Construction Economics and Building

Vol. 25, No. 2

July 2025

RESEARCH ARTICLE

Proactive Contract Theory-Based Resilience Framework Development for Public–Private Partnerships

Tharun Dolla1*, Nicola Thounaojam2, Ganesh Devkar3 and Boeing Laishram4

1 Department of Civil Engineering, GITAM Deemed to be University, Visakhapatnam, India, tdolla@gitam.edu

2 Department of Civil Engineering, Indian Institute of Technology Guwahati, Guwahati, India, nicola@iitg.ac.in

3 Faculty of Technology, CEPT University, Ahmedabad, India, ganesh.devkar@cept.ac.in

4 Department of Civil Engineering, Indian Institute of Technology Guwahati, Guwahati, India, boeing@iitg.ac.in

Corresponding author: Tharun Dolla, Department of Civil Engineering, GITAM Deemed to be University, Visakhapatnam, India, tdolla@gitam.edu

DOI: https://doi.org/10.5130/AJCEB.v25i2.9273

Article History: Received 02/08/2024; Revised 08/03/2025; Accepted 16/04/2025; Published 08/08/2025

Citation: Dolla, T., Thounaojam, N., Devkar, G., Laishram, B. 2025. Proactive Contract Theory-Based Resilience Framework Development for Public–Private Partnerships. Construction Economics and Building, 25:2, 253–275. https://doi.org/10.5130/AJCEB.v25i2.9273

Abstract

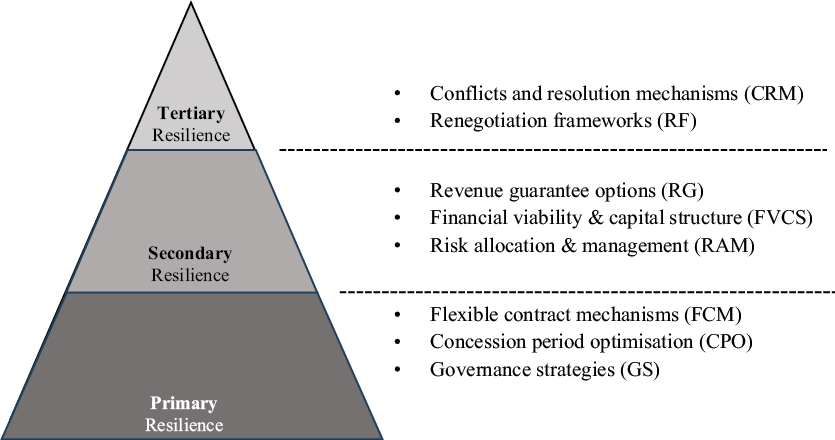

Public–private partnerships (PPPs) are long-term contracts spanning many decades and are susceptible to failure due to dynamic changes such as crises within the contract period. The impending need to incorporate resilience to sustain the impacts of unexpected events on projects and contractual structures compelled this review of the PPP literature. This is to understand and unravel how and in what manner PPPs are undergirded by resilience. Using a systematic literature review methodology, a critical search from 1997 to 2023 for relevant publications in the Scopus and Web of Science databases yielded 71,601 papers. Further screening using filtering criteria and selection from 12 leading journals in PPP studies resulted in a final set of 116 publications, which were then analysed using NVivo. This analysis led to the organisation of contained knowledge to form a resilience framework based on proactive-preventive contract theory. The findings revealed that the primary layer of resilience focuses on keeping the cause of the problem from arising in the first place through flexible contract mechanisms, concession period optimisation, and governance strategies; the secondary resilience intends to interrupt the cause and effect through revenue guarantee options, financial viability and capital structure, and risk allocation and management; and the tertiary resilience is about minimising the damage of any unwanted occurrences such as crisis through conflict and resolution mechanisms and the renegotiation framework. This review synthesised the accumulated PPP resilience knowledge to be used by practitioners while handling the projects—both procured and in pipeline—through the reviewed suggestions and strategies.

Keywords

Proactive-Preventive Contract Theory; Public–Private Partnerships (PPPs); Resilience, COVID-19

Introduction

The coronavirus disease 2019 (COVID-19) pandemic has caused disruption, which can be seen in the economic, social, and even political spheres, affecting governments, financial institutions, project companies, and users (Castelblanco, et al., 2022b) as well as infrastructure project delivery. The global economy suffered a significant and unforeseen blow due to the COVID-19 pandemic, resulting in challenges for public–private partnership (PPP) infrastructure projects in all areas and stages, from the design phase to the operation phase (PPLRC, 2020). In this study, PPP is a contractual arrangement model in which the private sector delivers public infrastructure through an appropriate risk allocation mechanism (Dolla and Laishram, 2021a). The design phase required integration of new health protocols, increasing design complexity, cost, and timelines. The procurement and construction phases were disrupted by economic instability, reduced PPP stakeholder participation (Guevara, et al., 2024), supply chain issues, and worker practice restrictions (Akomea-Frimpong, et al., 2021), while the operational phase experienced revenue shortfalls due to decreased traffic volumes and strained public finances. These aspects may result not only from COVID-19-related disruptions (Dolla, 2025) but also from other crises such as political unrest and financial instability.

Resilience is increasingly becoming a radical alternative that introduces critical modes of thought into conventional governance processes and has taken diverse perspectives, including individual, organisational, and supply chain standpoints, with concepts focusing on behaviour and dynamics, capabilities, strategy, and performance, among others (Bhamra, et al., 2011). Among these, the ecological and psychological use of the term “resilience” has long been accepted. Resilience is defined as “… the capability and ability of an element to return to a stable state after disruption” (Bhamra, et al., 2011). According to Sutcliffe and Vogus (2003), every threat would have two responses. One is a rigid response, typically a negative adjustment such as narrow information processing, tightening of control, or conservation of resources. There could be an alternative that is a more resilient response, which is typically a positive adjustment such as broader information processing, loosening control, and utilisation of slack capabilities (Ram and Dolla, 2023).

Several reviews on PPPs have been published. These studies (Ke, et al., 2009; Zhang, et al., 2020b) have conducted systematic reviews with diverse objectives, such as understanding the research trends and identifying research directions. A few lacked the needed comprehensiveness to study the resilience dimension. The disruption caused by the COVID-19 pandemic in the PPP projects underscored the critical need to embed resilience into the design, procurement, construction, and operation of such projects. This disruption also highlighted limitations in traditional contract law for managing uncertainties, prompting a focus on alternative approaches prioritising proactive resilience-building strategies. In this context, it is imperative to systematically review the existing literature to explore how resilience has been conceptualised and addressed in PPPs, particularly through the lens of proactive contracting. Such an effort will not only provide a foundation for advancing research in this area but also support the development of more robust and adaptive PPP contractual frameworks. For example, Castelblanco, et al. (2022b) focused on the global financial crisis of 2008 and posited the suggestion of resilience for road infrastructure PPP projects. To address the challenges of any crisis on PPPs, it would be pertinent and useful to understand the discourse on the resilience of PPP models. Therefore, in light of the increasing vulnerability of PPP projects, this study aims to develop a conceptual PPP resilience framework to explore and evaluate mechanisms that enable effective management of uncertainties across the project life cycle. To guide the development and application of this framework, the following research questions are posed:

1. How has the research on PPP resilience evolved over time, and what emerging perspectives have shaped its trajectory?

2. What are the methodological approaches, theoretical lenses, geographical distribution, and sectoral focus in PPP resilience studies?

3. What are the key research themes within PPP resilience literature, and how do these align with the principles of proactive contract theory?

This systematic review synthesises the existing PPP studies on prospective measures for managing uncertainties in PPPs, offering insights into both academic research and practical advancements. Specifically, it provides insights into how these measures can be effectively incorporated into PPP contracts and governance arrangements to enhance their resilience and adaptability. Resilience will be a necessary capacity to face dangers both retrospectively (after they manifest) and prospectively (before they manifest) (Sutcliffe and Vogus, 2003).

The article is organised as follows. It begins with an overview of proactive contract theory, followed by the Research Methodology section. This is followed by the Findings and Discussion sections. Finally, the last section summarises the study’s contributions and limitations and suggests future research directions and practical implications.

Proactive contract theory and resilience

Contracts are bestowed with expressive and regulatory power. In the context of law and contracts, the definition of resilience from a normative approach would mean desirable flexibility over the long term. This would include actions that can help prepare or adapt to the changing conditions so that the law-based contract can still withstand the disruptions and recover from the effects. This is consistent with the fundamental premise of proactive contracting theory, which is the conscious use of contracts and contracting processes to enable the success of projects (Haapio, 2007).

