Construction Economics and Building

Vol. 25, No. 3/4

December 2025

RESEARCH ARTICLE

Sensitivity Analysis of Key Factors Influencing Concession Period Estimation in PPP Wastewater Treatment Projects: A System Dynamics Approach

Mohamed Badawy*, Rana El-Sheikh, Khaled Hamdy

Structural Engineering Department, Ain Shams University, Postcode: 11517, Cairo, Egypt

Corresponding author: Mohamed Badawy, Mohamed_Badawy@eng.asu.edu.eg

DOI: https://doi.org/10.5130/AJCEB.v25i3/4.9514

Article History: Received 22/12/2024; Revised 15/02/2025; Accepted 23/03/2025; Published 05/12/2025

Citation: Badawy, M., El-Sheikh, R., Hamdy, K. 2025. Sensitivity Analysis of Key Factors Influencing Concession Period Estimation in PPP Wastewater Treatment Projects: A System Dynamics Approach. Construction Economics and Building, 25:3/4, 65–89. https://doi.org/10.5130/AJCEB.v25i3/4.9514

Abstract

Population growth, combined with a lack of adequate financing, has led to the need for innovative infrastructure financing solutions in developing countries. The mechanism for dealing with these challenges has been, to a certain degree, made viable through the establishment of public–private partnerships (PPPs). This study aims to develop a system dynamics (SD) model using AnyLogic to determine the optimal concession period for wastewater treatment PPPs. The model incorporates construction costs, discount rates, construction duration, and pre-construction expenses to provide an integrative mode of decision-making. This model’s application is demonstrated through a case study of the New Cairo Wastewater Treatment Plant, where the optimum concession period turned out to be 19 years. Sensitivity analysis showed that construction costs and discount rates are the most significant factors impacting the estimation of the concession period. The benefits of the SD approach were further validated through comparison with Monte Carlo simulations and agent-based modeling regarding capturing dynamic feedback mechanisms. The paper emphasizes the essence of adaptive governance and flexible contract structures that can help mitigate financial risks and build stakeholder confidence. The study presents practical recommendations to policymakers and practitioners.

Keywords

Concession Period; Public–Private Partnership; Wastewater Treatment; System Dynamics;

Risk-Decoupled Net Present Value

Introduction

The rapid growth of the population in many developing countries and the relative lack of finance have created a severe need for new types of financing for large-scale infrastructure projects (Kamel, et al., 2017). Public–private partnerships (PPPs) have emerged as an essential mechanism to ensure this by utilizing the efficiency of a private hand and public management over the project (Toma, et al., 2024). The application of PPPs has spread in various sectors such as transportation, healthcare, and wastewater treatment, making the model relevant globally as a means of financing those sectors (Martins, 2023).

Determining an appropriate concession period in PPP agreements is of paramount importance since this represents the time within which a private entity finances, constructs, and operates an infrastructure project before it is transferred to the government (Ding, et al., 2023). Poor estimation of the concession period may lead to financial disequilibrium; a very short concession period discourages private investment, while an overlong one involves too heavy costs for the public (Ullah and Thaheem, 2018). Now, national and international studies have been more on PPP models in the transportation and energy sectors, while methodologies for estimating concession periods in wastewater treatment projects, especially in emerging economies, are still less robust (Eshun, et al., 2021).

Despite its relevance, the determination of an optimal concession period is substantially difficult due to the high complexity of the involved risk factors and the dynamic traits of infrastructure projects (Feng, et al., 2025). In case the period is too short, the private sector operation may not have adequate time to recover its investment, which discourages participation. By contrast, a longer period may result in unfair pricing or excessive revenues for the private sector, becoming a risk factor for the public authority (Song et al., 2021). Traditional methods, such as the net present value (NPV) technique, often oversimplify complex risks and uncertainties involved in long-term projects (Kamel, et al., 2023).

This study presents a system dynamics (SD) model combined with a risk-decoupled net present value (RDNPV) approach to enhance the accuracy of concession period estimation in wastewater PPPs. It involves dynamic, flexible adaptation to this model to incorporate critical financial and risk parameters (construction costs, discount rates, construction duration, and pre-construction expenses) into a challenge common to most infrastructure projects anywhere in the world.

Literature review

PPPs are now a basic framework for the financing of large infrastructure projects, especially in developing countries (Martins, 2023). A main problem of PPP agreements is the selection of the ideal concession period (Hadi and Erzaij, 2019): the period during which the private partner builds and operates the infrastructure that is later transferred back to the government (Castelblanco, et al., 2025). This interval must be enough for the private partner to obtain a return on its investment and earn a reasonable profit. However, it should not be too long. It must not result in excessive costs for the public sector or citizens either (Ibem, et al., 2018).

Systematic review

The structured and replicable methodology was kept for the systematic review to ensure the comprehensiveness and reliability of the findings. The entire process was conducted in four stages: (1) search and identification of literature, (2) screening and selection, (3) data extraction, and (4) synthesis and analysis of findings.

Literature search and identification: The review mainly started with a wide search of Scopus, a well-known research database, which was expected to yield relevant studies on PPP concession period estimation, mostly for wastewater treatment projects. A carefully crafted Boolean search query was used, incorporating terms such as “system dynamics”, “PPP” and “public–private partnership”, “concession period”, and “wastewater treatment”. This query was designed to acquire as much relevant literature as possible while ensuring that it checks how accurately it captures studies that were specifically associated with the intervention.

Screening and selection: The first search yielded 480 articles. With an organized screening approach, the selection was iteratively refined in three distinct filters. Discipline filter: Here, the results were filtered for studies only concerning the engineering domain, bringing the count to 231 articles. Language filter: Articles not in English were excluded to have consistency in understanding and analysis, and in this process, 222 articles remained. Relevance filter: Studies not addressing specific models for estimating concession periods of PPP wastewater treatment projects were excluded, leaving 88 articles that will be examined in full text.

Data extraction: For each of the selected 88 articles, relevant data were systematically extracted to ensure a structured comparison of the methodologies and findings. The data extracted included the following: the main focus and objectives of the study, types of models used, influencing variables (such as construction costs, risks, discount rates, and pre-construction costs), major conclusions regarding concession period estimation, and numerical results for sensitivity analyses and break-even points.

Synthesis and analysis: This makes the synthesis of findings exhaustive for the identification of key trends and insights in the literature under review. The analysis focused on the following: comparing various modeling approaches to point out strengths and limitations in methodology, identifying common influential factors in the estimation of concession periods, numerical results, especially sensitivity analysis and break-even estimates, and geographical studies on concession period modeling to understand geographical disparities concerning concession period modeling. Figure 1 illustrates the distribution of relevant studies across different countries, demonstrating the geographical spread of research contributions in this field.

Figure 1. Distribution of relevant studies between countries

Systematic review forms a strong ground for understanding the main determinants of PPP concession periods in wastewater treatment projects. These will inform the development of the SD model applied in this study.

Advanced approaches to concession period estimation in PPP projects

For evaluating the viability of PPP projects, traditional financial models such as NPV have been very well utilized to calculate the time value of future cash flows (Jin, et al., 2019). However, NPV can by no means accurately reflect major characteristics and uncertainties of large-scale infrastructure projects, such as fluctuations in demand, regulatory changes, or operational risks, which, in turn, affect long-term financial success (Jin, et al., 2021). For instance, wastewater treatment projects may have demands that vary depending on population growth and industry activity, as well as changes in regulations, which make revenue predictions extremely uncertain (Wibowo, 2022). Moreover, unexpected increases in the operating costs increase energy prices (Zhang, et al., 2018), or increased frequency of maintenance affects project profitability and further complicates an appropriate estimation of the concession period (Mamdoohi, et al., 2023).

