Construction Economics and Building

Vol. 24, No. 4/5

December 2024

RESEARCH ARTICLE

Factor Analysis of Risk Allocation Criteria (RAC) in Public-Private Partnership (PPP) Projects: A Case of New Zealand

Nasir Rasheed1,*, Wajiha Mohsin Shahzad2, James Olabode Bamidele Rotimi3

1 School of Built Environment, Massey University, Auckland 0745, New Zealand, nrasheed@massey.ac.nz

2 School of Built Environment, Massey University, Auckland 0745, New Zealand, W.M.Shahzad@massey.ac.nz

3 School of Built Environment, Massey University, Auckland 0745, New Zealand, J.Rotimi@massey.ac.nz

Corresponding author: Nasir Rasheed, School of Built Environment, Massey University, Auckland 0745, New Zealand, nrasheed@massey.ac.nz

DOI: https://doi.org/10.5130/AJCEB.v24i4/5.9021

Article History: Received 29/01/2024; Revised 21/05/2024; Accepted 26/09/2024; Published 23/12/2024

Citation: Rasheed, N., Shahzad, W. M., Rotimi, J. O. B. 2024. Factor Analysis of Risk Allocation Criteria (RAC) in Public-Private Partnership (PPP) Projects: A Case of New Zealand. Construction Economics and Building, 24:4/5, 142–159. https://doi.org/10.5130/AJCEB.v24i4/5.9021

Abstract

The utilization of Public Private Partnerships (PPPs) has become widely prevalent as an innovative approach for procuring public infrastructure projects. Risk transfer/allocation is one of the main reasons for this widespread adoption and considered a critical success factor for a PPP. Given the importance of equitable risk allocation, this study identified and analysed 10 key risk allocation criteria. Experts with experience in PPP projects in New Zealand were surveyed through an empirical questionnaire to obtain industry-wide data. Mean score analysis and factor analysis were then used to analyse the collected data. In order to ensure the validity of the analysis results, appropriate statistical tests such as Cronbach’s Alpha, Kaiser-Meyer-Olkin (KMO) statistic and Bartlett’s test of Sphericity were conducted. Result indicate that the most important criteria for risk allocation are “risk foresight”, “minimize risk loss” and “response to risk”. Furthermore, factor analysis showed that the identified RAC can be classified into three component groups namely “risk management expertise”, “core risk management capability” and “risk management strategy”. This study aims to provide PPP stakeholders with useful insights into the most effective measures for achieving equitable risk allocation. To achieve this, the study recommends to consider the risk management capabilities of both the public and private sectors in light of the identified RACs/groupings. The results of the study are expected to assist PPP stakeholders in developing strategies that can enhance risk management and achieve a fair distribution of risks.

Keywords

Public-Private-Partnerships; Risk Management; Risk Allocation Criteria; Factor Analysis

Introduction

A country’s economic growth is highly dependent on its infrastructure. Governments all over the world continue to struggle in the provision of infrastructure in face of rising urban populations (Kaluarachchi, 2022; OECD, 2012). Infrastructure provision requires huge sums of money as well as innovative ways of construction management. Public sector is often criticized for struggling to adopt innovation and achieve value for money (Ammons, 2019). For these reasons, private sector involvement in infrastructure projects has become normal over recent decades. One of the innovative ways private sector is involved in the provision of public infrastructure projects is public-private partnership (PPP/P3) (Bayliss & Van Waeyenberge, 2018; Rasheed et al., 2022).

There are many evidences that PPPs work better than conventional procurement, which depend predominantly on government entities to carry out the project (Raisbeck et al., 2010; Wang & Zhao, 2018). The other aspect of public-private partnerships, however, raises the possibility that they are not a panacea because of the intricate nature of financial structure, the expectation of high returns on investment, the lengthier contract terms, and the inherently risky projects procured through this delivery method (Carbonara et al., 2015; Rybnicek et al., 2020). Moreover, inadequate risk management and inefficient risk transfer among the public and private sectors negatively impact project objectives (Jin & Zhang, 2011; Shrestha et al., 2017). As a result, effective project risk management is essential for PPP project implementation success.

Researchers have examined the issue of risk transfer and sharing in PPP projects and have found that there is often inefficient risk allocation. Many studies have compared the actual risk proportions in PPP projects with allocations based on subject matter expert judgements, often using surveys. These studies have shown a significant mismatch between preferred and actual risk distribution, resulting in inefficiencies in risk allocation. For example, in Chinese PPP water supply projects, the private sector was found to bear risks in an inefficient manner (Shrestha et al., 2018). More recently, some scholars have proposed best practices that evaluate each party’s capacity to manage identified risks and aim to prevent risk misallocation. These approaches often rely on principle of risk allocation in PPP i.e., “risks should be allocated to a party who is best able to manage it” (Ke et al., 2008).

