Construction Economics and Building

Vol. 25, No. 2

July 2025

RESEARCH ARTICLE

Assessing Financial and Professional Risks on Commercial Property Development and Investment in the Accra, Ghana Enclave

Rexford Asianoah1,*, Aryee Feizel Ayitey1, Botha Brink2

1 Faculty of Built & Natural Environment, Koforidua Technical University, Ghana

2 Department of Construction Management, Nelson Mandela University, South Africa

Corresponding author: Rexford Asianoah, rasianoah@gmail.com

DOI: https://doi.org/10.5130/AJCEB.v25i2.9123

Article History: Received 25/04/2024; Revised 07/03/2025; Accepted 20/04/2025; Published 08/08/2025

Citation: Asianoah, R., Ayitey, A. F., Brink, B. 2025. Assessing Financial and Professional Risks on Commercial Property Development and Investment in the Accra, Ghana Enclave. Construction Economics and Building, 25:2, 215–234. https://doi.org/10.5130/AJCEB.v25i2.9123

Abstract

Commercial property development and investment (CPDI) is considered to be one of the major investments that stimulate economic growth in many countries around the globe. Ghana is no exception. CPDI benefits include employment creation, tax revenue to the government, generation of income for investors, and gross domestic product (GDP) contribution. However, CPDI suffers from inherent risks in its planning, execution, and management stages. Some of the inherent risks can be identified and assessed prior to execution if effective financial and professional analyses are conducted. Hence, the purpose of this study was to critically evaluate financial and professional risks affecting CPDI projects in Accra, Ghana. Based on this, an extensive literature review was conducted on key variables such as PESTEL (Political, Economic, Social, Technology, Environment, and Legal), strategic factors, Project Management Body of Knowledge (PMBOK), and financial and professional feasibility. The proposition is that these variables have a significant effect on CPDI projects. Quantitative approach was employed to collect field data from property practitioners within the Accra enclave as respondents whereby a survey of questionnaires was distributed using the probability random sampling technique. Structural equation modeling was used to analyze the data gathered from the 172 respondents out of the 500-target population. This means that a 76% response rate was achieved per the total number of 225 distributed questionnaires. Analysis of the data proved that PESTEL analysis, strategic factors, and PMBOK statistically have a significant effect on CPDI projects’ risk assessment. The findings of the study indicate that financial and professional feasibility analysis serves as the primary basis for assessing risks in CPDI projects.

Keywords

Commercial Property Development; Investment; Risk Management

Introduction

Commercial property development and investment (CPDI) are considered to be one of the major investments that stimulate economic growth in many countries around the globe (Brounen and de Koning, 2014; Caputo, 2013). Many countries in Africa including Ghana have seen growth in the commercial property development sector perhaps due to its political stability over the years. The implementation of commercial property development projects has contributed to the growth of Ghana’s gross domestic product (GDP) from 10.8% in 2006 to 13.6% in 2011, and further surged to 17.8% in 2016, according to the Cytonn Real Estate Report (2017). Generally, CPDI serves to widen employment and business opportunities for both individuals and institutions (Khan et al., 2014). Apart from the opportunities CPDI provides, it is bound to face risks such as political, economic, social, and construction risks. It is upon this background that this study is necessitated to assess prospective risks associated with CPDI projects and further prescribe solutions that may be employed to manage such risks with the aim of achieving optimum returns in CPDI projects.

To assess and manage risks associated with CPDI projects in Ghana, researchers explore the effective use of a financial and professional feasibility analysis tool as a proactive approach to identify risks. The term “financial feasibility analysis” in this respect refers to the market and viability reporting standards, and the two words “market” and “viability” sometimes may be used separately, depending on the angle one is looking at (Costello and Preller, 2010). Market analysis is noted not only as a report that generates accounts on the future economic prospects of the development but also to continually re-examine the possibilities and chances whereby property development processes can be affected (Archibong and Ogunba, 2018; Costello and Preller, 2010).

Practically speaking, property investment complexity and its long-term characteristics sometimes result in low returns due to the lack of adequate risk management during the initial stages of the project. This leads investors and developers to incur losses. To address such a phenomenon, there is a need to undertake professional and financial feasibility studies prior to the implementation of the project. In practice, professional feasibility may represent the various practical steps professionals such as construction supervisors and project managers follow to ensure quality during project execution. Conducting professional and financial feasibility studies will help commercial property developers and investors to assess and manage risks in CPDI projects properly.

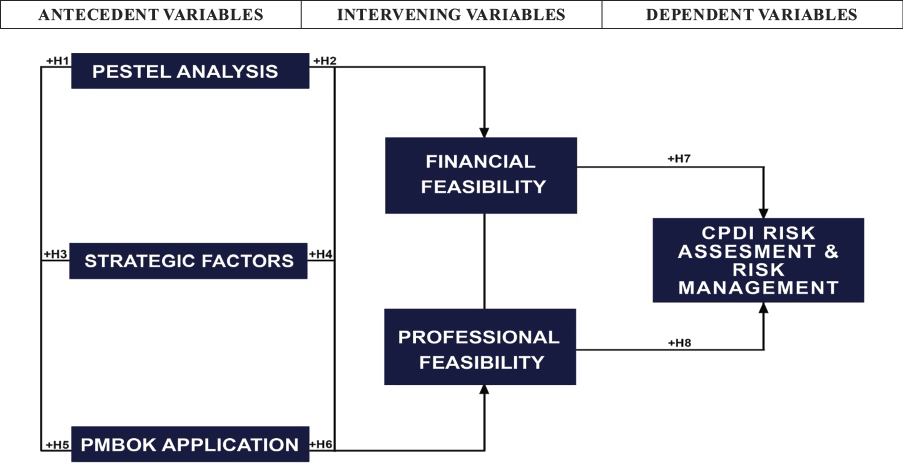

To conduct a risk assessment for CPDI projects, existing analytical tools such as PESTEL (Political, Economic, Social, Technology, Environment, and Legal) and Project Management Body of Knowledge (PMBOK) as well as strategic factors were adopted as antecedent variables in measuring CPDI. However, financial and professional feasibility were chosen as intervening variables due to their usefulness in decision-making. This may help establish a relationship between financial/professional feasibility and effective risk assessment in CPDI projects.

Literature review

Managing risks in commercial property development and investment projects

Under this, PESTEL analysis, PMBOK application, strategic factors considerations, and financial and professional feasibility analysis relative to risk assessment/management in commercial property development and investment projects are discussed.

PESTEL analysis

Risks associated with projects can be assessed with the uses of many frameworks and models, depending on the type of projects one is undertaking. Johnson et al. (2011) note that the PESTEL framework provides a comprehensive list of factors that affect the success or failure of many investment projects. This framework defines the six macro environmental factors, namely, political, economic, social, technological, environmental, and legal, and how each influences CPDI projects. On the other hand, another analytical framework, the Robson Risk Management Model, measures risk based on different variables.

In Sub-Saharan Africa, some countries face multiple structural pressures, including conflict due to political instability (Bello-Schünemann and Moyer, 2018). According to the Center for Strategic and International Studies Report (2011), Ghana has emerged as a paragon of political stability over the past two decades. Hence, the country has successively recorded mega commercial property development projects in its capital city (Accra) over the last 10 years. Among the few ones are the Accra Mall development, Stanbic Heights office building development, and West Hills Mall.