Adaptive concession periods, which permit adjustments based on project-specific conditions, risk-sharing arrangements, and economic uncertainties, are crucial to improving financial sustainability (Guo, Su, et al. 2024). Researchers nowadays have turned to advanced modeling techniques like agent-based modeling (Hamidreza, et al., 2023). A Monte Carlo simulation method based on cumulative prospect theory was used to build a model for determining the concession period of a transportation build–operate–transfer (BOT) project (Guo, et al., 2022), genetic algorithm (Altanany, et al., 2024), or system dynamics (FahimUllah, et al., 2018). To overcome these problems, another study for the development of public–private partnership projects in the field of highways, using the Delphi method, developed a unified framework for estimating the concession period. It emphasized the expert consensus on risk sharing, financial modeling, and stakeholder alignment to determine the optimal time frame (Fathi and Shrestha, 2023). SD is such a powerful methodology for simulating interactions among variables in time. In this case, it also applies well to PPP projects where multiple interacting variables usually exist (Taha, et al., 2022). Unlike traditional methods, SD considers the dynamic nature of revenue streams, operational costs, and demand fluctuations (FahimUllah, et al., 2018). This may be able to provide more realistic projections of the optimal concession period by modeling these factors in real time (Guo, et al., 2021). The wastewater treatment plant’s profitability given by altered demands or operational costs is a situation that can be modeled and simulated by the SD model to deduce the right concession period fairly and balanced for the stakeholders of both parties (Castelblanco, et al., 2024). Guo, Chen, et al. (2021) similarly presented a methodology to assign a reasonable concession period to the private sector concerning public works in the financial and operational aspects. There are many methods that one could use to determine the concession period in PPP projects, ranging from simple to complex and accurate ones. The common methods for determining the concession period are NPV, Monte Carlo simulations, and SD. All of them have merits and demerits (Dai, et al., 2020). NPV is simple but not appropriate for addressing complex, interacting variables. Monte Carlo analyzes risk through several scenarios based on probabilistic distributions, but it is very computably intensive and perhaps insufficiently captures all interactions of dynamics (Yu, et al., 2021). An SD is especially suitable for modeling the non-linear behavior of complex systems and hence is of special relevance for long-term infrastructure projects such as wastewater treatment plants. Real-time adjustments based on performance metrics and varying conditions are also possible from SD models, thus providing a much more accurate and adaptable framework for estimating concession periods (Nguyen, et al., 2021).

One of the main drawbacks of traditional methods, such as NPV, is the use of a single discount rate to capture risk. This simplifies the complex and uncertain nature of risks that may impact a long-term project (Kasprowicz, et al., 2023). RDNPV has been suggested as an alternative approach that decouples risk factors from the time value of money for a more realistic determination of the financial viability of the project (Ameyaw and Chan, 2015). By decoupling risk, RDNPV allows for a more granular analysis of a range of risk elements, such as regulatory changes, technological disruptions, and environmental factors, which enable more informed decisions about the concession period (Jin, et al., 2020). Dynamic pricing models, such as time-of-use pricing, have also been suggested to address revenue uncertainty in utility-based PPP projects (Song, et al., 2021). These models allow price adjustments depending on real-time demand fluctuations. The models offer a method for managing uncertainty while ensuring that private partners can recover their investment. By embedding dynamic pricing within the SD framework, stakeholders can develop flexible financial models that adapt to shifting market conditions (Amiri-Pebdani, et al., 2022). Government minimum revenue guarantees or subsidies are commonly applied to reduce risks for the private sector in PPP agreements (Ahmadabadi and Heravi, 2019). These revenue guarantees will stabilize the revenue streams and may affect the optimal concession period. For example, government support may reduce the length of the concession period by giving more financial certainty to the private sector (Sharafi, et al., 2021). Conversely, less government involvement could be balanced with a longer concession period to account for greater risk exposure (Zhang, et al., 2022). SD could model such differing levels of government support and hence provide useful insight into the sensitivity of structure and timing to such factors in PPPs (Qi, et al., 2020). While traditional methods like NPV and Monte Carlo simulations provide useful insights, they fall short of capturing the dynamic and uncertain nature of long-term infrastructure projects. The combination of SD and RDNPV offers a more flexible and accurate framework for estimating the optimal concession period, ensuring a balanced and fair approach that benefits both public and private stakeholders.

Factors affecting the concession period in PPP projects

Several studies have highlighted that the appropriate risk allocation between public and private parties is a critical issue in concession contracts (Nguyen and Likhitruangsilp, 2017; Rasheed, et al., 2024). It includes construction, operational, and financial risks (El-Kholy and Akal, 2021; Osama et al., 2023). The presence of proper risk-sharing mechanisms can influence the length of the concession period to ensure that the private sector is adequately compensated for the risks it assumes (Castelblanco, et al., 2023). The ability of the project to generate sufficient revenue during the concession period is one of the determinants of the length. The duration depends on factors like projected cash flow and revenue risks, allowing a reasonable return on investment to be made by the private sector (Fathi, 2024). Government policies, which include cost recovery, consideration of public interest, and adjustments due to unforeseen circumstances, may affect the concession period (Sanni, 2016). Economic conditions like the inflation rate, interest rate, and general economic conditions may influence both the cost and revenue generated over time. Also, the concession period influences the length of the concession period (Aljaber, et al., 2024). The degree to which the public sector demands performance and quality could equally affect the duration. Higher standards are imposed, which may imply a longer time to reach the expected performance levels (Chen, et al., 2020). The availability of payment is one of the major parameters in determining the concession period in PPP projects (Guo, Chen, et al. 2024).

Renegotiation in public–private partnerships

Renegotiation in PPPs is closely linked to the SD model, which provides a structured approach to understanding and managing complex systems like PPPs. The SD model focuses on feedback loops, delays, and non-linear relationships, making it ideal for analyzing the dynamic interactions between various stakeholders, financial models, and project variables during renegotiations. In the context of renegotiation, the SD model can be applied to simulate the long-term effects of changing conditions such as cost overruns, shifts in demand, or regulatory changes on project outcomes. For instance, when unexpected events occur that affect a PPP, renegotiation often becomes necessary to realign the project’s financial or operational terms (Javed, et al., 2014). The SD model helps stakeholders understand how changes in one area, such as increased costs or decreased revenues, can trigger a cascade of effects across other project components, including the concession period, financing structure, and risk allocation.

Chen, et al. (2023) emphasized the role of renegotiation in maintaining PPP viability amidst evolving circumstances, while Khallaf, et al. (2021) suggested that structured risk assessments can mitigate conflicts during renegotiation by identifying potential risks early. The SD model supports these concepts by offering a dynamic simulation framework that can forecast the long-term impact of renegotiation decisions. Furthermore, the SD model’s ability to visualize system behavior over time aligns with Jin, et al. (2020) game-theoretic framework, where renegotiations are modeled as strategic decisions between stakeholders. The SD model enables a deeper understanding of how stakeholders’ behaviors and decisions interact over time, ensuring that renegotiations are conducted in a manner that maintains project stability while aligning the goals of both public and private sectors. This approach, coupled with optimization models like those of Feng, et al. (2019), enhances the ability to renegotiate terms like concession periods and payment structures to better reflect the evolving realities of a project. Thus, integrating the SD model with renegotiation strategies offers a comprehensive tool for predicting, analyzing, and guiding PPP renegotiations, ensuring that projects remain viable and aligned with long-term objectives.

The research gap

Statistical financial models have been used in many studies to estimate the concession periods for wastewater treatment projects under PPP, but fail to capture the complexities of long-term agreements (Kasprowicz, et al., 2023). Monte Carlo simulations and Public Sector Comparator (PSC) analyses have been adopted, but have not accounted for changes in financial risks and economic conditions in real time (Guo, et al., 2022).

A serious obstacle encountered in extant research is the divergence in financial metrics, such as PSC vs. DNPV, adopted by the public and private sectors, creating a barrier to the proper determination of concession periods (Kasprowicz, et al., 2023). Past studies often ignored other critical dynamic considerations, such as inflation, variability in interest rates, and changes in risk-sharing arrangements (Guo, et al., 2022). Whereas many studies have investigated transportation and general infrastructure projects, wastewater treatment PPPs raise unique challenges yet are largely unexplored (Eshun, et al., 2021). Another gap in the literature is the lack of employment of advanced risk analysis and scenario-based decision-making tools, which are critical for improving the PPP framework (Nguyen, et al., 2021).

To overcome these challenges, this research presents a hybrid system dynamics and risk-decoupled net present value model. This approach decouples risk from the traditional NPV calculations and simulates the path of complex financial interactions over time to allow more realistic estimations of the concession period. In contrast to traditional frameworks restricting assumptions to fixed constructs, the SD–RDNPV framework can modify real-time fluctuations in finances, risk uncertainties, and policy changes, making it especially useful for infrastructure projects in developing economies. Through this dynamic modeling approach, the study develops a tool for optimizing concession terms that is both more flexible and realistic by conducting a fair balancing of risks and benefits for every stakeholder.

Methodology

The current study optimizes the concession duration of PPP, one of the most influential factors affecting the success and effectiveness of PPP contracts (Kukah, et al., 2024). This study develops an SD model integrated with an RDNPV framework to determine the optimal concession period for PPP wastewater treatment projects. The methodology follows a structured approach consisting of model building, parameter selection, validation, and sensitivity analysis.