While the concept of allocating risks to the party most capable of managing it is logical, implementing this principle can be challenging due to the subjective nature of assessing risk management capability. For this reason, researchers utilized criteria which can reflect risk management capability of participating parties. These criteria are termed as risk allocation criteria (RAC). Previous PPP studies had a strong emphasis on identifying and evaluating risks. Moreover, some attention has been given to the area of risk allocation in PPP. However, focus of risk allocation research in PPP has mainly been on preferred risk allocation where risk allocation preferences of experts are sought; and its comparison with actual allocation of risk. Given that risk allocation principle necessitates considering the risk management abilities of all parties involved, it is crucial to conduct research focused on risk management capability-based risk allocation. There is a considerable gap in the field of risk allocation derived from risk management competence of public or private sector particularly in social infrastructure projects. Therefore, this paper aims to fill this gap in light of the identified RAC from literature (as listed in Table 1). This study sought to explore key components that could guide RAC based risk management in PPP projects. The insights gained could assist practitioners in both the public and private sectors in assessing their risk management capabilities for partnership projects. Empirical data through questionnaire from PPP projects in New Zealand was collected and analysed using factor analysis to develop factor groups of RAC for simplicity. The findings of this study are anticipated to support PPP stakeholders in formulating strategies that enhance risk management and promote an equitable allocation of risks.

| RAC | Description of the criteria | Other examples in literature |

|---|---|---|

| Risk foresight | Ability of the party to identify and assess risk by predicting the probability of occurrence and the impact if that risk occurs. | (Mazher, 2019, Ameyaw and Chan, 2016, Lam et al., 2007, Thomas et al., 2003, Loosemore and McCarthy, 2008) |

| Response to risk | Ability of the party to minimize the probability and impact of risk before it takes place. | (Mazher, 2019, Ameyaw and Chan, 2016, Lam et al., 2007, Thomas et al., 2003, Loosemore and McCarthy, 2008) |

| Minimize risk loss | Ability of the party to minimize the loss/reduce the impact of the risk in case it occurs. | (Mazher, 2019, Ameyaw and Chan, 2016, Lam et al., 2007, Loosemore and McCarthy, 2008) |

| Absorb risk impact | The ability of the party to sustain the impact of the risk based on their experience. | (Mazher, 2019, Ameyaw and Chan, 2016, Lam et al., 2007, Thomas et al., 2003, Irwin, 2007) |

| Low risk cost | The ability of the party to manage risk in the least possible cost. | (Mazher, 2019, Ameyaw and Chan, 2016, Irwin, 2007) |

| Obtain risk premium | The ability to receive compensation of a loss borne as a result of risk occurrence. | (Mazher, 2019, Ameyaw and Chan, 2016, Lam et al., 2007) |

| Exploit risk | To take advantage of certain risks due to an organization’s capability and experience of dealing with that risk exceptionally well. | (Mazher, 2019, Ameyaw and Chan, 2016, Lam et al., 2007, Loosemore and McCarthy, 2008) |

| Risk attitude | The attitude of a party towards risk management i.e. risk averse/seeker/neutral/transfer. | (Mazher, 2019, Ameyaw and Chan, 2016, Chung et al., 2010) |

| Bargaining power/ negotiation tactics | The relative strength or influence of party in negotiating and executing the terms of the partnership agreement. | (Xu et al., 2010, Thomas et al., 2003, Arndt and Maguire, 1999) |

| Experience | The level of knowledge, skills, technical/financial capacity and track record of party in executing and managing PPP projects. | (Xu et al., 2010, Zhu et al., 2007, Jin and Doloi, 2008) |

(Adopted with permission from: (Rasheed et al., 2022))

Literature review

An overview of risk management in PPP

Governments’ increasing adoption of PPPs has spurred significant academic interest over the past decade (Lima et al., 2021). Researchers have focused on financing, economic viability, legal issues, risk management, regulations, and success factors relating to PPPs (Zhang et al., 2016; Cui et al., 2018). Risk management involves identifying, planning responses to, monitoring, and controlling project hazards (Schieg, 2006). The process starts with establishing strategy and stakeholder duties, followed by risk assessment, which must be preceded by thorough risk identification. Risks are evaluated based on their likelihood and impact using qualitative, quantitative, or mixed methods. Costs of managing key project risks are assessed, followed by planning for risk responses such as acceptance, transfer, avoidance, or reduction. Proper risk distribution is essential, with specific risks assigned to the most capable parties (Karim & Alkaf, 2011). Continuous monitoring and re-evaluation of risks are also necessary.

