.org/10.1046/j.1523-1739.1992.610037.x

Creecy, B. 2023, ‘The energy crisis and the just transition: How are countries and jurisdictions balancing these priorities in the CoP27 context?’, transcript, Department of Forestry, Fisheries, and the Environment. https://www.dffe.gov.za/Minister-Barbara-Creecy-addresses-2023-Intergovernmental-Summit-Mining-Indaba

Daly, H. E. 1996, Beyond Growth: The Economics of Sustainable Development, Beacon Press, Boston.

Delta BEC 2021, Musina-Makhado Special Economic Zone: Environmental Impact Assessment Report, LIM/EIA/0000793/2019, Delta Built Environment Consultants, Pretoria. https://www.wits.ac.za/media/wits-university/faculties-and-schools/commerce-law-and-management/research-entities/cals/documents/programmes/environment/in-court/P17102_REPORTS_25_REV%2002-FINAL%20EIA.pdf

D’Sa, D. & Bond, P. 2021, ‘Glasgow’s “Conference of the Polluters” Again Confirms that Global Arson Needs Local Fire Extinguishers’, Counterpunch, 16 November. https://www.counterpunch.org/2021/11/16/glasgows-conference-of-the-polluters-again-confirms-that-global-arson-needs-local-fire-extinguishers/

Department of Energy 2016, Integrated Energy Plan, Government Gazette No. 40445, Pretoria. https://cer.org.za/wp-content/uploads/2006/08/Draft-IEP.pdf

Department of Trade and Industry 2018, Memorandum of Understanding on Key Projects between the DTI and NDRC of China, Beijing. https://cer.org.za/wp-content/uploads/2019/07/MoU-on-key-projects-between-thedti-and-NDRC-of-China-Sep-2018.pdf

Erb, T. 2021, ‘The Social Cost of Carbon: Going Nowhere but Up’, Center for Energy and Climate Solutions, 30 March. https://www.c2es.org/2021/03/the-social-cost-of-carbon-going-nowhere-but-up/

Hartwick, J. 1977, ‘Intergenerational equity and the investing of rents from exhaustible resources’, American Economic Review, vol. 67, no. 5, pp. 972-74. https://doi.org/10.4324/9781315240084-4

Kikstra, J. S., Waidelich, P., Rising, J., Yumashev, D., Hope, C. & Brierley, C. M. 2021, ‘The social cost of carbon dioxide under climate-economy feedbacks and temperature variability, Environmental Research Letters’, vol. 16, no. 9, article 094037. https://doi.org/10.1088/1748-9326/ac1d0b

Kramer, K. & Ware, J. 2020, Counting the cost 2020: A year of climate breakdown, Christian Aid, London. https://reliefweb.int/sites/reliefweb.int/files/resources/Counting%20the%20cost%202020.pdf

Liebenberg, L. 2022, ‘White elephant tender-fest trampling SA’s impoverished far north’, Daily Maverick, 28 November. https://www.dailymaverick.co.za/opinionista/2022-11-28-white-elephant-tender-fest-trampling-sas-impoverished-far-north/. https://doi.org/10.51202/0947-7527-2022-8-028-3

Mokone, T. 2018, ‘Ramaphosa strikes deals in China to bring jobs‚ factories to Musina-Makhado corridor’, Times, 3 September. https://www.timeslive.co.za/politics/2018-09-03-ramaphosa-strikes-deals-in-china-to-bring-jobs-factories-to-musina-makhado-corridor/

Musina Makhado Special Economic Zone 2023, Tweet, 22 February. https://twitter.com/MusinaMakhadSEZ/status/1628458136309796864

Nyathi, M. 2023, ‘Mantashe accuses NGOs of being CIA funded’, Mail & Guardian, 14 September. https://mg.co.za/environment/2023-09-14-mantashe-accuses-environmental-activists-of-being-cia-funded/

Republic of South Africa 2021, South Africa’s First Nationally Determined Contribution under the Paris Agreement, Department of Environment, Forestry and Fisheries, Pretoria. https://www.dffe.gov.za/sites/default/files/reports/draftnationalydeterminedcontributions_2021updated.pdf

Savannah Environmental, Geyer, C., & Thomas, J. 2023a, Mutsho Solar Energy Facilities. Johannesburg, 13 January. https://savannahsa.com/public-documents/energy-generation/mutsho/

Savannah Environmental, Geyer, C., & Thomas, J. 2023b, ‘Appendix C8: Comments and Responses Report’, Environmental Impact Assessment Process: EIA for Mutsho Solar PV2, Limpopo Province, DFFE Reference No.:14/12/16/3/3/2/2181, Johannesburg. https://savannahsa.com/portal/wp-content/uploads/2023/01/Appendix-C8-CommentsResponses-Report.pdf

Solow, R. 1974, ‘The economics of resources or the resources of economics’, The American Economic Review, vol. 64, no. 2, pp. 1-14. https://www.jstor.org/stable/1816009

Solow, R. 1993, Sustainability: An Economist’s Perspective, Norton, New York.

Stoddard, E. 2024, ‘Loaded for bear’, Daily Maverick. 15 January. https://www.dailymaverick.co.za/article/2024-01-15-loaded-for-bear-for-better-or-worse-the-beneficiation-of-minerals-is-back-on-the-african-agenda/

Thompson, L. 2022, ‘Final rubber stamp for the Musina-Makhado Special Economic Zone travesty’, Mail & Guardian, 1 March. https://mg.co.za/thought-leader/opinion/2022-03-01-final-rubber-stamp-for-the-musina-makhado-special-economic-zone-travesty/

Thompson, L. & Shirunda, H. 2022, ‘UN Development Programme South Africa backs “dirty” Musina-Makhado Special Economic Zone’, Mail & Guardian, 27 July. https://mg.co.za/thought-leader/opinion/2022-07-27-un-development-programme-south-africa-backs-dirty-musina-makhado-special-economic-zone/

Thompson, L., Shirunda, H., & Mbangula, M. 2023, ‘Is Musina-Makhado Special Economic Zone sustainable? A UN team is investigating’, Mail & Guardian, 9 February. https://mg.co.za/thought-leader/opinion/2023-02-09-is-musina-makhado-special-economic-zone-sustainable-a-un-team-is-investigating/

United Nations Development Programme 2022. Human Development Report 2021-22: Dashboard 5, Socio-Economic Sustainability. New York. https://hdr.undp.org/sites/default/files/2021-22_HDR/HDR2021-22_Dashboard_5.pdf

United States Environmental Protection Agency 2023, Scope 3 Inventory Guidance, EPA Center for Corporate Climate Leadership, Washington, DC. https://www.epa.gov/climateleadership/scope-3-inventory-guidance

World Bank 2011, The Changing Wealth of Nations: 2011: Measuring Sustainable Development in the New Millennium, World Bank, Washington, DC. http://hdl.handle.net/10986/36400

World Bank 2018, The Changing Wealth of Nations 2018: Building a Sustainable Future, World Bank, Washington, DC. http://hdl.handle.net/10986/29001

World Bank 2021, The Changing Wealth of Nations 2021: Managing Assets for the Future, World Bank, Washington, DC. http://hdl.handle.net/10986/36400

Xinhua 2018, ‘China-S.Africa ties set example for China-Africa cooperation’, 23 July. http://www.xinhuanet.com/english/2018-07/23/c_137342694.htm