Identifying parameters from the literature review

To develop a comprehensive model, pertinent parameters were identified through a systematic literature review of PPP projects on wastewater treatment. The main variables impacting how concession periods are estimated were focused on in the identification of the parameters that were studied. In their studies, Jin, et al. (2021) and Nguyen, et al. (2021) recognized the importance of pre-construction costs, construction risks, and discount rates. Guo, Chen, et al. (2021) and Taha, et al. (2022), in turn, further pointed out the influence of operational costs and tax structures. These considerations were useful in selecting the fixed, variable, and dynamic parameters used in developing the model.

Model development

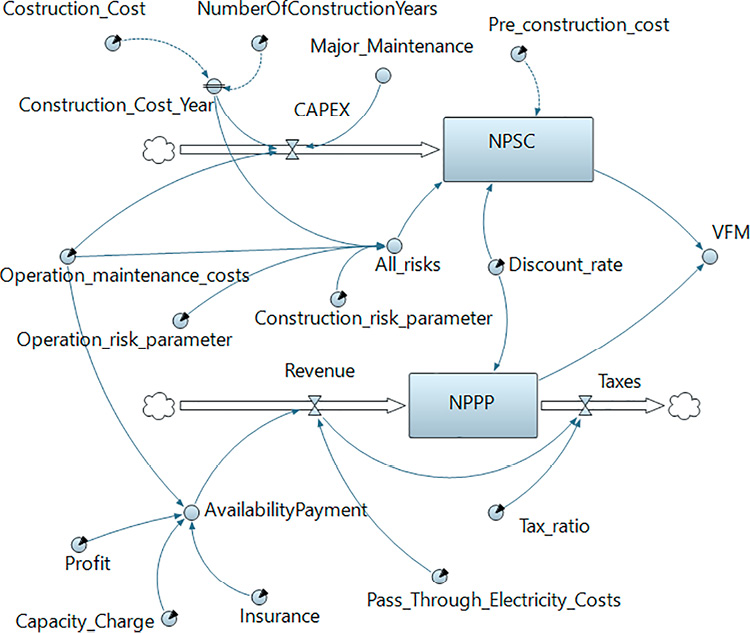

With the AnyLogic software, dynamic simulation of the interaction between financial and risk parameters influencing concession periods has been developed using an SD model. The model comprises two interlinked sub-models: PSC and PPP. PSC is a model representing the net present costs associated with a public project delivered traditionally, including construction, operational, and maintenance costs plus risk adjustments. In the PPP model, the financial interests of the private sector are captured through DNPV computation, investment recovery, and expected returns. The key variables in the model include pre-construction costs, construction costs, discount rates, construction duration, construction risk parameters, operational costs, and tax ratios. Causal loop diagrams (CLDs) and stock and flow diagrams (SFDs) were developed to represent the relationships among these variables.

Data collection and parameter selection

The fiscal data from the New Cairo Wastewater Treatment Plant (WWTP), which is Egypt’s first PPP for wastewater treatment, were employed. The parameters were retrieved from project documents, government policy papers, and expert consultations. Model input categories were as follows: fixed parameters (pre-construction costs, tax rates, and financing structures), variable parameters (construction costs, discount rates, and operation costs), and dynamic parameters (risk-adjusted cost variations and investment returns). A comparative analysis of traditional estimation methods, including NPV and Monte Carlo simulations, was conducted to validate the selection of SD for its flexibility in modeling dynamic financial interactions.

Model validation and sensitivity analysis

The model was well-validated with its robust three-step process: structural validation (domain experts examined the logic and causal relations held in the CLDs and SFDs), empirical validation (these validation considerations suggested that the historical concession agreements were parallel along similar PPP projects against the model output), and sensitivity testing (the analysis of critical factors affecting the optimal concession period, namely, construction costs, discount rates, construction time, risk parameters, and pre-construction costs). The sensitivity analysis was conducted in a multiple simulation run with one parameter changing at a time while the other parameters remained constant. The analysis of break-even points and concession period estimates for the parameters is considered: construction costs (from 550M to 650M Egyptian pound (EGP)), discount rates (from 0.15 to 0.17), construction duration (from 1.5 to 2.5 years), risk parameters (changed between 0.3 and 0.4), and pre-construction costs (range modeled between 90M and 110M EGP).

Alternative methods

Three methods were suggested - Monte Carlo, agent-based modeling, and SD - before the application of the model. Monte Carlo simulation was used for carrying out probabilistic risk analysis, but it does not consider dynamic feedback mechanisms over the long run, as seen in PPP agreements. In agent-based modeling, the individual stakeholder behaviors were modeled, but this method is computationally intensive and less practical for financial optimization. The SD approach can give a complete picture of financial interactions, allowing adaptive governance and risk-sensitive contract design; hence, it is fitting for complex infrastructure financing. Therefore, in this study, the authors determined the SD to model the simulation. While Monte Carlo analysis evaluates probabilistic risks and NPV offers static yield on finance, the risk-decoupled net present value framework integrates feedback loops and dynamic risk allocation, which allows and adapts better to real-world uncertainties in PPP wastewater projects. Thus, separating the financial risks from the discount rate, the model offers a more detailed, scenario-based understanding of risk effects, ensuring a fairer and more precise determination of concession periods.

Case study application

The method was applied to New Cairo WWTP within real-world financial constraints and involved contracts and stakeholder interests. The results indicated that the concession period optimally relates risks to benefits for both the public and private entities.

Develop an SD model

Generally, a longer concession period is required and is more beneficial for the private sector. The prolonged period will cause lucrative profits for the private investor but will lead to a loss in the government’s and citizens’ interests. However, if the period is very short, the private sector will refuse the contract or be forced to increase the service fees. Therefore, there is a need to estimate a concession period that ensures a reasonable profit for the private sector within a reasonable time and protects the public sector’s interests at the same time. Coupling the time value of money and risks may lead to overestimation of the benefits to the private sector at the expense of the public sector’s value for money. Therefore, the risk and time should be managed separately. The values of risks during the construction and operation periods were obtained by multiplying the construction risk parameter by the construction cost and the operation risk parameter by the operation and maintenance costs. Capital expenditure (CAPEX) describes all construction costs, equipment costs, overhauling costs, etc., during the project’s construction period. Operating expenditure (OPEX) represents the staff salaries, operating and maintenance costs, etc. It is defined as the total expenditures incurred day to day in the project’s operation period (Nguyen, et al., 2021). Value for money (VFM) is a key metric that guides public sector decision-making in PPP. It helps assess whether a project provides the best possible benefits relative to costs, ensuring that public funds are used efficiently. VFM is calculated to determine whether a PPP project yields better values compared to traditional public sector delivery. To achieve a balanced outcome between public and private sector interests, VFM is ideally set to zero, indicating that the benefits and costs are equitably shared, with no net advantage disproportionately favoring either party. This balance helps foster a sustainable partnership where the public sector benefits from high-quality, cost-effective services, and the private sector achieves reasonable returns on investment. VFM can be estimated using Equation (1).

VFM = (NPSC – NPPP)(1)

A model was proposed using the AnyLogic PLE simulation software. Figure 2 illustrates the CLD for VFM, the interaction between the variables, and the SFD for VFM. The types of variables in the stock and flow diagrams consist of three types: stocks represent the system’s condition on which the actions are based; flows represent the change in the stock at a particular time, causing an increase or a decrease in the stock; and converters represent constant variables or variables computed from other variables.

Figure 2. The proposed model to determine the optimum duration of the PPP project. PPP, public–private partnership

Table 1 shows the main variables of the model. The conditions and actions for each event are illustrated in Table 2.

Case study

New Cairo’s population was projected to increase from 550,000 to 4 million by 2026, a rapid expansion exceeding the capacity of the existing water supply and sanitation services. The New Cairo WWTP, Egypt’s first PPP for wastewater management, was established to address these challenges. With a capacity of approximately 250,000 m3 of sewage per day, the WWTP serves New Cairo, Madinaty, and El Mostakbal, ultimately benefiting approximately 3 million residents at full operational capacity. The Government of Egypt partnered with the International Finance Corporation (IFC) and the Public–Private Infrastructure Advisory Facility of the World Bank Group. The IFC, Egypt’s PPP Central Unit, and the Ministry of Housing, Utilities, and Urban Development structured the project as a 20-year concession under a design–build–finance–operate–transfer contract model. The New Urban Communities Authority managed the project, drawing on the concession period durations of similar international projects (Grupo Banco Mundial, 2020). The project was developed by Orasqualia, a consortium named after its shareholders: Orascom Construction Industries (presently named OC) and Aqualia (in February 2015, it was replaced by Aqualia New Europe), each with 50% equity. Aqualia New Europe itself is a joint venture and is 50% owned by Aqualia and 50% owned by the European Bank for Reconstruction and Development. The construction started in March 2010 and took 26 months, finishing in May 2012, although 2 months behind schedule due to political instability in Egypt in 2011. This delay also affected the operation phase, mainly because of quality issues in the pre-construction outflow, so the plant’s service began in October 2013, 16 months after construction was completed (Planas, 2018). Financing for the project followed a capital structure with a debt-to-equity ratio of 70/30, ensuring robust financial support for the project’s long-term viability (Velasco, 2012).