Law and contracts can exhibit resilience in two ways (Berger-Walliser, 2012; Garmestani, et al., 2013). First is the conventional approach of law, where legal thought is oriented to the past and the correction of risk. The second is the proactive preventive law approach, which typically concerns measures that can avoid the risk of emergence. The concept is based on the notion that the sooner a conflict or a possible issue is handled, the greater the likelihood that a fair and timely solution can be found. This results in less cost. The proactive preventive law approach of resilience is initiated and extensively discussed in works such as Brown (1983). While traditional legal thought is oriented to the past, proactive law is oriented towards future work (Berger-Walliser, 2012).

The systems and processes of procuring a project through the PPP mode are more on the side of standardisation across many countries. Therefore, in the context of the PPP model, institutional arrangements in public infrastructure procurement play a crucial role in federal systemic resilience. Project organisations have adopted many ad hoc and short-term measures to address the pandemic’s impact on PPPs. For instance, drawing on customary and typical contractual relief mechanisms such as force majeure, PPP contracts have created temporary arrangements between parties to offer feasible solutions and avoid disputes (PPLRC, 2020). However, law and contracts are among the areas that are slow to embrace the resilience phenomenon (Farca and Dragos, 2020). A comprehensive outlook of mechanisms that are flexible enough to address the shortcomings in PPP contract arrangements impacted by crisis scenarios is lacking. Adding to the criticism of PPPs for infrastructure delivery, PPP contracts are argued to lack the principles and mechanisms required to minimise unforeseen disturbance and successfully complete the charted concession period. In other words, resilience in the PPP model holds the key to ensuring the successful delivery of its projects, and thus, attention is needed.

Thus, there has been a new added focus on contract resilience in recent times, emphasising formulations and optimisations for economic benefit through the use of contracts to improve their resilience (Eldosouky, et al., 2021). This marks a shift from other resilience dimensions such as engineering, organisational, psychological, socioecological, ecological, physical, disaster recovery, and supply chain (see Bhamra, et al., 2011). This provides a new way of looking into the PPP model, thereby helping policymakers and practitioners apply the available resilience mechanisms.

According to the proactive preventive law framework for contractual projects, a framework conceptualised by Haapio (2007) and further developed by Berger-Walliser (2012), projects (including PPP concessions) are to become successful with their intended goals and effective contract management. This must be handled at three levels of resilience. First, the proactive preventive law handles the primary causes related to the dimension of resilience called primary prevention (Berger-Walliser, 2012; Haapio, 2007). These are required to promote successful performance and eliminate causes of negative surprises, problems, and failure planning, contracting for successful performance and good relationships. It intends to plan and contract for performance, recognise, align, and manage expectations, communication, and coordination strategies. Second, the proactive preventive law concerns the secondary effects related to the dimension of resilience called secondary prevention (Berger-Walliser, 2012; Haapio, 2007). These resilience aspects focus on minimising problems and harmful effects through planning and contracting primarily from risk and contingency perspectives. These resilience-focused aspects are contract terms dealing with failure, risk allocation, force majeure, liabilities, indemnities, and remedies. Third, proactive preventive law concerns the tertiary consequences from the perspective of contractual resilience called tertiary prevention (Berger-Walliser, 2012; Haapio, 2007). These include managing conflict, avoiding litigation, and minimising cost and loss planning using dispute resolution and alternative dispute resolution methods through planning, incorporation, and contracting. Overall, this theory tries to prevent the occurrence of undesirable events and dangers.

Building on this foundation, this study seeks to frame the key themes in PPP resilience research by aligning them with the framework’s preventive, responsive, and adaptive dimensions. By synthesising these insights, the study can contribute to a deeper understanding of resilience in PPPs and offer guidance for enhancing contractual effectiveness in complex and uncertain environments.

Research methodology

A systematic literature review entails adhering to specific procedures to report existing knowledge in an unbiased and structured manner. In contrast to a non-structured review procedure, a systematic review is considered a well-defined protocol to search and the fundamental scientific procedure essential for conducting a literature review (Tranfield, et al., 2003). Thus, the study adopted a systematic methodology to ensure that the results were sufficiently robust according to three stages of methodology.

Stage 1: Planning the review

A critical search for relevant publications was conducted in two of the most prominent databases, Scopus and Web of Science, until 2023. The search was based on a search string developed using an extensive list of search terms related to PPP, resilience, crisis, and associated terms. The search string that was used to conduct the systematic literature review is as follows:

[Title-Abs-Key (“uncertain*” OR “cris*s” OR “shock” OR “stress” OR “disaster” OR “disrupt*” OR “catastroph*” OR “failure” OR “recess*” OR “force majeure” OR “covid 19” OR “bankrupt*” OR “pandemic” OR “war” OR “recall” OR “strike” OR “massacre” OR “terroris*” OR “scandal*” OR “turbulen*” OR “resilien*” OR “flexib*” OR “adaptab*”) AND (“PPP” OR “Public‒Private Partnership” OR “Private Finance Initiatives” OR “PFI” OR “Build Operate Transfer” OR “BOT” OR “Transfer Operate Transfer” OR “TOT” OR “Build Operate Own Transfer” OR “BOOT”)]

Stage 2: Conducting the review

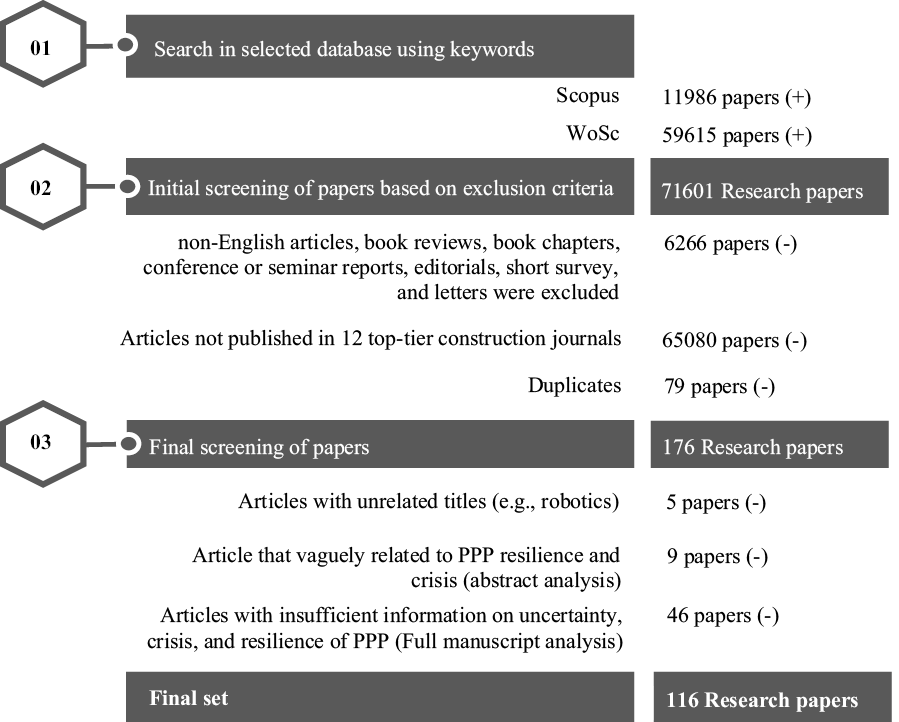

The search relied on a predefined search string and led to a total of 71,601 research articles from the two databases (Figure 1). To ensure that the search captured all relevant data, there was no start date during the search process. Accordingly, the first publication is observed in 1997, corroborating that interest is due to the Asian financial crisis. The search strategy and its comparison with published literature are shown in Table 1.

Figure 1. Research paper selection process (Source: Authors’ work).

| Step | Our study | Castelblanco, et al. (2022b) | Akomea-Frimpong, et al. (2022) |

|---|---|---|---|

| Keywords and Boolean expression | New unique terms:

| [Title-Abs-Key (“public private partnership” OR “public private partnerships” OR “build operate transfer” OR “build-operate-transfer” OR “build/operate/transfer” OR “private finance initiative” OR “concession” OR “PFI” OR “PPP/PFI” OR “PFI/PPP” OR “toll road” OR “P3” OR “PPP”) AND (“COVID” OR “COVID-19” OR “pandemic” OR “coronavirus” OR “recession” OR “crisis” OR “bailout” OR “force majeure”)] | (TITLE-ABS-KEY (“public-private partnerships” OR “public private partnership” OR “PPP” OR “PPPs” OR “public-private partnership projects” OR “public-finance initiative” AND “COVID-19” OR “coronavirus” OR “COVID-19 pandemic” OR “SARS-COV-2”)) |

| Timespan | 1997–2023 | 2008–2020 | 2020–2021 |

| Sector | Multiple | Road infrastructure | General |

| Database | Scopus and Web of Science | Scopus and Web of Science | Scopus, Web of Science, and PubMed search |

| Final paper sample | 116 | 24 papers initially and snowball process (final sample is not clear) | 29 |

| Analysis type | Content and thematic analysis | Community-based analysis and semantic network analysis | Content analysis |

Source: Authors’ work.