PPPs are inherently risky, making risk management crucial (PMI, 2013). Effective risk management not only reduces negative impacts but also enhances positive outcomes. Traditional risk management, focused before project commencement, is challenging and costly for long-term PPP projects (Xiong et al., 2017). Thus, improving risk management’s efficacy is vital, leading to increased research on risk identification, evaluation, and allocation (Ameyaw & Chan, 2015b; Liu et al., 2018; Osei–Kyei et al., 2021; Savrukov et al., 2020; Zhang, Zhao, et al., 2019). Besides construction, PPPs face risks in funding, operation, and maintenance. Stakeholders should be well-informed about these risks to achieve project milestones (Ibrahim et al., 2006). Realistic and objective risk assessment methodologies are essential (Li & Zou, 2011), helping project managers plan corrective actions efficiently (Ameyaw & Chan, 2015a).

Risks can be classified by their impact on public or private sectors, divided into national, regional, and project levels (Mazher, 2019). Akomea-Frimpong et al. (2020) categorized PPP project risks into pre-construction, construction, operation, maintenance, and market level. Bing et al. (2005) highlighted UK PFI project risks, categorized by design, delays, costs, and performance. Wu et al. (2018) identified 37 risks in PPPs, categorized into construction, operating, maintenance, legal, and economic risks.

Risk management’s importance in PPPs is evident from extensive research on risk identification, assessment, and measures. However, risk transfer and allocation has received less focus. Recent efforts aim to address this gap. PPPs are cost-effective by transferring most risks to private partners better equipped to handle them (Wibowo & Kochendoerfer, 2010). Fair risk transfer enhances performance and project success. Risks should be allocated to parties capable of managing them, but this is complex and prone to subjective judgment, leading to misallocation (Alonso‐Conde et al., 2007).

Expert opinions have been used to determine preferred risk allocation in previous studies (Ke et al., 2010; Rafaat et al., 2020). In China’s PPP projects, most risks were shared between public and private sectors, revealing inconsistencies between preferred and actual risk distribution (Ke, Wang, and Chan, 2010). Implementing risk allocation in real projects is challenging, supported by literature documenting inadequate risk distribution (Ameyaw & Chan, 2016; Mazher et al., 2019). Evaluating a party’s ability to handle risk depends on external factors, including bargaining power, stakeholder concerns, and financial arrangements (Ng & Loosemore, 2007).

Inefficient risk allocation has been examined in PPP projects. Ke et al. (2013) found that risk misallocation leads to poor project performance in Chinese PPP projects, particularly regarding government action, land acquisition, and approvals. Shrestha et al. (2018) found inefficiencies in risk allocation in Chinese PPP water supply projects, with external risks largely absorbed by the private sector despite limited capacity to manage them. Scholars have developed best practices to evaluate each party’s capacity to manage identified risks, typically based on Risk Allocation Criteria (Ameyaw & Chan, 2016).

Risk allocation criteria

Risk allocation criteria are used to determine the “what, which, and how” of risk allocation, or what risks to assign to which parties and how to accomplish allocation. For their broad application in PPP research, these standards taken from the contemporary literature have been included in Table 4.1. RAC evaluates a party’s capacity to successfully manage such risks. Risk allocation has traditionally been done through negotiations between players in the public and private sectors. Risk specialists from the public and commercial sectors form a risk allocation agreement. The value of negotiating in PPPs cannot be understated. It isn’t generally thought of as the ideal instrument for risk allocation practise, though. As one side may have more influence over the project than the other depending on its stage. For instance, the public sector has more power than the private parties during the procurement stage, which gives it more negotiating leverage. In the past, there have been instances where the private sector has been burdened with risks beyond its capacity, indicating a misuse of this approach (Loosemore & McCarthy, 2008; Xu et al., 2011). Hence, to better reflect the PPP’s risk-sharing principle, which specifies that responsibility for managing the risk should be placed with the party most qualified to do so, the ability of each party to handle risk may be taken into consideration to improve risk allocation, which will ultimately lead to effective risk allocation. Given there is a significant gap in understanding the risk management competence of the public and private sectors, research on risk allocation based on the risk management abilities of involved parties is crucial, and this paper aims to address this gap.