Model parameters

The financial data of the New Cairo WWTP and the parameters in this study were collected from the IFC. It was agreed that the government would pay a service availability payment to the service provider each year during the operation period to cover all expenses, financing costs, and profit (Mohy El Din, 2017). This is structured around five parameters. A capacity charge is a payment covering total investments made for the design and construction, all the capital expenditure required during the operational period, debt service costs, and return on equity. Insurance includes breakdown policy, civil liability insurance, insurance against theft, third-party insurance, and insurance against pollution. An operating charge is a payment covering operating and maintenance costs. A pass-through charge is a reimbursement of the full electricity costs. Taxes were deducted from revenue in the DNPV calculation according to the sector and deducted from government costs in the VFM calculation, as it is considered revenue to the government (Kokkaew and Tongthong, 2021). The tax rate was assumed to be 20% of the total revenue. The parameters of the model are shown in Table 3. The major maintenance table function is illustrated in Table 4.

| At year | 12 | 20 | 28 |

| Major maintenance | 30 | 50 | 50 |

Results

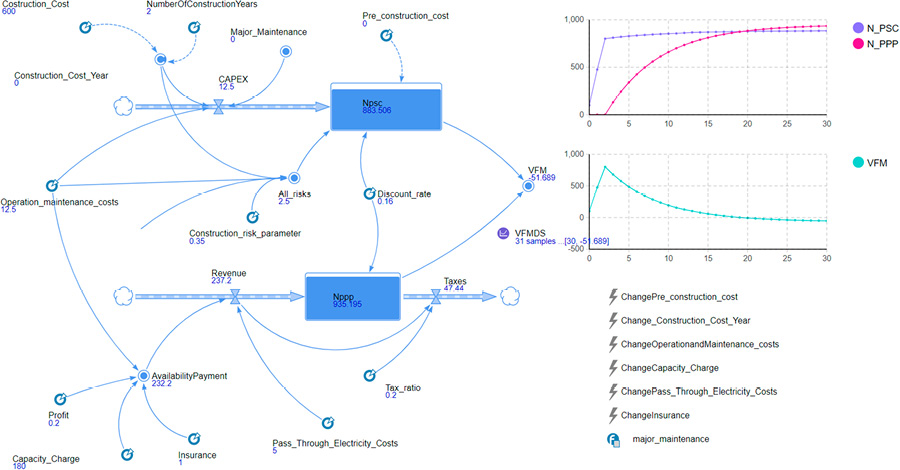

Figure 3 illustrates the relationship between the VFM in million pounds and the time in years.

Figure 3. The result of the value for money

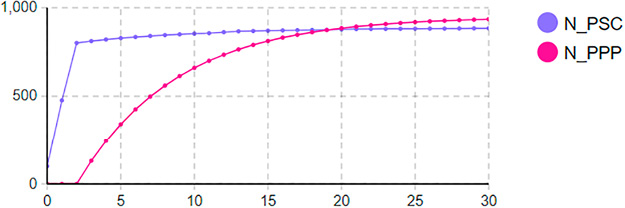

NPSC refers to the net present for the public sector (comparator). It represents the estimated total cost to the government if the project were implemented through the traditional public procurement approach. This cost includes construction, operation, maintenance, and risk-adjusted components, all discounted to their present value. It is often referred to as the public sector comparator (PSC) or the net present social cost (NPSC). NPPP refers to the net present for the public–private partnership (PPP) option. It represents the estimated total cost or value of delivering the same project under a PPP arrangement, also discounted to present value. The analysis of the difference between NPSC and NPPP yields the same number for both variables, showing their convergence in 19.15 years, as seen in Figure 4, which will ensure that financial benefits and costs are balanced for the duration identified for both the public and private sectors. Thus, the concession period will be optimized at 19 years to ensure that risks are allocated fairly and effectively at an efficient level for both parties involved.

Figure 4. The relationship between NPSC and NPPP

The results were compared with those of Monte Carlo simulations and agent-based modeling to assess the validity of the SD approach regarding robustness. Monte Carlo simulations were performed by generating 10,000 iterations of possible economic conditions, including different inflation rates and construction cost overruns. While it establishes the probabilistic range of concession periods at 95% confidence (between 17 and 22 years), it does not capture the dynamic feedback mechanisms intrinsic to long-term infrastructure projects. Agent-based modeling, in contrast, focuses on simulating the behavior of single stakeholders and clarifies how the changes in risk-sharing mechanisms affect concession periods; however, it incurs large computational requirements concomitant with various subjective assumptions of stakeholder decision-making behavior. In comparison, SD modeling strikes an appropriate balance between computational power and real-time adaptability, which makes it more applicable to long-term PPP agreements.

Critical factors affecting the concession period in PPP projects

In the case of the concession period for PPP projects on wastewater treatment, a few important factors are considered to determine an optimal concession period. Influencing elements are construction costs, discount rates, duration of construction, risk in construction, and pre-construction expenses. Each of these elements can significantly affect the speed at which a project recovers its costs; hence, they affect how attractive the project is to investors. By understanding how these factors are related, stakeholders are better prepared for the complexities that arise while attempting to finance and implement wastewater treatment projects.

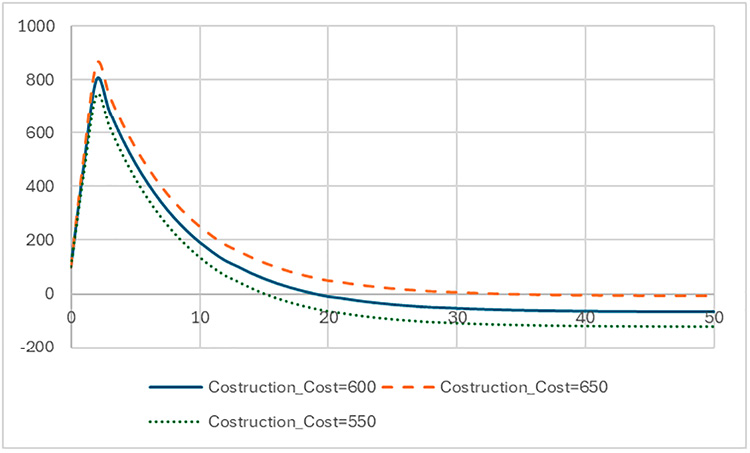

Construction cost

It is developed based on three different construction cost scenarios: A, 650M; B, 600M; and C, 550 M. The estimated time for VFM ranges from Year 0 to Year 50. The break-even points are in Scenario A (650M), breaking even in 34 years; Scenario B (600M), breaking even after 19 years; and Scenario C (550M), breaking even in 15 years. It can also be realized from this analysis that construction cost is a major factor affecting the concession period optimality of PPP. The higher construction costs with 650M correspond to a longer break-even period of 34 years, which means that the recovery of the investment takes more time. This misalignment indicates a potential risk for investors if the optimal concession period is shorter than the time required to achieve balance. Conversely, lower construction costs would have a rather small break-even period (e.g., 550M and 600M result in break-even periods of 15 and 19 years, respectively, thus coming closer to their corresponding optimum concession periods). Such investment atmospheres are preferable in investment circles because faster recoveries on investment translate into fewer risks. In all these findings, a vital correlation between construction cost and financial viability related to PPP projects is deduced. As construction costs increase, the break-even timeline increases, which may outpace the optimal concession period. This indicates that construction cost is an important factor in structuring the PPP agreement to ensure sustainable financial returns and project success. Figure 5 shows the concession period vs. construction cost scenarios.