Economic policies and regulations on mortgage lending affect the housing market (Hwang et al., 2013). The fact is that demand and supply for housing and commercial development in particular hinge on economic status. Florentino et al., (2014) are of the view that housing development affordability is a socio-economic requirement, and that it improves quality of life in our society. Although CPDI projects are capitally expensive, it offers good returns if they are able to meet their target taste and preferences. In the 21st century, commercial property built with technologies such as automation and sensor systems, may cause demand to increase with all things being equal. In the same way, Zhao et al. (2019) claim that environmental quality measures how social facilities can be assessed. This means that commercial property location has a significant influence on the rent it generates. In practice, properties found in locations that have easy access and are close to social amenities attract high rent and value.

Fundamentally, laws governing land acquisition in Ghana are an essential factor commercial property developers and investors have to take cognizance of. Taking this into consideration will alert developers to conduct extensive research before buying or paying for land, especially within the Accra catchment area. Adequate legal assessment on the property acquisition stage helps prevent litigation. Geipele et al. (2014) are of the view that real estate investment analysis should be designed around economic, political, social, environmental, and technological factors.

Strategic factor considerations

Strategic factors may be viewed as factors that organizations or business entities adopt to succeed in achieving their set goals and targets. These factors include the provision of customer satisfaction practices, ensuring employees’ competency and effective marketing, and adopting strategic leadership and management styles. Per Jabbar and Hussein (2017), management for organizations is to set vision, think strategically, plan, and lead to ensure effective operational activities. It follows that developers together with their project managers, property managers, and property marketers have to sharpen their managerial skills. This may help to increase performance efficiency in the hopes of performing duties and responsibilities well at all levels of work (De La Harpe, Mason and Peterson, 2011). To achieve an optimum level of success in every project, strategic leadership and management are critical (Pournasir, 2013). Strategic management is simply described as the process of forming and executing the necessary evaluated changes that put an organization to a sustainable and competitive advantage (Pournasir, 2013). Commercial property developers and investors may explore this concept by adopting the implementation of strategic factors in an attempt to position their projects on the competitive edge and also to address economic and management risks. The succeeding section explains in detail some of the key strategic factors mentioned in the above paragraph.

Strategic leadership

Authors such as Setiawan and Yuniarsih (2018) and Daft (2011) define strategic leadership as the ability of an organization to anticipate and envision the future, become flexible, think ahead, and initiate positive changes that are likely to position an organization on a competitive edge in the future. This definition emphasizes that strategic leadership is all about putting measures in place to ensure organizational posterity and sustainability. This may be uncommon in some organizations. Hence, effective strategic leadership appears to be one of the critical challenges some organizations face today. Despite several kinds of research on leadership, scholars have only recently begun to single out strategic leadership as a focus for attention (Palladan, 2017).

According to Saunders et at. (2015), strategic leadership is associated with organizational effectiveness. The behavioral complexity of the causal link between moderators and mediators suggests that there is difficulty in obtaining effective leadership (Saunders at al., 2015). This is due to the lack of instituting an effective succession plan for organizations. This may indicate that real estate development companies need a leadership succession plan to align their vision and values as steps to continuously set their goals (Lear, 2012).

As stated earlier, leaders set visions, think strategically, plan, and lead to administer operational activities for followers to emulate. In this vein, property developers together with the project manager, construction manager, site supervisor, property manager, and the property marketer could be classified as leaders and are expected to set the vision and think strategically in the course of executing their commercial real estate projects. Furthermore, business leaders are there to boost the morale and spirit of their subordinates by using appropriate leadership strategies. More importantly, they serve as teachers and motivators to their workers (Ingason, 2015).

Motivation, for example, is the process of energizing a person’s drive to work in an effort to achieve the set goals (Rey-Martí, Porcar and Mas-Tur, 2015). Others perceive motivation as the act of encouraging a person to complete a task by himself/herself effectively. Lunenburg (2011) believes that goal-setting theory should be the most appropriate theory to explain motivation. However, motivation impacts such as personal fulfillment and personal values put more weight to business performance and productivity (Asah et al., 2015). Applying motivation as a strategy when supervising real estate projects may influence project completion and cost. The fact is that workers’ attitude, behavior, and input may change positively. It is based on this that leaders need to have a clear mental approach to change their organization’s capabilities (Ingason, 2015).

Strategic leadership with effective strategies usually serves as the fundamental springboard for a fruitful strategic management process to take off (Ingason, 2015). Proactive leaders are able to expedite action to initiate suitable strategic growth for their organizations by ensuring proper ways of implementing the right strategies. Strategic leadership also creates an efficient evaluation system that runs parallel with the implementation of strategies at every stage of the organizational activity and that minimizes risks and lapses in management processes (Ingason, 2015).

Strategic managers perform the role of formulating the vision and strategy through the help of a visionary leader by understanding the organization as a whole (Laban, 2017). Key technical leaders in real estate organizations who spearhead development projects in the same way may need to formulate development visions and strategies that promote cost-effectiveness based on the professional feasibility analysis reports. This action may aid the development team in coming up with viable projects. However, a leader’s adoption of a realistic approach in identifying strategic gaps to employ a good mechanism is quite essential, according to Bouhali et al. (2015). However, procedures to implement such a mechanism may be cumbersome.

New policy implementation may be effective if leaders introduce the need for change by possibly creating a culture that integrates strategy and operational activities (Ingason, 2017). In such instances, effective communication may play a major role. Within the leadership communication cycle, behavioral factors such as motivation, power to influence, leading the change, cultivating trust, creating collaboration, leading through crisis and turmoil, mentoring, and discovery of different leadership styles are to be exhibited by the leaders to cause the change (Conrad and Newberry, 2012). Again, leadership driven by sustainable goals requires special attention to promote long-term involvement and value for all stakeholders to keep up with the challenges (Popescu et al., 2020). Lunenburg (2010) confirms that construction project managers must have leadership skills to perform their functions.

Effective marketing

Theurillat (2010) defines marketing as planning and implementing the concept of selling, pricing, promotion, and distribution of information, goods, and services to satisfy individual and organizational goals. Baumann and Hamin (2011) elaborate that marketing comprises the management of activities and decisions directed to meet opportunities and threats in a dynamic environmental setting to satisfy market offerings for identified consumers. In the world of the estate sector, the term “marketing” is historically and basically related to the use of postcards, a property flyer, and a computer website to market property sales, rent, or lease (Florentino et al., 2014).

Today, many real estate professionals such as property brokers, property developers, property managers, and facility managers have realized the need to incorporate technology to complement their way of conducting business (Laban, 2017; Florentino et al., 2014). The purpose is to improve efficiency and quality. However, the implementation of technology could primarily increase the cost of operations, and for that matter, cost–benefit analysis has to be conducted to achieve value addition. Modern real estate consumers are quite knowledgeable in information and technology and they may know how to access information online. In this regard, commercial real estate professionals may advertise their services and products through the internet (Florentino et al., 2014). The reason may be due to convenience and cost-effectiveness.

Effective advertisement for property offerings to consumers, such as commercial property spaces for rentals, may help minimize vacancy rate while strategic and effective marketing for residential accommodation could shorten the market rental period to a minimum level.