Out of the initial search results, non-English articles, book reviews, book chapters, conference or seminar reports, and editorials were excluded from the analysis, resulting in 65,335 papers (after removing 6,266 papers). Further, existing systematic reviews on PPPs were analysed to identify a list of leading journals. Based on the impact factors of these journals and their relevance to PPP studies, articles (255 papers) were subsequently curated from 12 top journals. Notably, these journals were also utilised in previous systematic reviews on PPPs, ensuring consistency with the established methodologies (Ke, et al., 2009; Zhang, et al., 2020b). In addition, 79 duplicates were identified and removed, resulting in 176 papers. Further screening resulted in a final set of 116 research papers.

Stage 3: Analysing, synthesising, and reporting review

To begin the analysis, a data extraction form was created in Excel to collate relevant information from the final set of 116 selected publications. Initially, this facilitated a broad content analysis to map key characteristics and research trends across the articles. Building on this, the study progressed to a thematic analysis to explore deeper patterns and meanings within the data. Thematic analysis is “a method of identifying, analysing, and reporting patterns in the data” (Braun and Clarke, 2006). The study followed six steps outlined by Braun and Clarke (2006): (1) becoming familiar with the data by reading through the selected papers, (2) generating a coding framework, (3) reading through the selected papers and coding the contents based on the coding framework, and (4) charting the coded data and analysing by constructing themes from these emergent ideas and concepts in an interpretive stage where findings from the selected papers were integrated into coherent themes. These steps align with other established qualitative research practices (Miles, et al., 2014). Coding was performed in the NVivo version 1.5.1 software (for Mac). Furthermore, following the suggestion of Kuhrmann, et al. (2017) to involve multiple authors to minimise the risk of subjectivity in publication selection since individual interpretation can influence the process, two authors conducted this exercise independently. The final decisions were made based on the authors’ mutual agreement. The number of publications from each of the top 12 journals is counted and presented in

Table 2.

*IF: Impact factor of the journal (2023).

Source: Authors’ work.

Findings

Chronological trend

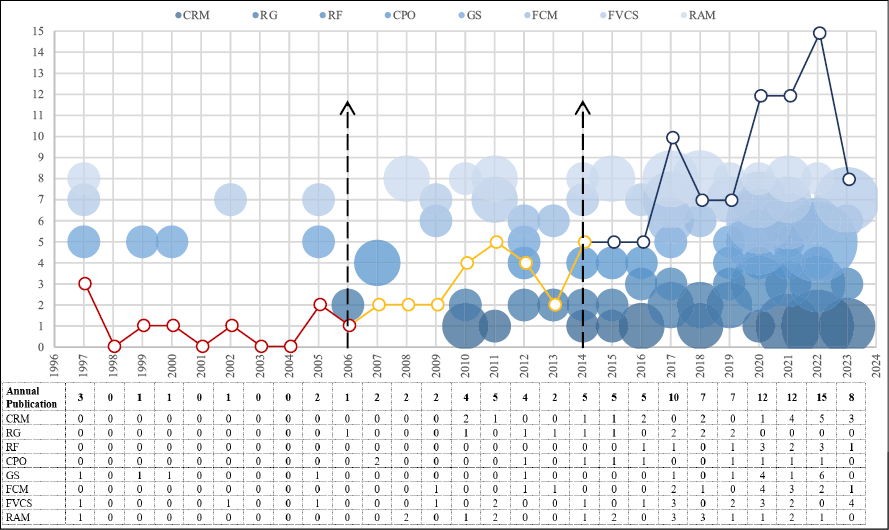

The study conducted chronological analysis to identify the temporal distribution of articles and the evolution of themes leading to the understanding of emergent perspectives in PPP resilience research. Figure 2 shows the evolution of research and highlights key themes, including conflict and resolution mechanisms (CRM), revenue guarantee options (RG), renegotiation framework (RF), concession period optimisation (CPO), governance strategies (GS), flexible contract mechanisms (FCM), financial viability and capital structure (FVCS), and risk allocation and management (RAM). These themes will be explored in detail in the subsequent sections. The bubble size (Figure 2) represents publications. It can be seen that there is a consistent increase in publications in the three epochs found in the literature. The temporal classification of papers shows a growing academic interest in this domain based on the number of papers, with peaks of sustained increase in 2006 and 2014. Most of the studies have been conducted since 2011. This demonstrates the issue’s rising prominence across countries, governments, and initiatives.

1. 1997–2006: The Asian financial crisis happened in 1997, so the focus started then.

2. 2007–2014: Since the global financial crisis (GFC) occurred in 2008, there has been a spike in research focus since 2009.

3. 2015–2024: Emergence of flexible contracts.

Figure 2. Research themes and their evolution. (Source: Authors’ work. Note: The two vertical arrows indicate the increase in number of publications).

During 1997–2006, governance mechanisms pertaining to force majeure risk and political risk in contract clauses were some of the key issues discussed. Some areas for improvement in the clauses were suggested, including government-supported refinancing options with direct financial assistance or insuring political risk obtained from the Multilateral Investment Guarantee Agency (Wang, et al., 2000). Several shortcomings of classic quantitative capital budgeting methodologies, such as internal rate of return (IRR), accounting rate of return (ARR), and net present value (NPV), are highlighted during this time period (Ho and Liu, 2002). Modern financial theory using an option pricing framework was introduced in the PPP resilience literature during this period (Ho and Liu, 2002). When the projects faced disruption, little was reported about how PPP suffered, tolerated, and withstood the financial crisis. However, there is a start of attraction to and inception of resilience focus for improved performance, but from political and financial perspectives.

Further to that, from 2007 to 2014, PPP faced another momentous, invigorated interest in resilience. This period captures 27% of the total papers reviewed. The areas of flexible contract mechanisms and PPP failure factors were introduced in the PPP resilience literature midway through this period (Cruz and Marques, 2013). The majority of the papers during this period dealt with revenue guarantees and risk management (Jin and Doloi, 2008). However, theories such as transaction cost economics (TCE), the resource-based view (RBV), and real option (RO) theory have gained popularity in applications related to minimum revenue guarantees, risk allocation, and procurement options analysis (Jin and Doloi, 2008; Ashuri, et al., 2012). The data, however, show that RO theory was scarcely applied in infrastructure projects at this time. This period also marks the introduction of studies on asset pricing mechanisms (Liu et al., 2017) and the growing importance of studies on concession period optimisation (Guo et al., 2021).

During 2015–2024, studies were published primarily to study and investigate various failure determinants and failure mechanisms that may lead to the premature cancellation of PPP projects in situations of crisis (Song, et al., 2018) and mechanisms associated with public and private partners’ roles in times of financial burden (Zhang and Soomro, 2016). The importance of flexible contract mechanisms justifies scholars’ growing attention to the resilience of PPPs, particularly in handling uncertainties through developments such as the dynamic incentive model (Zhang, et al., 2020a) and joint-contract functions (Cheng, et al., 2021). This period also marks the recognition of the need to allow renegotiation to counter, such as the incompleteness of PPP contracts and their rigidity (Chen, et al., 2022), mainly to deal with both rigid and flexible contracts (Feng, et al., 2022), readjust contract variables (Sharafi, et al., 2021), and improve the tender pricing mechanism by ex-ante consideration of expenses and gains of renegotiations (Xiong, et al., 2017). Apart from these attributes, researchers also focused on governance strategies, financial viability, concession period optimisation, and asset pricing during this period. Furthermore, RO theory was increasingly applied to understand or solve different kinds of PPP problems related to renegotiation (Xiong, et al., 2017), asset pricing and valuation (Liu, et al., 2017), and concession period optimisation (Zhang, et al., 2016a). This period also witnessed the growth of other theories, such as game theory (Sharafi, et al., 2021) and contract theory (Dolla and Laishram, 2020). The use of system dynamics, Nash negotiation, and binomial lattice models appeared to be significant in studies related to asset pricing, capital structuring, and renegotiation in PPP projects (Chen, et al., 2022).