Figure 5. Concession period vs. construction cost scenarios

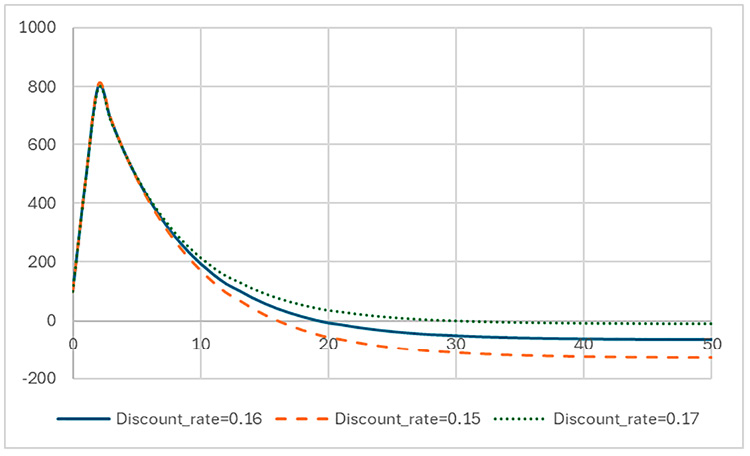

Discount rate

Three scenarios of different discount rate analyses are considered: A, 0.15; B, 0.16; and C, 0.17. The estimation time for VFM ranges from Year 0 to Year 50. Break-even points, which indicate where the projected values reach zero for each scenario, include Scenario A, breaking even after 16 years; Scenario B, breaking even after 19 years; and Scenario C, breaking even after 30 years. This indicates the variations in the times at which projects break even, as affected by the discount rate. In Scenario A (0.15), the break-even period of only 16 years creates a very favorable investment environment in which quick cost recovery is possible, thus appealing to investors. In Scenario B (0.16), the concession period is 19 years, offering a balanced recovery path that still presents attractive potential returns, although with slightly more risk. However, in Scenario C (0.17), the break-even period stretches to 30 years, which could deter investors due to the longer wait to recoup their investments and increased financial risk. Overall, these findings underscore the importance of discount rates in assessing project concession periods, as lower rates correlate with shorter recovery times and enhanced investor attractiveness, while higher rates lead to longer recovery periods and greater uncertainty. Figure 6 illustrates the concession period vs. discount rate scenarios.

Figure 6. Concession period vs. discount rate scenarios

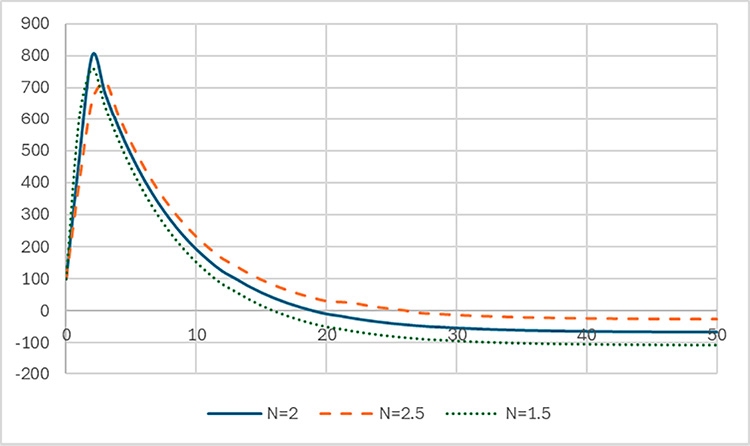

Number of construction years

The analysis considers three distinct number of construction years scenarios: Scenario A, 1.5; Scenario B, 2; and Scenario C, 2.5. The time frame for estimating VFM is from Year 0 to Year 50. The break-even points for each scenario, indicating when the projected values reach zero, are as follows: Scenario A, breaking even after 16 years; Scenario B, breaking even after 19 years; and Scenario C, breaking even after 26 years. The analysis reveals how varying construction durations impact the optimal concession period in PPP wastewater projects. Scenario A (1.5 years): With the shortest construction duration, this scenario allows for an optimal concession period of 16 years, suggesting a quicker return on investment. This could be attractive for investors because it means a relatively fast recovery of costs, which enhances the viability of the project as a whole. Scenario B (2 years): The concession period extends to 19 years, offering a moderate time frame for cost recovery. Although this option is a bit riskier than Scenario A, it still offers a reasonable prospect for investors. Scenario C (2.5 years): The longest time of construction is 26 years for breakeven. This very long period could be quite crucial for the investors because it implies a longer period that will be required to recover invested capital. This may discourage potential investors because of increased financial risk and uncertainties. In general, these all highlight the critical impact that the duration of construction has on determining the optimal concession period. Shorter construction periods correlate with quicker break-even points, making projects more attractive to investors, whereas longer ones result in longer recovery periods, which may also increase financial risks. Considering these factors, stakeholders need to be very cautious while planning and arranging finances for construction projects to maximize returns and keep risks within manageable limits. Figure 7 shows the concession period vs. the number of construction years scenarios.

Figure 7. Concession period vs. number of construction years scenarios

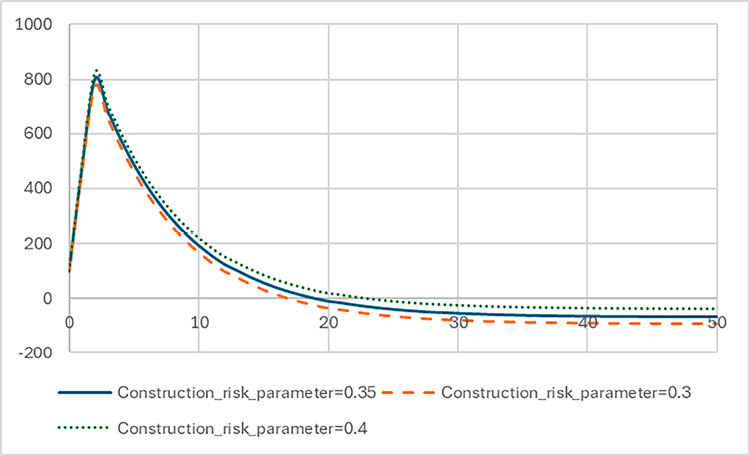

Construction risk parameter

One of the critical factors that affect the optimal concession period for the PPP wastewater project is the risk ratio linked to construction costs. Three different construction risk parameter scenarios are analyzed in this analysis: Scenario A, 0.3; Scenario B, 0.35; and Scenario C, 0.4. The time frame for evaluation for estimating VFM spans from Year 0 to Year 50. The break-even points for each construction risk scenario, indicating when the projected values reach zero, are as follows: Scenario A (0.3), breaking even after 17 years; Scenario B (0.35), breaking even after 19 years; and Scenario C (0.4), breaking even after 23 years. This analysis illustrates how varying construction risk ratios impact financial recovery timelines and, hence, the optimal concession period. Scenario A (0.3): With the lowest risk ratio, this scenario achieves a break-even point after 17 years, suggesting a stable investment environment. This could therefore be attractive to the investors as a result of the faster capital cost recovery and a lower likelihood of unexpected expenses. Scenario B (0.35): The break-even period increases in this scenario to 19 years. While still manageable, the higher risk ratio can indicate that investors may face a little higher uncertainty, which could reduce their confidence in the financial viability of the project. Scenario C (0.4): This implies the highest construction risk, yielding a break-even point of 23 years. This could lead to major concerns for investors since they will be demoralized because of higher costs and exposure to financial risks. The results provide insight into how construction risk ratios greatly impact the derivation of the optimal concession period in wastewater PPP projects. A low-risk ratio would involve a shorter break-even time, making the project more attractive to investors, whereas with a high-risk ratio, recovery may take longer, possibly increasing financial risks. These counter-balancing dynamics need to be studied thoroughly by stakeholders to make appropriate project financing and delivery decisions. Figure 8 shows the concession period vs. construction risk parameter scenarios.

Figure 8. Concession period vs. construction risk parameter scenarios

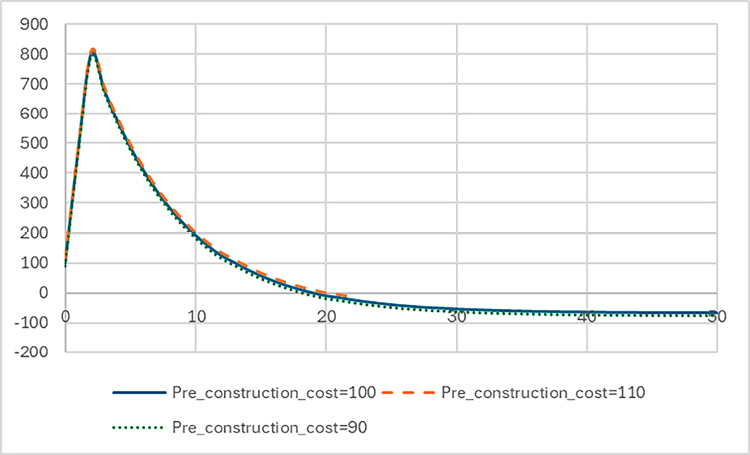

Pre-construction cost

The pre-construction cost is one of the most critical factors that influence the optimal concession period for the PPP wastewater project. This analysis highlights how different pre-construction costs affect the optimal concession period. This analysis examines three distinct pre-construction cost scenarios: Scenario A, 90 million; Scenario B, 100 million; and Scenario C, 110 million. The time frame for evaluation for estimating VFM spans from Year 0 to Year 50. The break-even points for each pre-construction cost scenario, indicating when the projected values reach zero, are as follows: Scenario A (90 million), optimal concession period at 18 years; Scenario B (100 million), breaking even after 19 years; and Scenario C (110 million), breaking even after 20 years. Scenario A (90 million): The lowest pre-construction cost results in a breakeven after 18 years, which would be ideal regarding investment climate; it implies shorter cost recovery for investors and lower financial vulnerability in the initial stages of an investment. Scenario B (100 million): Here, the breakeven increases to 19 years. Although still reasonable, the increase in pre-construction costs suggests a slightly higher financial risk, which may further affect investor confidence and willingness to engage. Scenario C (110 million): This scenario, with the highest pre-construction cost, yields a break-even point of 20 years. The longer recovery time may raise concerns for investors, who may be deterred by the higher initial investment and associated financial risks. These findings highlight that the magnitude of pre-construction cost plays an important role in defining the concession period of any particular PPP wastewater project. For low pre-construction costs, shorter break-even times imply higher profitability of the project for potential investors, whereas with increasing pre-construction costs, break-even times will increase along with increased financial risks. Proper analysis is required from the stakeholder side to accurately design a financing structure and ultimately implement the project smoothly. Figure 9 shows the concession period versus pre-construction cost scenarios.