Buyers and tenants’ trends have evolved, and for that matter, the marketing mix should include multiple listing, databases, and networks to take different forms to be congruent with the changing demand. This demand trend has changed how property brokers communicate with their prospective clients (Florentino et al., 2014). Offline approach and the use of telephone and Internet are some of the strategies marketers adopt to increase sales (Kumar et al., 2011). Goodwin and Stetelman (2013) acknowledge that the use of new technologies and applications such as global positioning system (GPS) technology, social networking, tablet computers, and smartphones has come to change the strategies real estate businesses conduct in the 21st century.

Empirical evidence in the market orientation industry shows that the stakeholder orientation construct may pose different relationships with sales results relative to general profit performance (Cadogan, 2012; Kumar et al., 2011). Performance measurement in marketing actually depends on the output of the marketer. Under certain market environmental conditions, strategic orientations may be less beneficial due to the changes in conditions (Cadogan, 2012). Hence, a marketer may have to study environmental conditions influencing the service or product, and this may inform an appropriate marketing strategy to adopt.

Project management body of knowledge application

PMBOK is the set of key knowledge areas used and applied by project management professionals as techniques to manage projects effectively (PMBOK Guide, 2017; Liljedahl and Möller, 2014). Under this section, the key knowledge areas considered in the study literature covered are project cost management, project quality management, and project risk management (PRM). Risk management is considered in the construction process throughout the project life cycle as an essential element according to many research scholars such as Banaitienė et al. (2011) and Turskis et al. (2012). Literature has broadly acknowledged the positive impact of risk assessment and management in reference to many projects across various fields (De Bakker et al., 2014 and de Bakker et al., 2012). In practice, it is important to actualize that these project knowledge areas are applied by project managers. These three project knowledge areas are therefore explained below.

Project cost management (PCM)

According to Vasista (2017), cost management is the process of controlling project expenses in all the stages, including feasibility to the handing-over stage to ensure that the set budget is relatively kept. By contrast, the project budget increases with no added value if proper control measures are not taken. To conduct efficient and professional cost analysis from the feasibility stage to the completion stage, the project manager ought to work around the clock to manage project cost overrun. Professionals who are usually capable of performing such analysis are quantity surveyors and cost engineers (Smith, 2014). “Cost engineer” is a title used by North and South America, while “construction economist” is used by some European countries, and a “quantity surveyor” is a professional term of UK origin and used in the Commonwealth countries at large. These professionals try to use scientific methods to estimate the cost of projects prior to the project commencement and during the execution of the work (Tesha, 2018).

In practice, a clear definition of work scope serves as the fundamental basis of identifying cost components to determine the total baseline cost for a project, such as constructing a commercial property. A baseline cost therefore is described as a cumulative time scheduled for budget that may be used to measure and monitor current and future cost performance for a proposed project (Khamidi et al, 2011). The total baseline cost and the determination of contingency cost have to be technically managed by the cost managers with the aim of minimizing cost overrun (Vasista, 2017).

Project cost management involves planning, estimating, financing, managing, and controlling costs in such a way that projects may be completed as budgeted (PMBOK Guide, 2017 and Artto et al., 2011).

It is important to note that cost estimation requires extensive knowledge of the construction principles, materials cost, labor cost, and sound judgment (Tesha, 2018). In addition, equipment cost and calculation skills are also vital in cost estimation. Project cost management is viewed as a professional expertise and capability in project management that involves estimating project cost, planning, and controlling cost with the sole aim of reducing capital cost swelling during the construction process (Tesha, 2018). The process of managing cost in each stage will promote resource optimization (Brook, 2016). Traditionally, cost managers (CMs) are mainly responsible for preparing the bill of quantities and variation certificates for claims. However, CMs’ functions further extend to the level of advising clients on cost implications of the project with the purpose of better value for money decisions without compromising project quality standards (Anifowose et al., 2013).

Cost managers’ value management performance in construction project delivery plays a pivotal role in the construction team. Cost variance in a project may simply be explained as the difference in the value between the work done and the amount of money spent. Moreover, CMs provide information to the internal stakeholders who need accurate and detailed information for economic decision-making purposes (Kujala et al., 2014). The purpose is to tally up the cost with the general project performance. For this reason, Khamidi et al. (2011) affirm that effective project management performance control may not be obtained only by monitoring the physical infrastructure but also by managing the spending components of the project.

One of the major challenges in PCM in construction projects across the globe is cost overrun and scope creep (Smith, 2014). Scope creep is any deviation that affects the original scope of the project. This deviation or change sometimes increases the project cost. A global survey of 20 countries from both developed and developing countries indicates a constant substantial cost escalation of construction and infrastructure projects with no exception (Flyvbjerg et al, 2009). Flyvbjerg et al, (2005) also outline that Boston’s Central Tunnel project had a budget overrun of up to 275%, amounting to US$11 billion. Project cost overrun strains clients financially. To this extent, Tirole (2014) quantifies cost overrun to be around US$1.7 trillion worldwide, and hence, emphasizes that it is a major global construction industry problem. This shows that academic researchers need to perform several studies to find out how such a problem can be addressed.

Furthermore, the increasing recognition from financiers and clients’ perspectives on effective PCM and cost control has called for the employment of qualified, specialized, and expert professionals to handle cost management portfolios in order to address cost overrun deficiency in construction and property development projects (Smith, 2014). In construction projects, cost overrun is caused by both internal and external factors. These factors include poor construction works that need to be demolished and client instruction to add other features to the existing planned working drawing. However, cost overrun, in general, comprises three parts: the early-stage cost overrun, construction implementation cost overrun, and post-construction stage cost overrun (Larsen et al., 2016).

The causes of cost overrun, to a large extent, can be linked to ineffective management of the project scope (Brook, 2016). Numerous budget cost blowouts affecting major construction projects across the globe have raised concern and attention at both local and international levels (Smith, 2014). Many governments, financiers, and major private developing entities, including the World Bank, the World Trade Organization, and the United Nations, have recognized the importance of effective cost control in construction projects (Larsen et al., 2016).

Large construction project management such as complex office development faces cost management challenges due to an increasing number of factors (Iyer and Jha, 2005). An economic factor like inflation rate causes materials price increase. In addition, other instances such as wide and varying work scope, multiple specialized machinery usage, and variable technical experts brought on board may pose a cost overrun risk. According to Palladan (2017), cost overrun occurs on construction projects due to the following reasons: error in design, changes in project scope, change orders, disputes at the construction site, material price fluctuations, and increase in labor wages. Such instances influence the entire project cost to drastically increase.

In complex situations, construction companies involved in executing such projects find it difficult to achieve cost efficiency and profitability according to Artto et al. (2011). Updating cost estimates, forecasting constantly, and evaluating invoices before releasing contingency costs are the steps some CMs adopt to monitor the project cost chain. Since cost management has become more complicated in this era due to technological advancement and shortage of resources, building construction contractors and property developers are inclined to hire CM professionals to manage the costs of running projects (Palladan, 2017).

The above consideration may help reduce the high cost overrun burden stakeholders experience in most projects. Ofori (2013) asserts that a good estimate may not exceed 10% of the actual cost estimate provided there is a limit to the unforeseen circumstances. Records indicate that most domestic contractors lack financial management skills (Palladan, 2017); hence, they may need to employ professional CMs to assist in managing project costs. Ofori (2013) suggest that cost management techniques such as cost planning, cost flow forecasting, and cost control are important in managing cost.