Research methodology

Every research study necessitates a well-defined research methodology, serving as a roadmap that directs the inquiry from inception to completion. (Akomea-Frimpong, Jin and Osei-Kyei, 2020). This study utilizes deductive reasoning approach using quantitative data collected through a questionnaire survey and collected data was analysed through statistical means. An extensive literature review was used to identify and develop a list of 10 RAC. However, a pilot research was carried out among four experts (two industry professionals and two academics) to determine the applicability and usefulness of the resulting RAC. The relevance and usefulness of the set of criteria were validated and reinforced by the experts, with just a few minor phrasing changes proposed and suggestion of removing one criterion for lack of clarity and redundancy. A questionnaire for the study was created using the finalized set of criteria using an online data gathering tool Qualtrics. Questionnaire survey was adopted for its widespread use in the area of construction management research (Wahid et al., 2023). The nine criteria are shown in Table 1 together with the corresponding definitions. Questionnaire was divided into two parts. First part corresponded to the respondent’s profile which was designed to assess whether they possessed appropriate experience and knowledge of PPP projects. Questions were asked about respondent’s experience in PPP project, type of project they worked on, their sector of association and position in their organization. These questions were important as they established credibility of the collected data, given the scarcity of PPP projects in New Zealand. Second part of the questionnaire was designed to understand the importance of the identified RAC and perceived risk management capability of the respondent’s organization for each RAC. A five-point Likert (1 = least important and 5 = most important) scale was adopted to assess the importance of RAC and ability of respondent’s organization to deal with risks in terms of identified RAC. A no idea (NI) option was also provided to respondents in case they felt they were not experienced enough to answer any of the questions.

After refining the questionnaire with the help of pilot study, the primary data for this study was gathered through an industry wide survey in New Zealand. All decision-makers and professionals from public and private sector who have been involved in PPP initiatives in New Zealand were the survey’s target audience. A combination of two non-probability sampling techniques, convenience and judgement, was used to approach respondents as opposed to random sampling as the exact population wasn’t available. An ongoing PPP initiative was approached for initial group of responders. Given their degree of PPP scene experience, it was anticipated that they would know other possible responders as well, therefore they were asked to share the survey form link with their network as well. However, this approach wasn’t fruitful and did not achieve the desired number of responses. Therefore, additional steps were taken to increase the survey responses. In doing so, all the relevant PPP projects in New Zealand were identified to obtain of list major stakeholders. These stakeholders were then contacted through academic connections to participate in the survey. Additionally, professionals from PPP organizations who worked on these projects were contacted individually through email and LinkedIn connections to distribute the survey.

The collected data from questionnaire survey was subjected to various statistical analysis techniques such as mean score analysis, reliability analysis and exploratory factor analysis using latest versions of Microsoft Excel and Statistical Package for Social Sciences (SPSS). Mean score ranking was used to establish the importance of RAC along with standard deviation of each RAC. Factor analysis was performed in SPSS using principle component analysis with varimax rotation to obtain factor loadings of the 9 RAC. Suitability of these two analysis techniques was also considered through various tests such as Cronbach’s alpha, internal consistency reliability, correlation matrix, Kaiser-Meyer-Olkin (KMO), and Bartlett’s test of Sphericity given their widespread use in other PPP studies involving factors, such as Critical Success Factors (Babatunde et al., 2016), Risk Factors (Mazher et al., 2018) and Critical Success Criteria (Osei-Kyei and Chan, 2021). More detail on these tests is provided in the result section of this paper.