Figure 9. Concession period vs. pre-construction cost scenarios

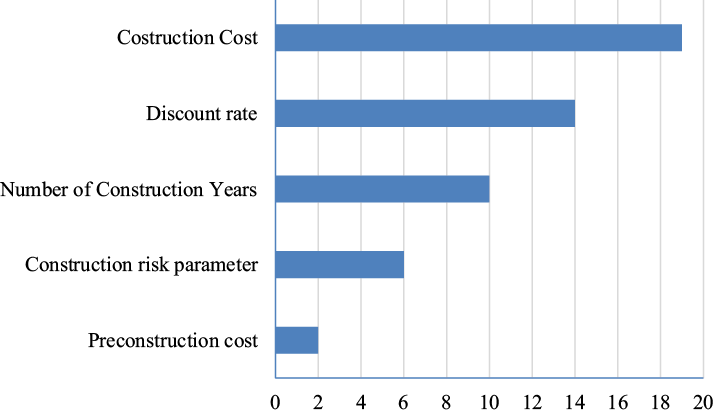

Sensitivity analysis

Table 5 shows a sensitivity analysis of key factors influencing optimal concession periods in PPP wastewater treatment projects. The optimal concession period in PPP wastewater treatment projects is influenced by five key factors—construction costs, discount rates, construction duration, construction risk parameters, and pre-construction costs—each impacting the break-even timeline in distinct ways. Construction cost is critical; higher costs (e.g., 650M) result in longer break-even periods (34 years), while lower costs (e.g., 550M) align with shorter break-even periods (15 years), enhancing investment appeal. The discount rates also play a significant role; lower rates (0.15) lead to quicker recovery (16 years), whereas higher rates (0.17) stretch break-even timelines to 30 years, potentially deterring investors. Construction duration impacts recovery times as well; shorter durations (1.5 years) yield faster break-even points (16 years), while longer durations (2.5 years) extend recovery to 26 years, raising financial risk. Construction risk ratio affects stability; lower risk ratios (0.3) result in quicker recoveries (17 years), but higher risks (0.4) extend break-even periods (23 years), increasing investor concerns. Finally, pre-construction costs influence initial financial exposure; lower costs (90 million) correspond to faster breakeven (18 years), while higher costs (110 million) lead to extended recovery times (20 years), impacting investor confidence. Overall, stakeholders must balance these factors to optimize concession periods and ensure project viability. Figure 10 illustrates the sensitivity analysis for the effect of each crucial factor on the optimal concession period in wastewater treatment projects.

Note: PPP, public–private partnership.

Figure 10. Sensitivity analysis for the crucial factors

Findings

This study shows that the variables with maximum influence on the optimal concession periods in PPP wastewater projects are construction costs, discount rates, construction duration, construction risk parameters, and pre-construction costs. The SD model, implemented in AnyLogic, simulates these factors and arrives at the break-even point at which public and private financial interests are met. Sensitivity analysis showed that the value of higher construction costs extending the concession period to up to 34 years was 650M, while that of lower construction costs reducing it to 15 years was 550M. Likewise, a higher discount rate (0.17) delays the cost recovery to 30 years, whereas a lower discount rate (0.15) shortens it to 16 years. The model also indicates that a longer construction duration (2.5 years) leads to a longer concession period (26 years), whereas a shorter one (1.5 years) reduces it to 16 years. The optimal concession period, therefore, for the New Cairo WWTP was estimated at 19 years, where the NPV of the Public Sector Comparator and the decoupled NPV of the private sector are equal. Unlike traditional models, which treat risk distributions as static, the risk-decoupled NPV framework incorporates dynamic risk factors to achieve a more equitable distribution of responsibility for finance between the public and private sectors. These findings provide evidence that the countries need adaptive governance, financial flexibility, and risk-sensitive contracts for the survival of PPP frameworks.

Discussion

Many parameters play a significant role in defining a concession period associated with wastewater treatment projects under the PPP scheme. This discussion utilizes academic literature and ongoing study findings to show users how certain factors influence the optimal concession period in PPP wastewater treatment projects. Pre-construction costs, including those related to design, planning, and compliance with regulations, are also significant (Ke, et al., 2017). This analysis reveals that higher pre-construction costs will lead to longer concession periods, enabling the investor to recover the costs of investment. This agrees with the findings of Yu, et al. (2021), who emphasized the importance of ascertaining pre-construction costs in ensuring enhanced financial viability. Therefore, in-depth analysis of pre-construction costs is crucial for striking a good deal for the parties involved. The most important determinant of the concession period is construction cost. In this respect, the analysis of the current study identified that with higher construction costs, longer concession periods are required to allow for sufficient recovery of investments. Kamel, et al. (2023) noted that high initial costs may discourage private participation, especially in developing regions such as Egypt. Therefore, the current research shares the view of Kamel, et al. (2023) that one of the most important determinants of the financial viability of PPP wastewater treatment projects is construction cost. A more holistic understanding of construction costs may lead to more competitive bids and concession periods since private investors would want faster returns on a lower-cost project. The duration of construction is another critical factor affecting the concession period. This study identifies that longer construction durations increase the risk exposure for private partners, necessitating longer concession periods to offset potential revenue losses during delays. The above sentiment is echoed by Jin, et al. (2021), who stated that construction risks complicate revenue projections. A concession length is substantially affected by a discount rate. The present value of future cash flows is determined mainly by a discount rate. The various economic scenarios analyzed herein reveal that a lower discount rate, which increases the present value of the revenues expected, can facilitate a shorter concession period. Guo, et al. (2021) supported these results by indicating that higher discount rates can lead to extended periods for cost recovery, which may deter investment. Therefore, careful calibration of the discount rate in line with market conditions is an important step in attracting private partners. Construction costs, discount rates, construction duration, and pre-construction costs are some of the various influences interacting in a complex manner in PPP wastewater treatment projects. From this study, the outcome of critical factors affecting the concession period provides an understanding coherent with the existing literature on the subject. By way of integrating these perceptions, the stakeholders would be able to shape the PPP agreements in a way that would ultimately balance the risk and investment attractiveness along with project sustainability, so it could go a long way in achieving better success in wastewater management.

Conclusion and policy implications

Conclusion

This study developed an SD model with a view to the RDNPV framework, watching for the optimal concession period for PPP wastewater treatment projects. Construction costs, discount rates, construction duration, construction risk parameters, and pre-construction costs have indeed been found to be the most effective parameters of the model. It confirmed that higher construction costs, longer construction durations, and high discount rates would prolong the break-even time, while lower values would render cost recovery faster. This study implied the New Cairo WWTP to be optimally concessioned over 19 years, during which the NPSC and the NPPP converged. Unlike static models, an SD framework instead holds probability ratio changes with time because the risk is dynamic; therefore, the concession period for PPPs can now be modeled very flexibly and accurately. These findings strengthen the argument for adaptive financial models integrating risk parameters into PPP contract design, ensuring truly equitable distribution of benefits. This study contributes to PPP infrastructure finance research by introducing a dynamic, risk-sensitive modeling framework that more accurately predicts concession durations. This approach would enhance the development of future research on adaptive financial models for emerging economies.

Implications for policy and practice

Policy frameworks for PPP agreements: Findings show that flexible concession period regulations adjust to changing economics. Therefore, they need to adopt adaptive governance models that consider real-time changes in costs and revenues while managing risks.

Risk allocation in contract design: Risk-decoupled NPV should be built into PPP appraisal processes to develop policy-related concerns about overrated or underrated financial risks in fair risk sharing among public and private partners.