Methodological classification

A methodology-based categorisation was performed on the publications to comprehend the methodological progression in the studies. Out of the 116 papers examined, only 4.31% were of a conceptual or theoretical nature, while the remaining 95.69% were empirical research papers, as shown in Table 3. The empirical papers employed quantitative, qualitative, and mixed methods research designs, with the quantitative papers having the majority at approximately 70%. The qualitative research methodology papers focused mainly on surveys based on interviews, while the quantitative papers increasingly used mathematical modelling, constituting approximately 59% of the total repository analysed. Mixed research methods have been employed recently, but the numbers are small, accounting for only approximately 9% of the total research repository.

| Research method | No. of papers | % of papers | Sample papers |

|---|---|---|---|

| Theoretical/conceptual | 5 | 4.31 | Regan, et al. (2011); Vassallo, et al. (2012) |

| Empirical | 111 | 95.69 | Ho and Liu (2002); Jin and Doloi (2008) |

| - Quantitative | 77 | 69.37 | Huang and Pi (2014); Wang and Jin (2019) |

| - Qualitative | 21 | 18.92 | Eshun, et al. (2021); Mostaan and Ashuri (2017) |

| - Mixed methods | 13 | 11.71 | Delhi and Mahalingam (2020); Zhang and Soomro (2016) |

| Primary data | |||

| - Mathematical modelling | 64 | 57.66 | Chen, et al. (2012); Cruz and Marques (2013); Guo, et al. (2021); Zhang, et al. (2020a); Zhang, et al. (2016b) |

| - Questionnaire | 21 | 18.92 | Cheng, et al. (2021); Tariq and Zhang (2021) |

| - Case study | 6 | 5.41 | Jie (2009) |

| - Interview | 7 | 6.31 | Mostaan and Ashuri (2017); Song, et al. (2018) |

| Secondary data | 13 | 11.71 | Castelblanco, et al. (2022b); Devkar, et al. (2020); Eshun, et al. (2021) |

Source: Authors’ work.

Among the empirical papers, 98 papers used primary data collection methods, where mathematical modelling dominated the category, with 58 out of 95 papers (61%). The remaining 32 articles relied on questionnaire surveys, case studies, and interviews. A few studies (nine papers) used literature and publicly available data to leverage secondary data.

Theoretical lenses for examining PPPs and resilience

Table 4 shows the theories that are used when resilience has been the focus. In the PPP resilience literature, findings show that RO theory has been extensively used. Other theories, apart from those shown in Table 4, are contract theory, institutional theory, cumulative prospect theory, option pricing theory, structuration theory, decision theory, Nash negotiation theory, agency theory, and incomplete contracts theory.

Source: Authors’ work.

PPPs, public–private partnerships.

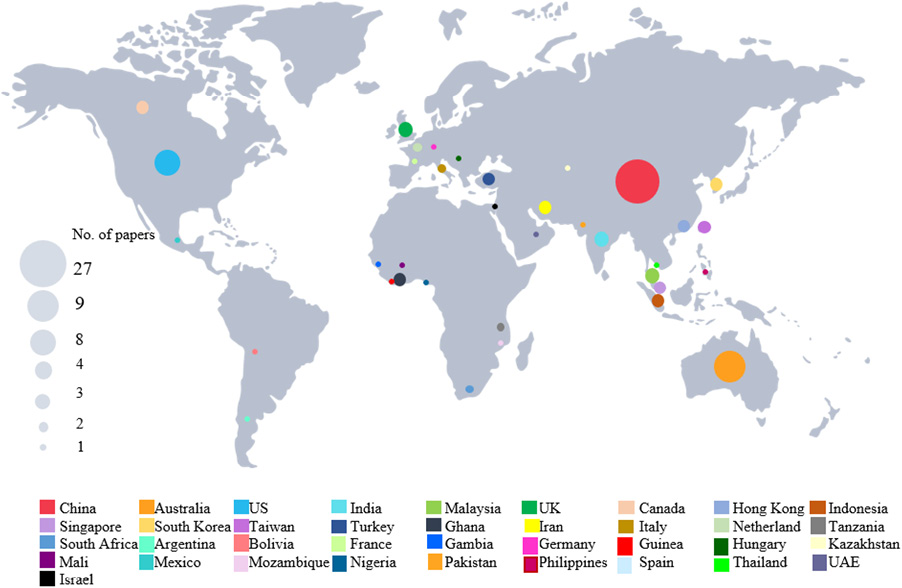

Geographical distribution

To track the spatial distribution of research in terms of where the study was carried out, a geographical distribution analysis was conducted. The research works were from (but not restricted to) China, Australia, the USA, India, Malaysia, the UK, Canada, and Hong Kong. Studies from China had a maximum contribution of 40%, and studies from Africa and Europe together constituted 43% of the studies. This revealed that scarce research on PPP resilience has been conducted in European and American projects compared to other projects in other geographical areas. Figure 3 shows the geographical distribution of the reviewed studies.

Figure 3. Geographical distribution (Source: Authors’ work).

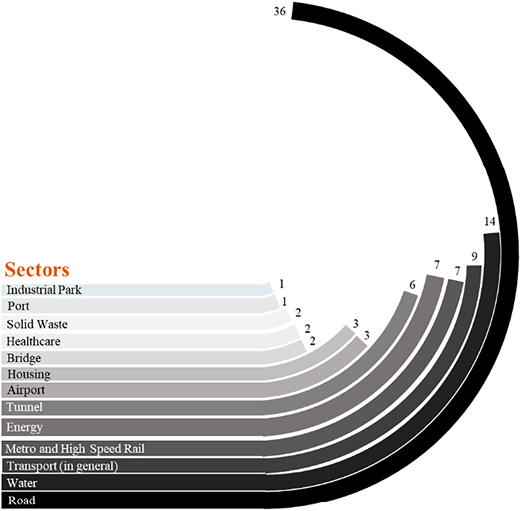

Sector-wise distribution

According to the sector distribution, 28% (30 articles) of the publications were identified to be broad across the sector (Figure 4). The review found that 64 papers appeared from the transportation sector, including road, transport (in general), metro and high-speed rail, tunnel, airport, bridge, and port. The remaining papers were spread across water, energy, housing, healthcare, solid waste, and industrial parks. The highest contributions appeared in the road sector (36 papers), followed by water (14 papers).

Figure 4. Sector-wise distribution. (Source: Authors’ work).

PPP resilience framework

The reviewed literature can be broadly classified into eight themes: CRM, RG, RF, CPO, GS, FCM, FVCS, and RAM. Figure 2 shows these research themes and their temporal evolution. A deeper analysis of these studies, guided by the proactive preventive law framework (Berger-Walliser, 2012), led to the development of a PPP resilience framework, which organises the insights into three layers of resilience: primary, secondary, and tertiary. This framework is significant because it integrates both pragmatic and theoretical approaches to demonstrate how PPPs can anticipate, absorb, and adapt to disruptions over their long life cycles.

The primary layer focuses on preventing disruptions (or keeping the cause of the problem from arising in the first place) through mechanisms such as flexible contracting, concession period optimisation, and governance strategies. The second layer aims at mitigating the impact of emerging issues (or interrupting the cause and effect) through responsive measures such as revenue-sharing adjustments and clear risk allocation. The tertiary layer represents the last line of defence (or minimising the damage of any unwanted occurrences), where formal and often institutionalised mechanisms like renegotiation frameworks or conflict and resolution mechanisms are employed to manage crises.

Organised in a pyramid-like structure (Figure 5), this framework also aligns with three levels of governance: relational, normative, and regulative. These correspond to how partnerships in PPPs are expected to evolve under stress. At the base of the pyramid lies relational governance, which serves as the first line of defence against project disruptions. Stakeholders initially engage in informal negotiations and cooperative engagement, embodying the true spirit of partnership that underpins PPP arrangements. When such relational efforts are insufficient to resolve the issue, the response escalates to the second layer (normative governance), where structured tools such as risk-sharing adjustments, performance incentives, or revenue redistribution mechanisms are activated to manage the disruption. If these measures fail to resolve the balance, stakeholders then turn to the apex of the framework (regulative governance). This layer comprises formal instruments like renegotiation frameworks, which are typically invoked only as a last resort.

Figure 5. PPP resilience framework based on the theory of proactive preventive law. Note: Developed by authors based on the works of Berger-Walliser (2012), Haapio (2007), and Hietanen-Kunwald and Haapio (2021), and the systematic review results; PPP: public–private partnership

By situating resilience as a dynamic and layered process rooted in the partnership ethos of PPPs, the framework provides a nuanced understanding of how public and private actors collaboratively manage disruptions. It underscores that resilience is not merely about surviving shocks but about enabling sustained performance and trust over time through an escalating set of responses tailored to the severity of the disruption and more adaptive and robust PPP contracts.

Discussion

The following section discusses the nine themes identified from the literature, structured according to the three layers of the framework discussed above.

Primary resilience

Flexible contract mechanisms

During the last decade, studies on flexibility have gained prominence across finance, management, and operations research (Cruz and Marques, 2013). In PPP research, scholars have emphasised incorporating contractual flexibility to address demand fluctuations and other project risks. Given the inevitable uncertainties and lengthy concession periods, Feng, et al. (2022) pointed out that flexibility in PPP contracts allows adaptation to unforeseen events. Eshun, et al. (2021) advocated shifting from rigid to flexible contracts, while Cheah and Liu (2006) stressed that flexibility in PPP design and implementation enhances value due to the irreversible nature of the economic element. In this context, Jie (2009) identified concession length, competitiveness, and unit price as three dynamic and adjustable contract conditions for PPPs. Chen, et al. (2012), using a game theory model, showed that developers adjust post-award contract terms strategically to sustain their competitive advantage. In addition, Cruz and Marques (2013), through a healthcare project in Portugal, quantified the economic gains of flexibility in PPP contracts and warned against limiting managerial discretion. Moreover, Zhang, et al. (2020a) proposed a dynamic incentive model enabling flexibility via a supervision mechanism, thus avoiding renegotiation. The conflicting interests of PPP parties, i.e., the pursuit of the public sector for socioeconomic multiplier benefits and the financial interests of the private sector, are to be managed through appropriate reward-penalty scenarios. Castelblanco, et al. (2022a) recommended integrating flexibility, adaptability, and changeability into the PPP procurement process to avoid ex-post renegotiations and boost resilience. Furthermore, robust ex-ante planning and coordinated execution are critical alongside contract flexibility for project success (Delhi and Mahalingam, 2020).