Project quality management

Project quality management (PQM) is the process of incorporating the organizational quality program with respect to planning, controlling, and managing projects to fulfill stakeholders’ aims and objectives (PMBOK Guide, 2017). It may be viewed as the management approach that ensures the fundamental quality standards to achieve project goals and objectives. In commercial property development projects, quality standard fulfillment at all levels tends to curb short- and long-term cost. Normally, buildings built with quality materials and construction techniques have lower maintenance cost. It is interesting to note that PMBOK entails the use of knowledge areas and processes that can actually optimize the allocation of resources based on an inter-connected system of actions purposely designed to achieve some specific objectives set for the projects (Cruz and Marques, 2013; Dominguez et al., 2010).

PQM, in simple interpretation, is meant to provide continuous support to improve project activities. On the other hand, quality management (QM) is viewed as a vital and insightful component of the management cycle. It is backed by modern research on different methodologies based on field and theoretical discoveries (Taniguchi and Onosato, 2018). Therefore, QM is relatively known as a discipline in project management and it is carried out by project managers, inspectors, and supervisors involved in managing projects.

The fundamental aspects of QM are well described by well-known and accredited international management standards such as ISO 9001 and ISO 14001 (Ingason, 2015). ISO 9001 is applicable to many kinds of business organizations worldwide. To ensure the usefulness and recognition of ISO 9001, Teller et al. (2014) made a remarkable comment on the total number of ISO 9001 certificates issued in countries worldwide from 1993 to 2010. It is evident that the issuance of the certificates has increased from more than 46,000 certificates in 60 countries in the year 1993 to 1.1 million certificates in 178 countries in 2010 approximately. Based on the numerous quantities of ISO 9001 certificates issued worldwide (Alolayan, 2014), can one confidently assert that quality management protocols in many operations have also increased? This question leaves a gap in literature and practice, especially in the construction and property development project management industry.

Alolayan (2014) conducted an extensive literature review on ISO 9001 studies, and they were able to analyze 100 research papers in an attempt to establish an overview of ISO 9001 certification. In the same way, Al‐Rawahi and Bashir (2011) conducted a comparative analysis of the implementation of ISO 9001 in Oman. Ingason (2015) also followed steps to conduct research about the implementation of ISO 9001 in small firms with special emphasis on the benefits. These cases presented different results and outcomes as far as assessing ISO 9001 certificates and implementing quality management are concerned.

The fundamental proposition of this literature study explores the conceptual meaning of project quality management and how it can be employed in construction and real estate development projects. In the project quality management evaluation process, literature often classifies the process, input, and outcome as performance variables according to Bou-Llusar et al. (2009). To ensure quality performance in project activities, effective evaluation exercises through the process of various activities should be adhered to. For this reason, Alolayan (2014) argues that it is insufficient to evaluate the end product alone; the process that produces the product should also be evaluated.

Quality performance in construction management entails how the project quality and environmental factors are managed appropriately. Managing technology, materials, and equipment to improve project quality by employing team members’ knowledge and technical skills capabilities is necessary (Halpin, 2017). Most organizations in this modern world apply process approach techniques (PATs) in their operations to ensure continual quality management in project management (Ingason, 2015). The aspect of PAT synergy demonstrates how organizations nowadays implement quality management systems in their operations (Ingason, 2015). The fact is that the application of PATs is massively gaining popularity in many organizations as a solution to the quality management problems in project management. However, there could be other QM techniques that are as equally effective.

Therefore, the quality management model measures the impact of changes in portfolio success antecedents and validates the construct using a longitudinal sample (Jonas et al., 2012). This could imply that a project portfolio success depends on the quality management mechanism put in place to achieve its outcomes. Ofori (2013) declares that quality has two different attributes: subjective and objective. Only the project team members can determine the subjectivity quality attribute, while the objectivity quality attribute has been determined by the project’s key stakeholders (Ingason, 2015). The key stakeholders for a commercial property project, for example, consist of the client, the property developer, and potential users.

Quality as a requirement is considered to be one of the important outcomes of a project since performance measurement is usually based on cost, time, and quality (Ofori, 2013). Another important period to measure quality is at the stage of conducting assessment in the project life cycle. Although Ogunlana (2010) and Heravi et al. (2015) believe that project quality is usually evaluated at the completion stage, it is efficient to evaluate quality period by period during the process of executing the project to minimize major defects at the completion stage.

However, it is interesting to note that the most significant time to make quality decisions in a project is during the planning and designing stages (Ofori, 2013) because laying a quality foundation through the formulation of specifications and standards at such an initial stage will provide a pathway in achieving quality in all aspects of the project. Generally, almost all the quality management efforts are put into the project during the implementation stage (Taniguchi and Onosato, 2018). In ensuring project quality, the onus lies on the project manager and the frontline team members. Ogunlana (2010) brings to light that the main objective of the quality management system is to identify and define techniques that will ensure quality results and products in project execution management processes.

Project risk management

Projects are usually exposed to risks. Commercial property development projects, for instance, can be affected by economic, engineering, and management risk. Therefore, risk management is vital in a project’s process through its life cycle, and many research scholars have analyzed these risks (Banaitienė et al., 2011; Turskis et al., 2012). Literature has broadly acknowledged the positive impact of risk management in an attempt to focus on the project stages across the various sectors (De Bakker et al., 2014). In practice, it is important to have a risk management plan for every stage of a project. This may enable implementers to lower the impact of risk at every level of the entire project. Many studies continue to show a positive relationship between PRM and project success according to Teller et al. (2014). However, integrating risk management into the project portfolio management process may encourage portfolio managers to adopt evaluation tools to promote project efficiency.

PRM assists institutions to minimize the negative impact of uncertainties on the balance of probability while aiming to anticipate the outcomes of the project opportunities (Petit, 2012). Koul et al. (2018), in conjunction with Teller et al. (2014), found that the PRM process consists of risk identification, risk analysis, risk definition, risk response implementation, and risk monitoring. There are quite a number of approaches a project manager may use to go about ensuring the PRM process. For example, a brainstorming approach can identify risks, and the probability matrix approach is usually employed to analyze risks (Teller et al., 2014). The decision tree approach may also help to determine a particular risk response to apply.

The main primary steps in risk management involve planning, resolution, risk control, and risk monitoring (Arias and Stern, 2011). Experience constantly proves that effective monitoring influences performance. A series of research studies have shown a positive relationship between PRM and project success, and a typical study in this regard is Khamidi et al. (2011). Other studies have confirmed that there is a positive relationship between risk management strategies and the performance of a new product development project in China (Bowers and Khorakian, 2014). Bowers and Khorakian (2014) highlight that organizations should not avoid risk as a strategy to avert risks in their operations. Rather, they should adopt a project risk diagnosis management plan to adjust and balance success and failure. The extensive application of effective and explicit risk management strategies may decrease failure and expenditure (Khamidi et al., 2011). Technically, it is notable that an inappropriate risk management strategy could also disturb and stifle innovation (Taplin, 2005). Hence, there is a need to find a balance. This caution is relevant when running many projects, including construction and real estate projects. On this basis, one may assert that the PRM plan should be flexible in the course of application.