Financing and investments: There should be a sensitivity analysis by private investors when they negotiate concession periods. The analysis would ensure cost recovery within time frames that are financially viable and prevent excessive profit that could burden the public sector.

Project approval implementation: Performance-based contract mechanisms should be introduced as dynamic adjustments of the concession period, dependent on economic and operational performance, unlike fixed assumptions.

Sustainability in PPP projects: Environmental and social impact considerations in estimating the concession period should not only be on financial feasibility but also on the capacity of projects to deliver long-term sustainability goals.

The recommendations of the findings of this study advise that policymakers should consider flexible concession period frameworks that adjust based on macroeconomic conditions. For example, a real-time monitoring system for discount rates and inflation could establish an automatic re-evaluation of concession periods in intervals of 5 years. Furthermore, risk-sharing agreements will have adaptive mechanisms for covering unforeseen cost overruns, and government guarantees for projects that exceed a threshold of defined financial risk. Adaptive governance would bolster investor confidence and public sector funding in the long run.

Limitations of the study

Data constraint: While the proposed model can be applied to various countries, the numerical results should be adjusted accordingly, as the research heavily relies on data obtained from the New Cairo WWTP.

Simplified risk modeling: Certain external risks (e.g., political, environmental, or demand fluctuations) have been simplified in the RDNPV model, which therefore can affect the concession periods under real conditions.

Assumed market stability: Discount rates and characteristics of finance were supposed to be constant; however, different permanent conditions exist in the economy (for example, changing inflation or interest rates), which could significantly affect the results of projects.

Data availability statement

All data, models, and code generated or used during the study appear in the submitted article.

References

Ahmadabadi, A.A. and Heravi, G., 2019. The effect of critical success factors on project success in Public-Private Partnership projects: A case study of highway projects in Iran. Transport Policy, 73, 152–161. https://doi.org/10.1016/j.tranpol.2018.07.004

Aljaber, K., Sohail, M., and Ruikar, K., 2024. Critical Success Factors of Water and Power Public–Private Partnerships in Developing Countries: A Systematic Review. Buildings, 14 (6), 1603. https://doi.org/10.3390/buildings14061603

Altanany, M.Y., Badawy, M., Ebrahim, G.A., and Ehab, A., 2024. Modeling and optimizing linear projects using LSM and Non-dominated Sorting Genetic Algorithm (NSGA-II). Automation in Construction, 165, 105567. https://doi.org/10.1016/j.autcon.2024.105567

Ameyaw, E.E. and Chan, A.P.C., 2015. Risk allocation in public-private partnership water supply projects in Ghana. Construction Management and Economics, 33 (3), 187–208. https://doi.org/10.1080/01446193.2015.1031148

Amiri-Pebdani, S., Alinaghian, M., and Safarzadeh, S., 2022. Time-Of-Use pricing in an energy sustainable supply chain with government interventions: A game theory approach. Energy, 255, 124380. https://doi.org/10.1016/j.energy.2022.124380

Castelblanco, G., Guevara, J., Mangano, G., and Rafele, C., 2024. Financial system dynamics model for multidimensional flexibility in toll road PPPs: a life-cycle analysis. Construction Management and Economics, 42 (9), 802–821. https://doi.org/10.1080/01446193.2024.2335566

Castelblanco, G., Mangano, G., Zenezini, G., and De Marco, A., 2025. Once concessioned, twice shy? Asymmetries of “reconcession” in national PPP programs. Construction Management and Economics. https://doi.org/10.1080/01446193.2024.2448975

Castelblanco, G., Safari, P., and Marco, A. De, 2023. Driving Factors of Concession Period in Healthcare Public Private Partnerships. Buildings. https://doi.org/10.3390/buildings13102452

Chen, C., Lv, L., Wang, Z., and Qiao, R., 2023. Bargaining optimization model for risk renegotiation with fairness concerns in infrastructure PPP projects. Engineering, Construction and Architectural Management, 30 (9), 3876–3894. https://doi.org/10.1108/ECAM-11-2021-1006

Chen, H., Zhang, L., and Wu, X., 2020. Performance risk assessment in public–private partnership projects based on adaptive fuzzy cognitive map. Applied Soft Computing, 93, 106413. https://doi.org/10.1016/j.asoc.2020.106413

Dai, T., Wang, Q., Sun, X., and Shi, B., 2020. Study on investment return system of PPP wastewater treatment projects based on system dynamics. International Journal of Technology, Policy and Management, 20 (3), 193–213. https://doi.org/10.1504/IJTPM.2020.109781

Ding, P., Xia, W., Zhao, Z., and Li, X., 2023. The impact of government subsidies on build-operate-transfer contract design for charging piles in circular economy. Industrial Management and Data Systems, 123 (4), 1084–1121. https://doi.org/10.1108/IMDS-01-2022-0060

El-Kholy, A.M. and Akal, A.Y., 2021. Assessing and allocating the financial viability risk factors in public-private partnership wastewater treatment plant projects. Engineering, Construction and Architectural Management, 28 (10), 3014–3040. https://doi.org/10.1108/ECAM-05-2020-0373

Eshun, B.T.B., Chan, A.P.C., and Osei-Kyei, R., 2021. Conceptualizing a win–win scenario in public–private partnerships: evidence from a systematic literature review. Engineering, Construction and Architectural Management, 28 (9), 2712–2735. https://doi.org/10.1108/ECAM-07-2020-0533

FahimUllah, Jamaluddin, T.M., E., S.S.M., and Nuria, F., 2018. System Dynamics Model to Determine Concession Period of PPP Infrastructure Projects: Overarching Effects of Critical Success Factors. Journal of Legal Affairs and Dispute Resolution in Engineering and Construction, 10 (4), 4518022. https://doi.org/10.1061/(ASCE)LA.1943-4170.0000280

Fathi, M., 2024. A Structural Equation Model on Critical Risk and Success in Public–Private Partnership: Exploratory Study. Journal of Risk and Financial Management, 17 (8), 354. https://doi.org/10.3390/jrfm17080354

Fathi, M. and Shrestha, P.P., 2023. Public-Private Partnership Contract Framework Development for Highway Projects: A Delphi Approach. Journal of Legal Affairs and Dispute Resolution in Engineering and Construction, 15 (1). https://doi.org/10.1061/(ASCE)LA.1943-4170.0000575

Feng, K., Wang, S., Wu, C., Xia, G., and Hu, W., 2019. Optimization of concession period for public private partnership toll roads. Engineering Economics, 30 (1), 24–31. https://doi.org/10.5755/j01.ee.30.1.19215

Feng, Z., Gao, Y., Song, J., and He, Q., 2025. An analysis of information disclosure in build–operate–transfer road projects. European Journal of Operational Research, 322 (1), 292–306. https://doi.org/10.1016/j.ejor.2024.10.032

Grupo Banco Mundial, 2020. Wastewater: From Waste to Resource The Case of New Cairo, Egypt. Water Global Practice.

Guo, J., Chen, J., and Xie, Y., 2022. Determining a reasonable concession period for risky transportation BOT projects with government subsidies based on cumulative prospect theory. Engineering, Construction and Architectural Management, 29 (3), 1396–1426. https://doi.org/10.1108/ECAM-11-2019-0612

Guo, K., Zhang, L., and Wang, T., 2021. Concession period optimisation in complex projects under uncertainty: a public–private partnership perspective. Construction Management and Economics, 39 (2), 156–172. https://doi.org/10.1080/01446193.2020.1849752

Guo, Y., Chen, C., Luo, X., and Martek, I., 2024. Determining concessionary items for ‘availability payment only’ PPP projects: a holistic framework integrating Value-For-Money and social values. Journal of Civil Engineering and Management, 30 (2), 149–167. https://doi.org/10.3846/jcem.2024.20841

Guo, Y., Su, Y., Chen, C., and Martek, I., 2024. Inclusion of “managing flexibility” valuations in the pricing of PPP projects: a multi-objective decision-making method. Engineering, Construction and Architectural Management, 31 (11), 4562–4584. https://doi.org/10.1108/ECAM-07-2022-0672

Hadi, A.H. and Erzaij, K.R., 2019. Determination a Reasonable Concession Period for (PPP) Projects. Civil Engineering Journal (Iran), 5 (6), 1235–1248. https://doi.org/10.28991/cej-2019-03091328

Hamidreza, A., Sajad, N., Abbasianjahromi, H., and Naserkhaki, S., 2023. Using Agent-Based Modeling to Determine the Concession Period of BOT Contracts. Journal of Infrastructure Systems, 29 (2), 4023010. https://doi.org/10.1061/JITSE4.ISENG-2183