Concession period optimisation

The concession period is a critical component of PPP contracts, delineating the powers, obligations, and benefits shared between public and private sectors, and is thus central to contract success (Carbonara, et al., 2014). Over time, researchers have proposed various methods to determine the optimum concession length, influenced by project type, traffic volume, investment returns, income, and risk allocation (Guo, et al., 2022). Models using Monte Carlo simulation have been applied to account for uncertainties in build-operate-transfer (BOT) ports (Carbonara, et al., 2014) and transport projects (Jin, et al., 2020). In contrast, Khanzadi, et al. (2012) employed fuzzy-system dynamics to address ambiguity in influencing factors, predicting mutually agreeable concession periods in a highway project, and reducing renegotiation failures. In addition, Zhang, et al. (2016b), applying their model to the Hong Kong tunnel project, showed that concession length can be estimated prior to inviting bids by accounting for the net social benefits of the project and the life span of the project. This model helped to delink the prevalent uncertainty and make PPPs financially resilient, particularly concerning the revenues during the concession period.

Governance strategies

PPP projects involve a wide variety of uncertainties that impact planning and management processes. These uncertainties have the potential to increase the project value, performance risks, or both. Effective governance mechanisms are essential to address these uncertainties. During unprecedented times such as economic recessions, PPP concessions may require contract restructuring and revised funding models, along with navigating unforeseen legal and legislative challenges (Dewulf and Garvin, 2020; Vassallo, et al., 2012). Devkar, et al. (2020) highlighted that trust, shared commitment, and collaboration between public and private agencies enhance the ability to manage such complexities. For instance, in Spain’s 2008 recession, subordinated public participation loans (SPPLs) were used to pay cost overruns and prevent concessionaires’ bankruptcies (Vassallo, et al., 2012). Similarly, many relational mechanisms also emerged during the project as a response to unforeseen events. It can even be to the extent of adding “contract review” clauses to the agreement (Dewulf and Garvin, 2020). Therefore, there is a need for responsiveness and complementarity of contractual and relational mechanisms in PPPs. Moreover, Ampratwum, et al. (2024) highlighted that PPP resilience requires a stable political environment and clear legal and regulatory frameworks, while subsequent policy shifts, particularly driven by electoral motives, create investment uncertainty. Political risk insurance, such as that offered by international financial institutions, effectively covers uncertainties like wars, civil disturbances, or legal changes. Furthermore, Casady and Baxter (2020) called for force majeure contract terms led by sustainability and resilience measures, stressing the importance of rapid trust-building between parties during a crisis.

Secondary resilience

Revenue guarantee options

Traditionally, revenue shortfall renegotiation strategies in PPPs include increasing service charges, extending concession periods, or providing lump sum payments. To control and minimise revenue risk and incorporate contractual flexibilities, several scholars have used the RO method, which differs significantly from NPV models (Ashuri, et al., 2012). Cheah and Liu (2006) conceptualised contractual elements as a form of ROs, incorporating their value into the negotiation framework to stabilise risk and return. Ashuri, et al. (2012) proposed combining minimum revenue guarantees with traffic revenue caps to mitigate uncertainty in traffic forecasts. Similarly, Carbonara, et al. (2014) used RO-based models to incorporate fairness and determine optimum revenue caps to safeguard private sector interests. Guo, et al. (2021) advocated for RO analysis to optimise profit-sharing mechanisms in PPPs. Due to the uncertainty and irreversibility inherent in PPPs, governments often offer excessive guarantees. In this regard, Buyukyoran and Gundes (2018) demonstrated that a toll road RO model with fair lower- and upper-income guarantees significantly alters risk profiles compared to scenarios without guarantees. In addition, Attarzadeh, et al. (2017) modelled a valuation method for early fund generation options that can mitigate financial fluctuations and applied it to a power plant PPP project. Furthermore, Chen, et al. (2018) modelled a toll-adjustment mechanism as a RO, highlighting its role in preventing opportunistic behaviours, ensuring reasonable profits, and preserving public interest through toll-adjustment mechanism-related clauses.

Financial viability and capital structure

Privately built public infrastructure projects often face uncertain financial viability due to their scale, long contract durations, nonrecourse financing, and complexity despite being technically feasible. As such, improved financial engineering techniques are required. In this sense, Ho and Liu (2002) addressed bankruptcy risk by modelling financial viability using RO pricing of government debt and developer negotiation options. Similarly, Jeong, et al. (2016) combined RO valuation with discounted cash flow analysis to better capture future uncertainties in BOT projects. Wang and Jin (2019) identified the impact of unpredictable factors such as debt service coverage ratio, NPV, capital cost rate, return on equity, and debt sustainability ratio on the formulation of the BOT project’s optimal capital structure, proposing the interval number method to assess financial feasibility. Furthermore, Hou and Wang (2022) introduced a Markov model to optimise capital structure under dynamic maintenance demands, reducing refinancing needs and improving economic value. Regan, et al. (2011) highlighted the need for alternative financing mechanisms integrating stringent sustainability standards and life cycle costs to stabilise the capital market.

Risk allocation and management

Risk allocation in PPPs is often one-sided, creating an imbalance between private and public entities. Given the complex characteristics of PPP projects, including long contract periods, high capital costs, and uncertainties, they are prone to risk, which is sometimes catastrophic. Ineffective risk management is a major cause of PPP failures, heightening the need for robust risk assessment and fair allocation (Eshun, et al., 2021). Jin and Doloi (2008) observed that risk transfer is shaped more by TCE than by actual risk management capabilities. In a similar study, Xiong, et al. (2017) emphasised the need for ex-post risk management alongside ex-ante measures in highly complex projects. Models incorporating risk impact evaluation and enforcement of ex-post responses are in renegotiation and early termination scenarios (Osei-Kyei, et al., 2023). Furthermore, Akomea-Frimpong, et al. (2021) identified financial risks as key barriers in PPPs, especially in developing economies, calling for further research into emerging risks such as sustainability demands, carbon regulations, trade sanctions, and regional competitiveness. Similarly, PPP project valuation is also challenged by future uncertainties that may prompt abandonment or early termination of projects (Huang and Pi, 2014). Flexibility in asset pricing and valuation is thus essential.

Real option theory has attracted considerable attention in valuation methods, particularly for multistage BOT projects using sequential compound call options and performance bonding (Huang and Pi, 2014). This approach enhances concessionaires’ ability to manage market risks, potentially increasing project value, although sanctions may constrain flexibility. In addition, Liu, et al. (2017) developed an early termination pricing model under two scenarios of excessively high and low cash flows, allowing public and private parties to anticipate and manage termination-related financial risks.

Tertiary resilience

Conflict and resolution mechanisms

Anticipating the reasons for past conflicts and failures is central to proactive preventive contract law (Hietanen-Kunwald and Haapio, 2021). Conflicts in PPPs often arise from misaligned stakeholder expectations, ambiguous responsibility allocation, unclear contract terms, and communication gaps (Ampratwum, et al., 2024). A persistent challenge is the misalignment of public and private interests, particularly regarding risk allocation, financial viability, and performance expectations. Tariq and Zhang (2021) highlighted that socioeconomic (related to local economic circumstances and conditions such as citizens’ low purchasing power), macroeconomic (related to national and global financial situations such as a nation’s economic depression), and socio-political (related to social systems affected by political influences) factors often create tensions. These factors typically intersect, making private sector failure a multifaceted issue. Song, et al. (2018) identified market and regulatory changes as major causes of conflicts, leading to early termination. To mitigate such conflicts, Osei-Kyei, et al. (2023) advocated for strong legal and institutional frameworks that clarify stakeholder roles, support structured conflict resolution, and establish mechanisms for accountability.

Renegotiation framework

Renegotiation is a prevalent and recurring feature of PPP projects, particularly during economic crises. It serves as a contractual adjustment mechanism to mitigate the financial impact of unforeseen events and enhance value for money. Researchers have examined various dimensions of renegotiation processes in PPPs. Feng, et al. (2022) highlighted the increasing frequency of renegotiations, often driven by contractual inadequacies, financial uncertainties, and regulatory changes. As noted by Eshun, et al. (2021), renegotiable contracts uphold the win–win principle by enabling adjustments in response to uncertainties during the construction and operation stage. A key trigger for renegotiation in user-pay PPPs is the uncertainty in revenue, primarily stemming from fluctuations in user volumes, which threatens project profitability.