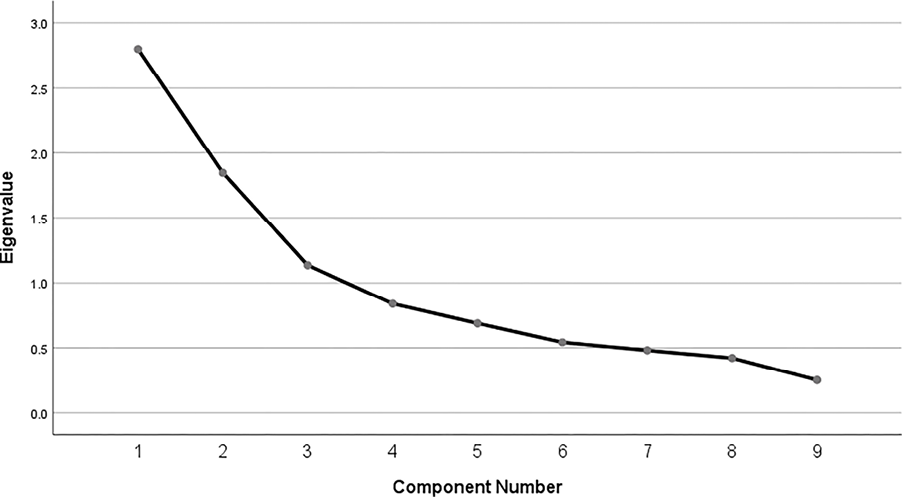

Factor analysis operates on the fundamental principle that observable variables can be condensed into a smaller collection of underlying variables that exhibit shared variance, a process known as dimensionality reduction (Yong and Pearce, 2013). The relevance of factors is determined by their eigenvalues, with only factors having an eigenvalue higher or equivalent to 1 being considered in analysis (Hsueh & Chang, 2017; Osei-Kyei and Chan, 2021). A n x n correlation matrix “A” will have “n” number of eigenvalues (λ1, λ2,…, λn) given by equation 1, where I represent the identity matrix of A. Since each Eigenvalue correspond to variances of the factors. Taking a percentage of Eigenvalue of each factor to the total number of factors resulted in the total variance explained by each factor.

| A – λI | = 0(1)

Results and discussion

A total of fifty-one responses were deemed valid, and based on the comparison with other similar studies that utilized questionnaire surveys, the sample size was deemed adequate for further analysis, (Osei-Kyei and Chan, 2021) collected 48 responses, Ameyaw and Chan (2015c) obtained 35 responses and Jin, Zhang and Yang (2012) obtained 44 responses in their respective studies. Additionally, given the small number of PPP projects present in New Zealand and study area being somewhat advanced 51 responses were considered sufficient. Table 2 displays a comprehensive overview of the background information of the participants. As indicated in Table 2, the majority of respondents (63%) possess over five years of experience working on PPP projects.

The mean scores of the nine RAC were used to identify RAC groups (RACGs) through the Factor Analysis (FA) technique. Typically, a recommended variable to sample size ratio of 1:5 is followed prior to conducting FA (Lingard & Rowlinson). Given the sample size of 51 against nine RAC, the FA technique is deemed suitable and appropriate for the data set. However, to confirm the suitability of the technique for this study, various preliminary tests such as internal consistency reliability, correlation matrix, Kaiser-Meyer-Olkin (KMO), and Bartlett’s test of Sphericity were also conducted (Norusis, 2008; Osei-Kyei and Chan, 2021).

Initially, a reliability test was performed using the Cronbach’s alpha model. The primary objective of the test is to verify if the factors and their corresponding Likert scale accurately measure the intended construct. The Cronbach’s alpha coefficient, which can range from 0 to 1, is commonly used to assess internal consistency. As a general guideline, George and Mallery (2021) proposed that a score of at least 0.7 is the minimum threshold, while a score of 0.8 or higher is considered an excellent indicator of internal consistency. The overall alpha value for the nine RAC was found to be 0.721, which exceeds the recommended threshold, suggesting a good level of consistency in the survey responses.

In addition, the correlation matrix was used to evaluate the relationships among the factors by calculating the partial correlation coefficients. The resulting matrix showed strong correlations among the nine RAC, as their correlation coefficients exceeded 0.30 for more than one other variable (Li et al., 2005; Norusis, 2008; Osei-Kyei and Chan, 2021). Output rotated component matrix from SPSS is tabulated in Table 3 below. Furthermore, to check the adequacy of applying FA, KMO statistic and Bartlett’s test of Sphericity were performed (Table 4).

| Rotated Component Matrix | |||

|---|---|---|---|

| Component | |||

| 1 | 2 | 3 | |

| RAC3 | 0.792 | ||

| RAC9 | 0.779 | ||

| RAC4 | 0.777 | ||

| RAC6 | 0.72 | ||

| RAC1 | 0.824 | ||

| RAC8 | 0.765 | ||

| RAC5 | 0.671 | ||

| RAC7 | 0.81 | ||

| RAC2 | 0.75 | ||

Figure 1. Scree plot from analysis

| KMO and Bartlett’s Test | ||

|---|---|---|

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | .687 | |

| Bartlett’s Test of Sphericity | Approx. Chi-Square | 93.063 |

| df | 36 | |

| Sig. | .000 | |

The KMO test is used to assess the degree of partial correlation among variables and its strength. A KMO value closer to 1.0 is considered to be ideal, while values below 0.5 are deemed unacceptable (Tang and Shen, 2013). However, many researchers have suggested value of greater than 0.7 to be desirable. Shrestha (2021) reported that for sample sizes below 100, a value exceeding 0.6 is considered acceptable. Results of this study revealed a KMO value of 0.687, indicating a significant overlap of information among the variables or the presence of strong partial correlation. This suggests that conducting a factor analysis is a plausible approach.