Financial and professional feasibility analyses

Per this study, financial feasibility analysis views how commercial property development and investment projects can be critically assessed to establish whether a project is viable or not. Various calculations such as payback period and net present value (NPV) are conducted at the initial stage of the project period. To determine the NPV, an appropriate discount rate has to be adopted to discount all the expected incomes year by year, whereby the total figure is obtained for the said project (Khamidi et al., 2011). Similarly, market research conducted to establish a good location for the proposed project could also be embedded in the financial feasibility analysis report. Professional feasibility, on the other hand, endeavors to analyze and discover the possible professional best practices that need to be adopted throughout the development processes of the project with the aim of ensuring efficiency and cost-effectiveness. There may be other analytical exercises that could detail project viability, but these two feasibility analyses mentioned appear to be “Y” components needed to secure the success level of a project realization in practice.

This study therefore presents the identified factors (PESTEL analysis, strategic factors, and PMBOK application) and evaluates each factor against CPDI risk assessment/risk management through financial and professional feasibility variables. Figure 1 proposes a conceptual framework of the study summarizing the identified factors as well as indicating their relationships with financial and professional feasibility vis-à-vis risk assessment and risk management hypothetically.

Figure 1. Conceptual framework of the study.

Research methodology

The study employed a quantitative methodology using a survey of questionnaires to collect data on the identified risk factors (strategic factors, PESTEL, and PMBOK) presumed existing and that influence CPDI projects as far as risk assessment/risk management is concerned. Under strategic factors, for example, probable closed-ended questions were set to cover strategic leadership and effective marketing, while similar questions were structured to cover PESTEL and PMBOK applications.

Copies of the prepared questionnaire were sent to 12 selected commercial property development and investment professionals in Accra, Ghana for them to answer and review the questions as a source of conducting industry testing to establish the relevance and validity of the study instrument. Feedback received guided the researcher to modify the set of questions in the study questionnaire and finally adopted it. The target population of the study comprises commercial property developers and investment advisors located in Accra because major commercial properties in Ghana are found in Accra and its surroundings. An estimated population number of 500 for the study was obtained as the key managers from the selected companies based on the lists received from the two major professional bodies (Ghana Real Estate Developers Association and Ghana Institution of Surveyors-Estate Division) recognized in Ghana. Hence, 225 questionnaires were distributed as target sample size respondents according to the Krejcie and Morgan sampling table by using the probability sampling technique. However, only 172 questionnaires were received from respondents that were deemed as correct and credible for statistical analysis. The effect was that 76% response rate was obtained demonstrating respondents’ readiness and eagerness to participate in the study.

Structural equation modeling (SEM), specifically known as SEM-AMOS 28, was used to analyze this study’s data due to its high level of producing effective results. Because the study hinges on hypothesis testing, Hair et al. (2017) posit that a Cronbach alpha coefficient of 0.7 or greater indicates acceptable internal consistency reliability. However, the Cronbach alpha coefficient obtained during the study instrument test was 0.963, which shows that the instrument has demonstrated an adequate level of internal consistency reliability.

Eight hypotheses were set to establish whether there was a positive relationship between the identified factors and risk assessment/risk management through financial and professional feasibility.

The eight hypotheses were as follows:

H1: There is a positive relationship between PESTEL analysis (PS) and professional feasibility (PF).

H2: There is a positive relationship between PESTEL analysis (PS) and financial feasibility (FF).

H3: There is a positive relationship between strategic factors (SF) and professional feasibility (PF).

H4: There is a positive relationship between strategic factors (SF) and financial feasibility.

H5: There is a positive relationship between PMBOK application (PM) and professional feasibility (PF).

H6: There is a positive relationship between PMBOK application (PM) and financial feasibility (FF).

H7: There is a positive relationship between financial feasibility (FF) and risk assessment/risk management (EE).

H8: There is a positive relationship between professional feasibility (PF) and risk assessment/risk management.

Results

This section provides the results of the study. Table 1 shows the results of the hypotheses testing conducted.

NB: SE = standard error, CR = critical ratio, and p = probability value

Decision rules adopted to evaluate/test the set hypotheses are briefly described below:

Each study variable is interpreted by considering its p-value (p) and critical ratio (CR) results obtained in Table 1. Results interpretation shows that any p-value that is less than 0.05 indicates an acceptance decision whereas any p-value greater than 0.05 indicates rejection. For critical ratio, a value less than 1.96 represents rejection, and a value greater than 1.96 indicates acceptance. Similarly, when the coefficient value of a variable is positive, a positive relationship is said to be established while a negative coefficient value signifies a negative relationship.

The study factors were analyzed below.

PESTEL analysis; H1 and H2

PESTEL analysis was adopted as one of the factors that may likely be employed to evaluate financial and professional feasibility for CPDI projects relative to risk assessment and risk management. Two hypotheses (PS-PF and PS-FF) results were measured using PESTEL analysis. Table 1 findings indicate that the two results tested positive (accepted) with the highest p-value of 0.000 each. Critical ratio for PS-FF was 4.597 and that for PS-PF was 3.643. The results could be viewed with the two hypothetical tests confirmed to be true. In this case, the four indicators, which consisted of Economic (Ps1), Social (Ps2), Technology (Ps3), and Legal (Ps5), proved the acceptance results. The results demonstrate that conducting an effective PESTEL analysis on a commercial property development has a significant effect on the project’s financial and professional feasibility.

This indicates that target clients/customers’ income level has to be considered when undertaking commercial property development. Furthermore, application of technology in the built environment industry may reduce cost, improve quality, and add value to the development process.

Strategic factors; H3 and H4

Strategic factors may be considered as factors many organizations need to succeed in achieving their set goals and targets. The main factors clustered and tested in this study were strategic leadership and effective marketing. The two hypotheses tested as a result of assessing strategic factors indicated positive (SF-PF and SF-FF) as reported in Table 1. p-values obtained were 0.029 and 0.134 for SF-PF and SF-FF, respectively. Test results fell within the acceptance threshold. It suggests that there is a positive relationship between strategic factors and financial feasibility as well as professional feasibility. In addition, the result embraces the adoption and implementation of strategic factors such as effective marketing, which can be used as an effective mechanism to enhance project viability.

Project management body of knowledge application; H5 and H6

The associated hypotheses (H5 and H6) on PMBOK application were tested, and the results are presented in Table 1 as PM-PF and PM-FF. The purpose was to establish whether the application of PMBOK in CPDI projects could have a positive relationship with financial and professional feasibility. According to Table 1, PM-FF had a p-value of 0.000 and a coefficient of −0.263, showing that there is a negative but statistically significant influence. PM-PF had a p-value of 0.009 and a coefficient of 0.197, showing that there is a positive relationship existing between PMBOK and professional feasibility.

Discussion

PESTEL analysis; H1 and H2ty

PESTEL analysis was adopted as one of the factors that may likely be employed to evaluate financial and professional feasibility for CPDI projects relative to risk assessment and risk management. It could be viewed as an analytical tool to carry out external macro environmental analyses when assessing opportunities and threats associated with business or project establishments (Zafar, Rajpoot and Khalid, 2014; Jurevicius, 2013). Results for the two hypotheses (PS-PF and PS-FF) were measured using PESTEL analysis. Table 1 findings indicate that the two results tested positive (accepted) with a highest p-value of 0.000 each. Similarly, the critical ratio for PS-FF was 4.597 and that for PS-PF was 3.643. The results could be interpreted as confirming that the two hypothetical tests are true. In this case, the four indicators, which consisted of Economic (Ps1), Social (Ps2), Technology (Ps3), and Legal (Ps5), proved the acceptance results. These findings suggest that proper assessment of legal requirements governing commercial property development processes such as thorough search for land ownership and type of interest may be essential as part of the measures to address risk in CPDI projects.