Xiong and Zhang (2016) pointed out the challenges in applying RO theory due to the difficulty of establishing a Nash equilibrium in renegotiation bargaining scenarios. To address this, Bae, et al. (2019) developed a renegotiation framework based on NPV equivalency, allowing parties to reclaim losses during the mid-concession period through a minimum revenue guarantee clause. Their case application to South Korea’s Incheon Airport Highway demonstrated that alternative renegotiation paths could sustain the NPV of the private sector while limiting government financial exposure. Jin, et al. (2020), using bargaining and coalitional game theory, further argued that renegotiation can be an optimal response even in excessively profitable circumstances for private investors. Similarly, Sharafi, et al. (2021) proposed a model to strategically revise key contract conditions such as concession length, government subsidies, and availability payment to facilitate strategic renegotiations fairly and effectively. Recognising the limitations of existing models, Chen, et al. (2022) introduced a renegotiation framework that integrates perceptions of fairness, thereby enhancing the psychological legitimacy and practical acceptance of renegotiated outcomes.

Implications

The findings of this study have significant implications for both policy and practice in enhancing the resilience of PPPs.

Practical implications

From a practical standpoint, the study provides actionable insights for contract design and PPP implementation. PPP success depends not only on effective risk allocation but also on the contract’s ability to adapt to unforeseen changes over a long concession period. Importantly, contracting is not an end in itself but a means to ensure sustained performance throughout the concession period. In this context, resilience can be seen as a close ally of proactive preventive contracting. The proposed PPP resilience framework offers a strategic guide to answer the question: how far are we in drafting resilient PPP contracts?

Proactive contract design should incorporate mechanisms that anticipate and respond to disruptions, including flexible clauses, concession period adjustments, and structured renegotiation processes. Practitioners are encouraged to adopt a tiered governance approach, where the primary resilience focuses on keeping the cause of the problem from arising in first place through FCM, CPO, and GS; the secondary layer of resilience intends to interrupt the cause and effect through RG, FVCS, and RAM; and the tertiary layer of resilience is about minimising the damage of any unwanted occurrences such as crises through CRM and RF.

These insights suggest that PPP contracts should move beyond static agreements to incorporate flexible, multi-layered resilience strategies. This proactive approach ensures that PPPs remain viable and effective, even in the face of major disruptions like the COVID-19 pandemic.

Policy implications

The sceptics of PPPs continue to argue about the validity and rationality of using PPPs (see Sherratt, et al., 2020). However, these arguments still do not address the holistic development agenda or the immediate needs of emerging economies that perhaps only PPP can solve. This still holds true even when today’s expenditure is necessarily (helplessly) pushed to tomorrow’s exchequer (Dolla and Laishram, 2021b). If there is anywhere that proactive contracting theory is vigorously attempted, it is in the PPP concessions. PPP concessions are the highest cooperative transaction model in all possible types of contracting for building civil infrastructure.

A key policy implication emerging from this study is the growing relevance of proactive contract theory in shaping the resilience of PPP arrangements. Recent trends have suggested that PPPs are increasingly embracing alternative dispute resolution mechanisms, which align with the tertiary layer of resilience under the proactive preventive law framework. This shift reflects a broader policy movement from reactive dispute settlement towards preventive legal design. Proactive law, underpinned by principles of legal certainty, legal literacy, and cross-professional collaboration (Berger-Walliser, 2012), provides a valuable foundation for framing PPP contracts that can withstand complex and long-term uncertainties. Policymakers are thus encouraged to integrate proactive legal principles into PPP regulatory frameworks, mandating structured negotiation protocols, promoting early warning systems, and institutionalising capacity-building efforts. Recognising that resilience is not an inherent characteristic of PPPs but rather a product of deliberate contractual, financial, and governance design, this study calls for reorienting policy priorities towards embedding resilience thinking in the legal architecture of public–private collaborations.

Conclusions and recommendations

This research sought to systematically review the resilience perspective of PPP models in response to the documented challenges posed by the COVID-19 pandemic on the PPP procurement model. While there is diversity in sectors of usage, success, terminologies, and even models, PPPs remain the go-to model to procure many infrastructure projects that otherwise would not be procured. The resilience of the PPP model literature, as reviewed in this paper, shows that while it is growing, many of the crucial insights are disseminated in diverse disciplinary domains and across a few infrastructure sectors. Research has been categorised based on three levels of resilience according to proactive preventive contract law (theory). At the primary level of PPP resilience, the framework has FCM, CPO, and GS, and these focus on keeping the cause of the problem from arising in the first place. At the secondary level of resilience, the framework has RG, FVCS, and RAM, which is about interrupting or breaking the link between the cause and effect. At the tertiary level of resilience for PPPs, the framework has CRM and an RF, which minimises the damage of unwanted occurrences such as crises. This study discussed the reviewed literature in these three layers. Thus, this study consolidates and distils the PPP literature so that resilience can be modelled into future projects if it is not the case. This study also explicates best practices to enhance the PPP model’s resilience to future crises, including pandemics like COVID-19. Based on a systematic literature review, this study extends proactive contract theory to analyse and assimilate the resilience modalities of the PPP model, which is novel.

Despite the contributions of this study, several limitations should be acknowledged to guide future research. First, the framework requires empirical validation. Future research should conduct in-depth case studies of PPP projects across diverse industries and regions to evaluate the implementation and effectiveness of the proposed resilience strategies. Second, given that resilience is not inherent but built through legal, financial, and governance mechanisms, future studies could investigate regulatory reforms needed to institutionalise proactive contracting practices. On the practice front, research should further explore how flexible, multi-layered contractual designs, such as flexible mechanisms, risk allocation strategies, and dispute resolution processes, are operationalised. Understanding how proactive elements have evolved over time will provide insights into their role in enhancing project resilience and success. Third, future research would benefit from integrating social and environmental dimensions, thereby broadening its scope to address the impacts of PPPs on communities, ecosystems, and climate change (Akomea-Frimpong, et al., 2023). Researchers could also examine how PPP contracts may be structured to ensure social fairness alongside resilience (Osei-Kyei, et al., 2023). Finally, the role of digital technologies in enhancing PPP resilience is an important avenue for future research (Ampratwum, et al., 2024). Technologies such as building information modelling (BIM), artificial intelligence (AI), and blockchain could significantly improve risk management, monitoring, and collaboration in PPP projects. Addressing these gaps will deepen the understanding of resilience in PPPs and strengthen the practical application of the proposed framework.

References

Akomea-Frimpong, I., Dzagli, J. R. A. D., Eluerkeh, K., Bonsu, F. B., Opoku-Brafi, S., Gyimah, S., Asuming, N. A. S., Atibila, D. W. and Kukah, A. S., 2023. A systematic review of artificial intelligence in managing climate risks of PPP infrastructure projects. Engineering, Construction and Architectural Management, ahead-of-print(ahead-of-print). https://doi.org/10.1108/ECAM-01-2023-0016

Akomea-Frimpong, I., Jin, X. and Osei-Kyei, R., 2021. A holistic review of research studies on financial risk management in public–private partnership projects. Engineering, Construction and Architectural Management, 28(9), pp. 2549-2569. https://doi.org/10.1108/ECAM-02-2020-0103

Akomea-Frimpong, I., Jin, X., Osei-Kyei, R. and Tumpa, R. J., 2022. A critical review of public–private partnerships in the COVID-19 pandemic: key themes and future research agenda. Smart and Sustainable Built Environment, ahead-of-print(ahead-of-print). https://doi.org/10.1108/SASBE-01-2022-0009

Ampratwum, G., Osei-Kyei, R. and Tam, V. W. Y., 2024. Development of a risk assessment model for adopting public–private partnership in building Ghana’s critical infrastructure resilience against unexpected events. Smart and Sustainable Built Environment, ahead-of-print(ahead-of-print). https://doi.org/10.1108/SASBE-04-2024-0109

Ashuri, B., Kashani, H., Molenaar, K. R., Lee, S. and Lu, J., 2012. Risk-Neutral Pricing Approach for Evaluating BOT Highway Projects with Government Minimum Revenue Guarantee Options. Journal of Construction Engineering and Management, 138(4), pp. 545-557. https://doi.org/10.1061/(ASCE)CO.1943-7862.0000447

Attarzadeh, M., Chua, D. K. H., Beer, M. and Abbott, E. L. S., 2017. Options-based negotiation management of PPP–BOT infrastructure projects. Construction Management and Economics, 35(11-12), pp. 676-692. https://doi.org/10.1080/01446193.2017.1325962

Bae, D. S., Damnjanoic, I. and Kang, D. H., 2019. PPP Renegotiation Framework based on Equivalent NPV Constraint in the Case of BOT Project: Incheon Airport Highway, South Korea. KSCE Journal of Civil Engineering, 23(4), pp. 1473-1483. https://doi.org/10.1007/s12205-019-1444-9

Berger-Walliser, G., 2012. The Past and Future of Proactive Law: An Overview of the Proactive Law Movement. In: Berger-Walliser, G. and Østergaard, K. (Eds.) Proactive Law in a Business Environment. Denmark: DJØF Publishing. pp. 13-31.