Ibem, E.O., Onyemaechi, P.C., and Yo-Vaughan, E.A., 2018. Project Selection and Transparency Factors in Housing Public-Private Partnerships in Nigeria. Construction Economics and Building, 18 (2), 15–40. https://doi.org/10.5130/AJCEB.v18i2.5771

Javed, A.A., Lam, P.T.I., and Chan, A.P.C., 2014. Change negotiation in public-private partnership projects through output specifications: an experimental approach based on game theory. Construction Management and Economics, 32 (4), 323–348. https://doi.org/10.1080/01446193.2014.895846

Jin, H., Liu, S., Li, J., and Liu, C., 2020. Imperfect Information Bargaining Model for Determining Concession Period of PPPs under Revenue Uncertainty. Journal of Legal Affairs and Dispute Resolution in Engineering and Construction, 12 (2). https://doi.org/10.1061/(ASCE)LA.1943-4170.0000382

Jin, H., Liu, S., Liu, C., and Udawatta, N., 2019. Optimizing the concession period of PPP projects for fair allocation of financial risk. Engineering, Construction and Architectural Management, 26 (10), 2347–2363. https://doi.org/10.1108/ECAM-05-2018-0201

Jin, H., Liu, S., Sun, J., and Liu, C., 2021. Determining concession periods and minimum revenue guarantees in public-private-partnership agreements. European Journal of Operational Research, 291 (2), 512–524. https://doi.org/10.1016/j.ejor.2019.12.013

Kamel, M., Khallaf, R., and Nosaier, I., 2023. Net present value-time curve behaviour of public private partnership projects. International Journal of Construction Management, 23 (11), 1924–1931. https://doi.org/10.1080/15623599.2022.2025742

Kamel, M., Montaser, A., and El-Rashid, I.A., 2017. Public Private Partnership in Egypt. In: Proceedings of the Canadian Society for Civil Engineering Annual Conference (CSCE 2017), 6th CSCE/CRC International Construction Specialty Conference. Vancouver, BC, Canada.

Kasprowicz, T., Starczyk-Kołbyk, A., and Wójcik, R.R., 2023. The randomized method of estimating the net present value of construction projects efficiency. International Journal of Construction Management, 23 (12), 2126–2133. https://doi.org/10.1080/15623599.2022.2045426

Ke, Y., Hao, W., Ding, H., and Wang, Y., 2017. Factors Influencing the Private Involvement in Urban Rail Public-Private Partnership Projects in China. Construction Economics and Building, 17 (1), 90–106. https://doi.org/10.5130/AJCEB.v17i1.5105

Khallaf, R., Naderpajouh, N., and Hastak, M., 2021. Robust Decision-Making for Multiparty Renegotiations in Public-Private Partnerships. Journal of Legal Affairs and Dispute Resolution in Engineering and Construction, 13 (3). https://doi.org/10.1061/(ASCE)LA.1943-4170.0000473

Kokkaew, N. and Tongthong, T., 2021. Computational Framework for the Determination of Duration and Revenue Sharing Rates in PPP Concession Renewal: A Monte Carlo and Risk Premium Approach. Engineering Journal, 25 (7), 59–71. https://doi.org/10.4186/ej.2021.25.7.59

Kukah, A.S.K., Owusu-Manu, D.-G., Badu, E., and Edwards, D.J., 2024. Delphi study for evaluating critical success factors (CSFs) for PPP power projects in Ghana. Journal of Facilities Management, 22 (5), 828–848. https://doi.org/10.1108/JFM-04-2022-0040

Mamdoohi, S., Miller-Hooks, E., and Gifford, J., 2023. An equilibrium approach for compensating public–private partnership concessionaires for reduced tolls during roadway maintenance. Transportation Research Part A: Policy and Practice, 175. https://doi.org/10.1016/j.tra.2023.103759

Martins, A., 2023. Public-Private Partnerships with No Contractual Base Case: Adjusting for the Impacts of Covid-19. European Procurement and Public Private Partnership Law Review, 18 (1), 40–49. https://doi.org/10.21552/epppl/2023/1/7

Mohy El Din, N.S., 2017. An integrated framework approach for PPP projects in Egypt. Master’s Thesis, the American University in Cairo.

Nguyen, N., Almarri, K., and Boussabaine, H., 2021. A risk-adjusted decoupled-net-present-value model to determine the optimal concession period of BOT projects. Built Environment Project and Asset Management, 11 (1), 4–21. https://doi.org/10.1108/BEPAM-12-2019-0134

Nguyen, P.T. and Likhitruangsilp, V., 2017. Identification risk factors affecting concession period length for public-private partnership infrastructure projects. International Journal of Civil Engineering and Technology, 8 (6), 342–348.

Osama, M., Sherif, A., and Badawy, M., 2023. Risk analysis of construction of administration projects using Bayesian networks. Journal of Engineering, Design and Technology, 21 (1), 281–298. https://doi.org/10.1108/JEDT-04-2021-0222

Planas, M.R., 2018. The New Cairo Wastewater Treatment Plant (Egypt). IESE Business School Specialist Center on PPP in Smart and sustainable Cities, 173–186.

Qi, R., Shen, Z., and Wang, J., 2020. Research on Government Compensation Mechanism of Public Rental Housing in Public Private Partnership Mode. In: ICCREM 2020: Intelligent Construction and Sustainable Buildings - Proceedings of the International Conference on Construction and Real Estate Management 2020. 501–512. https://doi.org/10.1061/9780784483237.060

Rasheed, N., Shahzad, W., and Rotimi, J., 2024. Factor analysis of risk allocation criteria (RAC) in public-private partnership (PPP) projects: A case of New Zealand. Construction Economics and Building, 24 (4/5). https://doi.org/10.5130/AJCEB.v24i4/5.9021

Sanni, A.O., 2016. Factors determining the success of public private partnership projects in Nigeria. Construction Economics and Building, 16 (2), 42–55. https://doi.org/10.5130/AJCEB.v16i2.4828

Sharafi, A., Sadegh Amalnick, M., and Allah Taleizadeh, A., 2021. Outcome of Financial Conflicts in the Operation Phase of Public-Private Partnership Contracts. Journal of Construction Engineering and Management, 147 (6). https://doi.org/10.1061/(ASCE)CO.1943-7862.0002011

Song, Y., Shangguan, L., and Li, G., 2021. Simulation analysis of flexible concession period contracts in electric vehicle charging infrastructure public-private-partnership (EVCI-PPP) projects based on time-of-use (TOU) charging price strategy. Energy, 228, 120328. https://doi.org/10.1016/j.energy.2021.120328

Taha, G., Sherif, A., and Badawy, M., 2022. Dynamic Modeling for Analyzing Cost Overrun Risks in Residential Projects. ASCE-ASME Journal of Risk and Uncertainty in Engineering Systems, Part A: Civil Engineering, 8 (3), 04022041. https://doi.org/10.1061/AJRUA6.0001262

Toma, H.M., El-Sayed, S., Ibrahim, A.H., and Badawy, M., 2024. Hybrid Evaluation Model to assess the overall barriers of public-private partnership contracts. International Journal of Construction Management, 1–10. https://doi.org/10.1080/15623599.2024.2358584

Ullah, F. and Thaheem, M.J., 2018. Concession period of public private partnership projects: industry–academia gap analysis. International Journal of Construction Management, 18 (5), 418–429. https://doi.org/10.1080/15623599.2017.1333400

Velasco, M.D.R. de, 2012. Case study on New Cairo Wastewater Project. In: Public-private partnerships conference. Dakar, Senegal: International Finance Corporation, World Bank Group.

Wibowo, A., 2022. VfM-at-Risk Analysis Model for Build–Operate–Transfer Infrastructure Projects. Journal of Infrastructure Systems, 28 (4), 4022032. https://doi.org/10.1061/(ASCE)IS.1943-555X.0000721

Yu, S., Dai, T., Yu, Y., and Zhang, J., 2021. Investment decision model of wastewater treatment public–private partnership projects based on value for money. Water and Environment Journal, 35 (1), 322–334. https://doi.org/10.1111/wej.12629

Zhang, H., Jin, R., Li, H., and Skibniewski, M.J., 2018. Pavement Maintenance–Focused Decision Analysis on Concession Periods of PPP Highway Projects. Journal of Management in Engineering, 34 (1). https://doi.org/10.1061/(ASCE)ME.1943-5479.0000568

Zhang, Y., Yuan, J., Zhao, J., Cheng, L., and Li, Q., 2022. Hybrid Dynamic Pricing Model for Transport PPP Projects during the Residual Concession Period. Journal of Construction Engineering and Management, 148 (2). https://doi.org/10.1061/(ASCE)CO.1943-7862.0002218