The proper assessment of legal requirements governing property development process can be ensured through the process of fulfilling all the institutional requirements before a real estate development project commences (The Real Estate Law Review Eighth Edition, 2019). Economic indicators, on the other hand, have a huge potential effect on the commercial property development and investment projects (Kauškale and Geipele, 2017; Kauškale and Geipele, 2016). That is why Kauskale and Geipele (2016) argue that economic problems affect the business environment. Mulliner, Malys and Maliene (2016) are also of the opinion that housing affordability is a socio-economic requirement that improves quality of life in every society. This could indicate that the target clients/customers’ income level has to be considered when undertaking commercial property development.

The built environment is gradually influenced by the rapid and intensive creation of the use of information, knowledge, and automation technologies as decision support systems (Kaplinski and Tupenaite, 2011). Hence, the application of technology in the built environment industry may reduce cost, improve quality, and add value to the development process.

The above findings agree with the assertions made by Llobera et al. (2015) and Mulliner et al. (2016). These authors pointed out that considerations such as innovations and the socio-economic aspect of people’s lives are necessary factors in real estate development. This implies that developers cannot achieve their investment objectives if their products are not patronized by their target customers.

Strategic factors; H3 and H4

As stated earlier, strategic factors are considered as factors many organizations need to succeed in achieving their set goals and targets (Daft, 2011). Such factors include effective marketing, partnership, strategic planning, and leadership. Besides, strategic management can simply be described as the process of forming and executing the necessary evaluated changes that put an organization on a competitive edge to achieve its long-term goals (Pournasir, 2013). To achieve the highest optimum level of success in CPDI projects, strategic leadership and management are critical (Pournasir, 2013; Daft, 2011). It is for this reason that strategic factors were identified as a construct to be assessed in this study. The hypotheses tested as a result of assessing strategic factors indicated positive (SF-PF and SF-FF) as reported in Table 1. This shows that p-values (0.029 and 0.134 obtained from SF-PF and SF-FF test results, respectively) fell within the acceptance threshold. It suggests that there is a positive relationship between strategic factors and financial feasibility as well as professional feasibility. The fundamental strategy to achieve excellence is to employ strategic planning and leadership approach, and this enables a manager to envision the future (Setiawan and Yuniarsih, 2018; Lear, 2012; and Daft, 2011).

The findings therefore agree with the assertion made by Lear (2012), Setiawan and Yuniarsih (2018), and Daft (2011) when it comes to the way of ensuring sustainable growth in CPDI projects. In addition, the adoption and implementation of strategic factors such as effective marketing can be used as an effective mechanism to enhance project viability (Goodwin and Stetelman, 2013; Frost and Strauss, 2016).

Project management body of knowledge application; H5 and H6

As stated earlier, PMBOK is the set of key knowledge areas used by project management professionals as a technique to manage projects (PMBOK Guide, 2017; Liljedahl and Möller, 2014). In practice, knowledge areas, including project quality management, project cost management, and project risk management are vital. Effective application of the knowledge areas could maximize the project’s efficiency. The associated hypotheses (H5 and H6) on PMBOK application were tested, and the results are presented in Table 1 as PM-PF and PM-FF. The purpose was to establish whether the application of PMBOK in CPDI projects could have a positive relationship with financial and professional feasibility.

According to Table 1, PM-FF had a p-value of 0.000 and a coefficient of −0.263, showing that there is a negative but statistically significant influence. PM-PF had a p-value of 0.009 and a coefficient of 0.197, showing that there is a positive relationship existing between PMBOK and professional feasibility. The findings discovered at this stage agree with the fact that the project management discipline has gained remarkable attention over the years due to the increase in the number and size of projects that have been carried out in many sectors (Desalegn, 2018). Evidence shows that many modern organizations carry out their business activities by using the concept of project-based techniques (Kerzner, 2018; Muszynska et al., 2015).

Financial and professional feasibility; H7 and H8

Financial and professional feasibility were adopted as two intervening variables for the purpose of evaluating the chosen antecedent/independent variables against the dependent variable (risk assessment/risk management for CPDI projects). Financial feasibility analysis needs to be supported with empirical market research even if the financial calculations conducted on the project prove feasible (Mintah et al., 2018). Hypotheses (H7 and H8) were tested and FF-EE and PF-EE were the results shown in Table 1. The table shows that FF-EE has a p-value of 0.000 with a critical ratio of 2.650. This indicates an acceptance relationship between financial feasibility and risk management. PF-EE has a p-value of 0.008 with a critical ratio of 8.222, meaning that there is a positive relationship between professional feasibility and risk management. The finding proves that adequate financial and professional feasibility in CPDI helps to establish project viability (Koleda, and Oganisjana, 2015). Developers and investors can use feasibility recommendations as a guide in addressing risks likely to emerge during the development process.

Conclusion

This study was designed to assess risks associated with CPDI projects in Accra, Ghana. The selected three antecedent variables, namely, PESTEL analysis, strategic factors, and PMBOK application were set to measure the effective and successful implementation of risk assessment for CPDI through financial and professional feasibility analysis. Data gathered from the study respondents were captured into the SEM-AMOS 28 software to test the eight-hypotheses set for this study. It was evident after testing that all the eight hypotheses showed a significant influence on the key variables of the study (risk assessment and risk management). Hence, the following key outcomes were established:

Majority of the respondents believe that financial and professional feasibility analyses are important assignments to conduct before CPDI projects commence. This may help commercial property developers and investors identify some of the risks that are likely to affect the project and find possible measures to manage them appropriately. The study contributed to the field of CPDI in that it shows there is a need to assess risks at the very beginning of the project. It has been recognized through the study that the effective application of PMBOK, the use of PESTEL analysis, and the employment of strategic factors in CPDI projects are the key elements to consider when conducting risk assessment.

Recommendation

In reference to the above conclusion, it is recommended that commercial property developers and investors take action in developing their professional competencies in the three antecedent variables discussed in this study so that they can apply them when conducting financial and professional analysis.

Limitation and further research

The findings of this study are strictly based on the respondents’ views on and understanding of the identified variables relative to the commercial property development and investment in Accra, Ghana.

Further research may be proposed to look into the utilization of financial and professional analysis in commercial real estate returns.

References

Alolayan, Salah (2014) An assessment of quality management system indicators for the ISO 9001:2008 certified work organisations in Kuwait. PhD thesis, Dublin City University.