Bhamra, R., Dani, S. and Burnard, K., 2011. Resilience: the concept, a literature review and future directions. International Journal of Production Research, 49(18), pp. 5375-5393. https://doi.org/10.1080/00207543.2011.563826

Braun, V. and Clarke, V., 2006. Using thematic analysis in psychology. Qualitative Research in Psychology, 3(2), pp. 77-101. https://doi.org/10.1191/1478088706qp063oa

Brown, L. M., 1983. Manual for Periodic Legal Checkup. Oxford, UK: Butterworth Legal Publishers.

Buyukyoran, F. and Gundes, S., 2018. Optimized real options-based approach for government guarantees in PPP toll road projects. Construction Management and Economics, 36(4), pp. 203-216. https://doi.org/10.1080/01446193.2017.1347267

Carbonara, N., Costantino, N. and Pellegrino, R., 2014. Revenue guarantee in public-private partnerships: a fair risk allocation model. Construction Management and Economics, 32(4), pp. 403-415. https://doi.org/10.1080/01446193.2014.906638

Casady, C. B. and Baxter, D., 2020. Pandemics, public-private partnerships (PPPs), and force majeure | COVID-19 expectations and implications. Construction Management and Economics, 38(12), pp. 1077-1085. https://doi.org/10.1080/01446193.2020.1817516

Castelblanco, G., Guevara, J. and Mendez-Gonzalez, P., 2022a. In the Name of the Pandemic: A Case Study of Contractual Modifications in PPP Solicited and Unsolicited Proposals in COVID-19 Times. In: Jazizadeh, F., Shealy, T. and Garvin, M. J. (Eds.) Construction Research Congress 2022: Project Management and Delivery, Controls, and Design and Materials. Ch.6, pp. 50-58. https://doi.org/10.1061/9780784483978.006

Castelblanco, G., Guevara, J. and Salazar, J., 2022b. Remedies to the PPP Crisis in the Covid-19 Pandemic: Lessons from the 2008 Global Financial Crisis. Journal of Management in Engineering, 38(3). https://doi.org/10.1061/(ASCE)ME.1943-5479.0001036

Cheah, C. Y. J. and Liu, J., 2006. Valuing governmental support in infrastructure projects as real options using Monte Carlo simulation. Construction Management and Economics, 24(5), pp. 545-554. https://doi.org/10.1080/01446190500435572

Chen, C., Lv, L., Wang, Z. and Qiao, R., 2022. Bargaining optimization model for risk renegotiation with fairness concerns in infrastructure PPP projects. Engineering, Construction and Architectural Management, ahead-of-print(ahead-of-print). https://doi.org/10.1108/ECAM-11-2021-1006

Chen, Q., Shen, G., Xue, F. and Xia, B., 2018. Real Options Model of Toll-Adjustment Mechanism in Concession Contracts of Toll Road Projects. Journal of Management in Engineering, 34(1), p. 04017040. https://doi.org/10.1061/(ASCE)ME.1943-5479.0000558

Chen, T. C., Lin, Y. C. and Wang, L. C., 2012. The analysis of BOT strategies based on game theory - Case study on Taiwan’s high speed railway project. Journal of Civil Engineering and Management, 18(5), pp. 662-674. https://doi.org/10.3846/13923730.2012.723329

Cheng, M., Liu, G. and Xu, Y., 2021. Can joint-contract functions promote PPP project sustainability performance? A moderated mediation model. Engineering, Construction and Architectural Management, 28(9), pp. 2667-2689. https://doi.org/10.1108/ECAM-06-2020-0419

Cruz, C. O. and Marques, R. C., 2013. Flexible contracts to cope with uncertainty in public-private partnerships. International Journal of Project Management, 31(3), pp. 473-483. https://doi.org/10.1016/j.ijproman.2012.09.006

Delhi, V. S. K. and Mahalingam, A., 2020. Relating Institutions and Governance Strategies to Project Outcomes: Study on Public-Private Partnerships in Infrastructure Projects in India. Journal of Management in Engineering, 36(6), p. 04020076. https://doi.org/10.1061/(ASCE)ME.1943-5479.0000840

Devkar, G., Palliyaguru, R. and Oyegoke, A. S., 2020. The effects of institutional frameworks on implementation of PPP projects: a comparative perspective in Australia and India. International Journal of Construction Management, 20(6), pp. 720-736. https://doi.org/10.1080/15623599.2020.1769255

Dewulf, G. and Garvin, M. J., 2020. Responsive governance in PPP projects to manage uncertainty. Construction Management and Economics, 38(4), pp. 383-397. https://doi.org/10.1080/01446193.2019.1618478

Dolla, T. and Laishram, B., 2020. Bundling in public–private partnership projects – a conceptual framework. International Journal of Productivity and Performance Management, 69(6), pp. 1177-1203. https://doi.org/10.1108/IJPPM-02-2019-0086

Dolla, T. and Laishram, B., 2021a. Effect of energy from waste technologies on the risk profile of public-private partnership waste treatment projects of India. Journal of Cleaner Production, 284(xxxx), pp. 124726-124726. https://doi.org/10.1016/j.jclepro.2020.124726

Dolla, T. and Laishram, B., 2021b. Infrastructure development governance: taking stock of emerging policy issues. In: Zafarullah, H. and Huque, A. S. (Eds.). Edward Elgar Publishing. pp. 192-204. https://doi.org/10.4337/9781839100871.00024

Dolla, T. (2025), “Exploring the Legal Perspective of the Impacts of COVID-19 on the Public–Private Partnership Procurement Model”, Journal of Legal Affairs and Dispute Resolution in Engineering and Construction, Vol. 17 No. 2. https://doi.org/10.1061/JLADAH.LADR-1142

Eldosouky, A., Saad, W. and Mandayam, N., 2021. Resilient critical infrastructure: Bayesian network analysis and contract-Based optimization. Reliability Engineering & System Safety, 205, p. 107243. https://doi.org/10.1016/j.ress.2020.107243

Eshun, B. T. B., Chan, A. P. C. and Osei-Kyei, R., 2021. Conceptualizing a win–win scenario in public–private partnerships: evidence from a systematic literature review. Engineering, Construction and Architectural Management, 28(9), pp. 2712-2735. https://doi.org/10.1108/ECAM-07-2020-0533

Farca, L. A. and Dragos, D., 2020. Resilience in Times Of Pandemic: Is the Public Procurement Legal Framework Fit for Purpose? Transylvanian Review of Administrative Sciences, 16(SI), pp. 60-79. https://doi.org/10.24193/tras.SI2020.4

Feng, X., Cao, J., Wu, G. and Duan, K., 2022. A critical review of studies on renegotiation within the public-private partnerships (PPPs) scheme. Engineering, Construction and Architectural Management, ahead-of-print(ahead-of-print). https://doi.org/10.1108/ECAM-09-2021-0790

Garmestani, A. S., Allen, C. R. and Benson, M. H., 2013. Can Law Foster Social-Ecological Resilience? Ecology and Society, 18(2), p. 37. https://doi.org/10.5751/ES-05927-180237

Guevara, J., Rojas, D., Khallaf, R. and Castelblanco, G., 2024. Navigating PPP Renegotiations in the Wake of COVID-19: Insights from a Toll Road Program. Journal of Legal Affairs and Dispute Resolution in Engineering and Construction, 16(1), p. 05023007. https://doi.org/10.1061/JLADAH.LADR-1082

Guo, J., Chen, J. and Xie, Y., 2022. Determining a reasonable concession period for risky transportation BOT projects with government subsidies based on cumulative prospect theory. Engineering, Construction and Architectural Management, 29(3), pp. 1396-1426. https://doi.org/10.1108/ECAM-11-2019-0612

Guo, K., Zhang, L. and Wang, T., 2021. Concession period optimisation in complex projects under uncertainty: a public–private partnership perspective. Construction Management and Economics, 39(2), pp. 156-172. https://doi.org/10.1080/01446193.2020.1849752

Haapio, H., 2007. An ounce of prevention—contracting for project success and problem prevention. In: PMI, Global Congress 2007—North America, Atlanta, GA. Newtown Square, PA: Project Management Institute.