Al-Rawahi, A., & Bashir, H. (2011). On the implementation of ISO 9001:2000: A comparative investigation. The TQM Journal, 23, 673–687. https://doi.org/10.1108/17542731111175275

Anifowose, F. (2013). Ensemble Learning Model for Petroleum Reservoir Characterization: A Case of Feed-forward Back-propagation Neural Networks. Trends and Applications in Knowledge Discovery and Data Mining Lecture Notes in Computer Science, Volume 7867. https://doi.org/10.1007/978-3-642-40319-4_7

Anifowose, F. A., Labadin, J., & Abdulraheem, A. (2013). Ensemble model of non-linear feature selection-based extreme learning machine for improved natural gas reserviour characterization. Scribd. https://www.scribd.com/document/467439737/anifowose2015. https://doi.org/10.1016/j.jngse.2015.02.012

Arias, J. C., & Stern, R. (2011). Review of Risk Management Methods in Project Development | Course Hero. https://www.coursehero.com/file/237640444/SERIM-Article-3pdf/

Artto K., Martinsuo M., Kujala J., 2011. Project business. Helsinki, Finland, http://pbgroup.tkk.fi/en/ , (ISBN 978-952-92-8535-8)

Archibong, T.C. and Ogunba, O.A., 2018. An Appraisal of Feasibility and Viability Studies Practice among Estate Surveyors and Valuers in Uyo (No. afres 2018_118). African Real Estate Society (AfRES).

Asah, F., Fatoki, O. O., & Rungani, E. (2015). The impact of motivations, personal values and management skills on the performance of SMEs in South Africa. African Journal of Economic and Management Studies, 6(3), 308-322. https://doi.org/10.1108/AJEMS-01-2013-0009

Banaitienė, N., Banaitis, A. and Norkus, A., 2011. Risk management in projects: peculiarities of Lithuanian construction companies. International Journal of strategic property Management, 15(1), 2011 Vol 15(1): pp.60-73. https://doi.org/10.3846/1648715X.2011.568675

Bello-Schünemann, & Moyer, J. (2018, October 2). Structural Pressures and Political Instability: Trajectories for Sub-Saharan Africa | Political Settlements Research Programme X. https://psrpdev.law.ed.ac.uk/psrpx/2018/10/02/structural-pressures-and-political-instability-trajectories-for-sub-saharan-africa/

Bowers, J. and Khorakian, A., 2014. Integrating risk management in the innovation project. European Journal of Innovation Management, 17(1), 25–40. https://doi.org/10.1108/EJIM-01-2013-0010

Brook, M. (2016). Estimating and Tendering for Construction Work (5th ed.). Routledge. https://doi.org/10.4324/9781315734699

Caputo, A., 2013. Systemic stakeholders’ management for real estate development projects. Global Business and Management Research: An International Journal. Vol. 5, No. 1.pp 66-82.

Conrad, D. and Newberry, R., 2012. Identification and instruction of important business communication skills for graduate business education. Journal of Education for Business, 87(2), pp.112-120. https://doi.org/10.1080/08832323.2011.576280

Costello, G. and Preller, F., 2010. Property Development Principles and Process–An Industry Analysis. Pacific Rim Property Research Journal, 16(2), ISSN: 1444-5921.Vol.16.No.2, pp.171-189. https://doi.org/10.1080/14445921.2010.11104300

Cruz, C.O. and Marques, R.C., 2013. Flexible contracts to cope with uncertainty in public–private partnerships. International journal of project management, 31(3),Vo. 3. pp.473-483. https://doi.org/10.1016/j.ijproman.2012.09.006

Cytonn Real Estate: ‘A Golden Investment Opportunities’ report publication. 2017. Accra, Ghana. Pp.24-45.

Desalegn, T., 2018. The Effect Of Project Integration Management Process On Project Success: The Case of Berhan Bank Data Center Project (Doctoral dissertation, Addis Ababa University).

De Bakker, K., Boonstra, A. and Wortmann, H., 2014. The communicative effect of risk identification on project success. International Journal of Project Organisation and Management, 6(1-2), pp.138-156. https://doi.org/10.1504/IJPOM.2014.059749

De La Harpe, B., Mason, T. and Peterson, F., 2011. Reflections on establishing a network to strengthen leadership of learning and teaching in the creative arts. Text: Special Issue Website Series, (12), pp.1-22.

Dominguez, C., Ribeiro, P., Paiva, A. and Varajão, J., 2010, July. Insights on critical management aspects in construction projects–evidences from large Portuguese companies. In Proceedings of the 3rd WSEAS international conference on Engineering mechanics, structures, engineering geology (pp. 39-43). World Scientific and Engineering Academy and Society (WSEAS).

Florentino, T., Casaca, J.A. and Empresa–Universitário, L., 2014. Real Estate Brokers in Premium Segment-Marketing and Communication through Technologies (No. eres2014-97). European Real Estate Society (ERES).

Flyvbjerg, B., Garbuio, M. and Lovallo, D., 2009. Delusion and deception in large infrastructure projects: two models for explaining and preventing executive disaster. California management review, 51(2), pp.170-194. https://doi.org/10.2307/41166485

Goodwin, K. and Stetelman, S., 2013. Perspectives on Technology Change and the Marketing of Real Estate. Journal of Housing Research, 22(2), pp.91-108. https://doi.org/10.1080/10835547.2013.12092075

Geipele, I., Kauskale, L., Lepkova, N. and Liias, R., 2014. Interaction of socio-economic factors and real estate market in the context of sustainable urban development. In Environmental Engineering. Proceedings of the International Conference on Environmental Engineering. ICEE (Vol. 9, p. 1). Vilnius Gediminas Technical University, Department of Construction Economics & Property. https://doi.org/10.3846/enviro.2014.117

Hair Jr, J.F., Sarstedt, M., Hopkins, L. and Kuppelwieser, V.G., 2017. Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. European business review. Vol.25. No.2. pp. 111-113.

Halpin, D.W., Lucko, G. and Senior, B.A., 2017. Construction management. John Wiley & Sons.

Heravi, A., Coffey, V. and Trigunarsyah, B., 2015. Evaluating the level of stakeholder involvement during the project planning processes of building projects. International Journal of Project Management, 33(5), pp.985-997. https://doi.org/10.1016/j.ijproman.2014.12.007

Hwang, S., Park, M. and Lee, H.S., 2013. Dynamic analysis of the effects of mortgage-lending policies in a real estate market. Mathematical and Computer Modelling, 57(9-10), pp.2106-2120. https://doi.org/10.1016/j.mcm.2011.06.023

Ingason, H.T., 2015. Best project management practices in the implementation of an ISO 9001 quality management system. Procedia-Social and Behavioral Sciences, 194(3), pp.192-200. https://doi.org/10.1016/j.sbspro.2015.06.133

Iyer, K.C. and Jha, K.N., 2005. Factors affecting cost performance: evidence from Indian construction projects. International journal of project management, 23(4), pp.283-295. https://doi.org/10.1016/j.ijproman.2004.10.003

Johnson, G., Whittington, R., & Scholes, K. 2011. Exploring Strategy: Text & Cases (11 ed.). London: Pearson Education. P 50.

Jonas, D., Kock, A. and Gemünden, H.G., 2012. Predicting project portfolio success by measuring management quality—a longitudinal study. IEEE Transactions on Engineering Management, 60(2), pp.215-226. https://doi.org/10.1109/TEM.2012.2200041

Jurevicius, O. 2013. Strategic Management & Strategic Planning Process. Strategic Management Insight, 1-9.

Khan, R.A., Liew, M.S. and Ghazali, Z.B., 2014. Malaysian construction sector and Malaysia vision 2020: developed nation status. Procedia-social and behavioral sciences, 109(2014), pp.507-513. https://doi.org/10.1016/j.sbspro.2013.12.498

Kauškale, L. and Geipele, I., 2017. Integrated approach of real estate market analysis in sustainable development context for decision making. Procedia Engineering, 172, pp.505-512. https://doi.org/10.1016/j.proeng.2017.02.059

Kauskale, L. and Geipele, I., 2016, April. Economic Problems of Real Estate Market and Its Influence on the Development of Business Environment. In Economic Science for Rural Development Conference Proceedings (No. 43).

Kaplinski, O. and Tupenaite, L., 2011. Review of the multiple criteria decision making methods, intelligent and biometric systems applied in modern construction economics. Transformations in Business & Economics, 10(1), pp.166-181.

Kerzner, H., 2018. Project management best practices: Achieving global excellence. John Wiley & Sons. https://doi.org/10.1002/9781119470717

Khamidi, M.F., Waris, A.K. and Idrus, A., 2011. The cost monitoring of construction projects through earned value analysis.

Koul, P., Rai, R.S. and Ahuja, V., 2018. An integrated approach based structural modelling for developing risk assessment framework for real estate projects in India. Technology, 9(13), pp.1721-1736

Kujala, J., Brady, T. and Putila, J., 2014. Challenges of cost management in complex projects. International Journal of Business and Management, 9(11), p.48-49. https://doi.org/10.5539/ijbm.v9n11p48

Kumar, V., Jones, E., Venkatesan, R. and Leone, R.P., 2011. Is market orientation a source of sustainable competitive advantage or simply the cost of competing?. Journal of marketing, 75(1), pp.16-30. https://doi.org/10.1509/jm.75.1.16

Koleda, N. and Oganisjana, K., 2015. Challenges in Learning for Company‘s Financial Viability Assessment and Management. Business: Theory and Practice, 16, p.195. https://doi.org/10.3846/btp.2015.552

Laban, K.N., 2017. Integrating Gis and Real Estate Management Systems to Market and Manage Facilities on the Web (Doctoral dissertation, University of Nairobi).

Larsen, J.K., Shen, G.Q., Lindhard, S.M. and Brunoe, T.D., 2016. Factors affecting schedule delay, cost overrun, and quality level in public construction projects. Journal of Management in Engineering, 32(1), p.04015032. https://doi.org/10.1061/(ASCE)ME.1943-5479.0000391

Lear, L.W., 2012. The relationship between strategic leadership and strategic alignment in high-performing companies in South Africa. University of South Africa.

Liljedahl, H. and Möller, J., 2014. Success factors in commercial property projects: the contractor’s perspective (Master’s thesis). p4.

Lunenburg, F.C., 2010. Formal communication channels: Upward, downward, horizontal, and external. Focus on Colleges, Universities, and Schools, 4(1), pp.1-7.

Mintah, K., Higgins, D., Callanan, J. and Wakefield, R., 2018. Staging option application to residential development: real options approach. International Journal of Housing Markets and Analysis. https://doi.org/10.1108/IJHMA-02-2017-0022

Mulliner, E., Malys, N. and Maliene, V., 2016. Comparative analysis of MCDM methods for the assessment of sustainable housing affordability. Omega, 59, pp.146-156. https://doi.org/10.1016/j.omega.2015.05.013

Muszynska, K., Dermol, K., Trunk, V., Ðakovic, A. and Smrkolj, G., 2015, May. Communication management in project teams–practices and patterns. In Joint International Conference (pp. 1359-1566).

Ofori, D.F., 2013. Project management practices and critical success factors-A developing country perspective. International Journal of Business and Management, 8(21), p.14. https://doi.org/10.5539/ijbm.v8n21p14

Ogunlana, S.O., 2010. Beyond the ‘iron triangle’: Stakeholder perception of key performance indicators (KPIs) for large-scale public sector development projects. International journal of project management, 28(3), pp.228-236. https://doi.org/10.1016/j.ijproman.2009.05.005

Palladan, A.A., 2017. Effects of strategic leadership, organizational innovativeness, information technology capability on effective strategy implementation (Doctoral dissertation, Universiti Utara Malaysia).

Petit, Y., 2012. Project portfolios in dynamic environments: Organizing for uncertainty. International Journal of Project Management, 30(5), pp.539-553. https://doi.org/10.1016/j.ijproman.2011.11.007

Popescu, L., Iancu, A., Avram, M., Avram, D. and Popescu, V., 2020. The Role of Managerial Skills in the Sustainable Development of SMEs in Mehedinti County, Romania. Sustainability, 12(3), p.1119. https://doi.org/10.3390/su12031119

Pournasir, S., 2013. Key success factors of strategic management implementation in SMEs in Iran. Journal of International Studies, 6(2), pp.65-78. https://doi.org/10.14254/2071-8330.2013/6-2/6

Project Management Body of Knowledge (PMBOK) Guide. Eight Edition. 2017. Pp 15-323.

Rey-Martí, A., Porcar, A.T. and Mas-Tur, A., 2015. Linking female entrepreneurs’ motivation to business survival. Journal of business research, 68(4), pp.810-814. https://doi.org/10.1016/j.jbusres.2014.11.033

Setiawan, Y. and Yuniarsih, T., 2018. Leaderships strategic and employee performance. The International Journal of Business Review (the JOBS Review), 1(1), pp.63-72. https://doi.org/10.17509/tjr.v1i2.14529

Smith, P., 2014. Project cost management-global issues and challenges. Selected papers from the 27th ipma (international project management association). Pp 54-67.

Taniguchi, A. and Onosato, M., 2018. Effect of continuous improvement on the reporting quality of project management information system for project management success. International Journal of Information Technology and Computer Science (IJITCS), 10(1), pp.1-15. https://doi.org/10.5815/ijitcs.2018.01.01

Taplin, R. ed., 2005. Risk management and innovation in Japan, Britain and the USA. Routledge. https://doi.org/10.4324/9780203027783

Teller, J., Kock, A. and Gemünden, H.G., 2014. Risk management in project portfolios is more than managing project risks: A contingency perspective on risk management. Project Management Journal, 45(4), pp.67-80. https://doi.org/10.1002/pmj.21431

Tesha, D.N., 2018. Mitigation Measures in Dealing with Delays and Cost Overrun in Public Building Projects in Dar-Es-Salaam, Tanzania. Jongo, JS Tesha, DNGAK, Kassonga, R., Teyanga, JJ, and Lyimo, KS,(2019), pp.81-96.

The Real Estate Law Review.2019. Eighth Edition. p126.

Turskis, Z., Gajzler, M. and Dziadosz, A., 2012. Reliability, risk management, and contingency of construction processes and projects. Journal of Civil Engineering and Management, 18(2), Vol. 18(2): pp.290-298. https://doi.org/10.3846/13923730.2012.672931

Vasista, T.G.K., 2017. strategic cost management for Construction project success: a Systematic study. Civil Engineering and Urban Planning: An International Journal (CiVEJ), 4(1), Vol.4, No.1. pp.41-52. https://doi.org/10.5121/civej.2017.4105

Zafar, F., Rajpoot, A.A. and Khalid, A., 2014. Strategic management and its commitment to acquire business excellence through continuous improvement. International Journal of Advancements in Research & Technology, 3(1), pp.42-54.

Zhao, X., Tang, Y., Lu, M. and Zhang, X., 2019. Foreign Direct Investment Dynamic Performance with Low-Carbon Influence: A Provincial Comparative Application in China. International Journal of Financial Studies, 7(3), p.46. https://doi.org/10.3390/ijfs7030046