Hietanen-Kunwald, P. and Haapio, H., 2021. Effective dispute prevention and resolution through proactive contract design. Journal of Strategic Contracting and Negotiation, 5(1-2), pp. 3-23. https://doi.org/10.1177/20555636211016878

Ho, S. P. and Liu, L. Y., 2002. An option pricing-based model for evaluating the financial viability of privatized infrastructure projects. Construction Management and Economics, 20(2), pp. 143-156. https://doi.org/10.1080/01446190110110533

Hou, W. and Wang, L., 2022. Research on the refinancing capital structure of highway PPP projects based on dynamic capital demand. Engineering, Construction and Architectural Management, 29(5), pp. 2047-2072. https://doi.org/10.1108/ECAM-05-2020-0321

Huang, Y. L. and Pi, C. C., 2014. Real-option valuation of build-operate-transfer infrastructure projects under performance bonding. Journal of Construction Engineering and Management, 140(5). https://doi.org/10.1061/(ASCE)CO.1943-7862.0000821

Jeong, J., Ji, C., Hong, T. and Park, H. S., 2016. Model for Evaluating the Financial Viability of the BOT Project for Highway Service Areas in South Korea. Journal of Management in Engineering, 32(2), p. 04015036. https://doi.org/10.1061/(ASCE)ME.1943-5479.0000396

Jie, L. I., 2009. Dynamic contract conditions for built operation transfer (bot) projects in China. International Journal of Construction Management, 9(2), pp. 55-64. https://doi.org/10.1080/15623599.2009.10773129

Jin, H., Liu, S., Li, J. and Liu, C., 2020. A game-theoretic approach to developing a concession renegotiation framework for user-pays PPPs. International Journal of Construction Management, 20(6), pp. 642-652. https://doi.org/10.1080/15623599.2020.1738003

Jin, X. H. and Doloi, H., 2008. Interpreting risk allocation mechanism in public–private partnership projects: An empirical study in a transaction cost economics perspective. Construction Management and Economics, 26(7), pp. 707-721. https://doi.org/10.1080/01446190801998682

Ke, Y., Wang, S., Chan, A. P. and Cheung, E., 2009. Research Trend of Public-Private Partnership in Construction Journals. Journal of Construction Engineering and Management, 135(10), pp. 1076-1086. https://doi.org/10.1061/(ASCE)0733-9364(2009)135:10(1076)

Khanzadi, M., Nasirzadeh, F. and Alipour, M., 2012. Integrating system dynamics and fuzzy logic modeling to determine concession period in BOT projects. Automation in Construction, 22, pp. 368-376. https://doi.org/10.1016/j.autcon.2011.09.015

Kuhrmann, M., Fernández, D. M. and Daneva, M., 2017. On the pragmatic design of literature studies in software engineering: an experience-based guideline. Empirical Software Engineering, 22(6), pp. 2852–2891. https://doi.org/10.1007/s10664-016-9492-y

Liu, J., Gao, R. and Cheah, C. Y. J., 2017. Pricing Mechanism of Early Termination of PPP Projects Based on Real Option Theory. Journal of Management in Engineering, 33(6), p. 04017035. https://doi.org/10.1061/(ASCE)ME.1943-5479.0000556

Miles, M. B., Huberman, A. M. and Saldana, J., 2014. Qualitative Data Analysis. London, UK: Sage Publications.

Mostaan, K. and Ashuri, B., 2017. Challenges and Enablers for Private Sector Involvement in Delivery of Highway Public-Private Partnerships in the United States. Journal of Management in Engineering, 33(3). https://doi.org/10.1061/(ASCE)ME.1943-5479.0000493

Osei-Kyei, R., Tam, V. W. Y., Komac, U. and Ampratwum, G., 2023. Review of the Relationship Management Strategies for Building Flood Disaster Resilience through Public–Private Partnership. Sustainability, 15(13), p. 10089. https://doi.org/10.3390/su151310089

PPLRC, 2020. PPP Legal Framework Practice Note: Post-Covid-19. [online] World Bank Group. Available through: https://ppp.worldbank.org/public-private-partnership/sites/ppp.worldbank.org/files/2021-05/PPP_Legal_Frameworks_Post-COVID-19.pdf

Ram, J. and Dolla, T., 2023. Investigating the Leadership and Visionary Capabilities to Make Projects Resilient: Processes, Challenges, and Recommendations. Project Management Journal, 54(5), pp. 523-542. https://doi.org/10.1177/87569728231164353

Regan, M., Smith, J. and Love, P. E. D., 2011. Impact of the capital market collapse on public-private partnership infrastructure projects. Journal of Construction Engineering and Management, 137(1), pp. 6-16. https://doi.org/10.1061/(ASCE)CO.1943-7862.0000245

Sharafi, A., Amalnick, M. S. and Taleizadeh, A. A., 2021. Outcome of Financial Conflicts in the Operation Phase of Public-Private Partnership Contracts. Journal of Construction Engineering and Management, 147(6), p. 04021047. https://doi.org/10.1061/(ASCE)CO.1943-7862.0002011

Sherratt, F., Sherratt, S. and Ivory, C., 2020. Challenging complacency in construction management research: the case of PPPs. Construction Management and Economics, 38(12), pp. 1086-1100. https://doi.org/10.1080/01446193.2020.1744674

Song, J., Hu, Y. and Feng, Z., 2018. Factors Influencing Early Termination of PPP Projects in China. Journal of Management in Engineering, 34(1). https://doi.org/10.1061/(ASCE)ME.1943-5479.0000572

Sutcliffe, K. M. and Vogus, T. J., 2003. Organizing For Resilience. In: Cameron, K., Dutton, J. E. and Quinn, R. E. (Eds.) Positive Organizational Scholarship. San Francisco: Berrett-Koehler. Ch.7, pp. 94-110.

Tariq, S. and Zhang, X., 2021. Socioeconomic, Macroeconomic, and Sociopolitical Issues in Water PPP Failures. Journal of Management in Engineering, 37(5). https://doi.org/10.1061/(ASCE)ME.1943-5479.0000947

Tranfield, D., Denyer, D. and Smart, P., 2003. Towards a Methodology for Developing Evidence-Informed Management Knowledge by Means of Systematic Review. British Journal of Management, 14(3), pp. 207-222. https://doi.org/10.1111/1467-8551.00375

Vassallo, J. M., Ortega, A. and Baeza, M. D. L. Á., 2012. Impact of the economic recession on toll highway concessions in Spain. Journal of Management in Engineering, 28(4), pp. 398-406. https://doi.org/10.1061/(ASCE)ME.1943-5479.0000108

Wang, S. Q., Tiong, R. L. K., Ting, S. K. and Ashley, D., 2000. Evaluation and Management of Political Risks in China’s BOT Projects. Journal of Construction Engineering and Management, 126(3), pp. 242-250. https://doi.org/10.1061/(ASCE)0733-9364(2000)126:3(242)

Wang, Y. and Jin, X., 2019. Determine the optimal capital structure of BOT projects using interval numbers with Tianjin Binhai New District Metro Z4 line in China as an example. Engineering, Construction and Architectural Management, 26(7), pp. 1348-1366. https://doi.org/10.1108/ECAM-07-2018-0259

Xiong, W. and Zhang, X., 2016. The Real Option Value of Renegotiation in Public–Private Partnerships. Journal of Construction Engineering and Management, 142(8), p. 04016021. https://doi.org/10.1061/(ASCE)CO.1943-7862.0001130

Xiong, W., Zhao, X., Yuan, J.-F. and Luo, S., 2017. Ex Post Risk Management in Public-Private Partnership Infrastructure Projects. Project Management Journal, 48(3), pp. 76-89. https://doi.org/10.1177/875697281704800305

Zhang, H., Yu, L. and Zhang, W., 2020a. Dynamic performance incentive model with supervision mechanism for PPP projects. Engineering, Construction and Architectural Management, 27(9), pp. 2643-2659. https://doi.org/10.1108/ECAM-09-2019-0472

Zhang, S., Chan, A. P. C., Feng, Y., Duan, H. and Ke, Y., 2016a. Critical review on PPP Research – A search from the Chinese and International Journals. International Journal of Project Management, 34(4), pp. 597-612. https://doi.org/10.1016/j.ijproman.2016.02.008

Zhang, X., Bao, H., Wang, H. and Skitmore, M., 2016b. A model for determining the optimal project life span and concession period of BOT projects. International Journal of Project Management, 34(3), pp. 523-532. https://doi.org/10.1016/j.ijproman.2016.01.005

Zhang, X. and Soomro, M. A., 2016. Failure Path Analysis with Respect to Private Sector Partners in Transportation Public-Private Partnerships. Journal of Management in Engineering, 32(1), p. 04015031. https://doi.org/10.1061/(ASCE)ME.1943-5479.0000384

Zhang, Y.-C., Luo, W.-Z., Shan, M., Pan, D.-W. and Mu, W.-J., 2020b. Systematic analysis of PPP research in construction journals: from 2009 to 2019. Engineering, Construction and Architectural Management, 27(10), pp. 3309-3339. https://doi.org/10.1108/ECAM-03-2020-0178