The Bartlett’s test of sphericity is a statistical tool used to examine the null hypothesis that the correlation matrix is an identity matrix, indicating that the variables are independent and not suitable for factor analysis (Norusis, 2008). If the statistical test produces a significant result, typically less than 0.05, it means that the correlation matrix is not an identity matrix and the null hypothesis can be rejected. The Bartlett’s test of sphericity produced a large value (chi-square = 133.653) and a significance value of less than 0.05 (p = 0.00), suggesting that the population correlation matrix is not an identity matrix (ibid.).

Table 5 presents the analysis of the mean values of nine RAC along with factor loadings, Eigenvalues, percentage of variance explained and cumulative percentage of variance. The mean values, ranging from 4.34 (indicating high importance) to 3.52 (important), and the standard deviation values (SD) ranging from 0.53 to 0.94 are shown in the table. It is noteworthy that only three criteria are considered to be of very high importance in evaluating risk allocation decision in PPP projects. These criteria are “risk foresight” (ms = 4.34), “response to risk” (4.12) and “minimize risk loss” (ms = 4.08).

As mentioned earlier, to investigate the underlying relationships among nine RAC, factor analysis was employed. This analysis holds importance as it condenses the factors into smaller clusters, facilitating practitioners in pinpointing the essential practices required to meet the criteria within these clusters. Additionally, by employing factor analysis, practitioners gain insights into the interconnections among various criteria within each grouping.

A three-factor solution was obtained using principal factor extraction with varimax rotation, which had eigenvalues exceeding 1.0 (see Table 5). Varimax rotation was preferred because it simplifies the interpretation process by representing the principal component factor with a small number of easily interpretable variables (Osei-Kyei et al., 2017). All variables had factor loadings at or above 0.50, with seven of them exceeding 0.69, as shown in Table 5. This once again confirms the suitability of the survey data for factor analysis (Osei-Kyei, Tam and Ma, 2021). Table 5 presents the extracted factors, with their eigenvalues being greater than 1. Additionally, the three major factors account for 64.21% of the total cumulative variance, indicating the sufficiency of the three factors in representing the 10 RAC. These three major components are labelled as follows:

1. RACG1 – Risk management expertise.

2. RACG2 – Core risk management capability.

3. RACG3 – Risk management strategy.

The three primary components/groups were named according to the subfactors’ loadings, meaning that subfactors with higher absolute loading values had a greater impact on the naming of their respective RAC. It’s important to note, however, that this naming process can also be considered theoretical, subjective, as discussed in a previous study by Osei-Kyei et al., 2023.

RACG1: Risk management expertise

Explaining 31.09% of the variance the first group was called “Risk management expertise”. This group consists of four RAC: RAC3 “Absorb risk impact”; RAC9 “Experience”; RAC4 “Exploit risk” and RAC6 “Bargaining power/negotiation tactics” with factor loading of 0.792, 0.779, 0.777 and 0.720, respectively. Notably, these four sub criteria mainly relate to the past experience of a party in PPP project to implement valuable lessons learned and insights that can be used to inform future risk management practices. The RAC3 exhibits the highest factor loading value, indicating that the ability of a party to absorb the risk impact is a noteworthy criterion to take into account when allocating risks of the project. Shrestha et al. (2018) and Ameyaw and Chan (2016) also stress the importance of this in their studies that the party responsible for managing the risk should possess the ability to minimize the costs. It is important to note that bargaining power/negotiation tactics with a factor loading of 0.72 is an important criterion. Rasheed et al. (2022) stress the importance of understanding the negotiating power of each party at the time of allocating risks, as this can lead to unequitable allocation of risks at negotiation stage of the project. With a mean score of 3.84, this group ranked third in the mean score ranking of groups. However, still signifies importance on the mean score scale used in this study. Moreover, with an eigenvalue of 2.799 this group explains the most percentage of variance equal to a value of 31.09.

Risk management expertise plays a critical role in the successful execution of public-private partnership (PPP) projects. It involves the knowledge, skills, and capabilities of the project stakeholders in identifying, assessing, mitigating, and managing risks throughout the project lifecycle. In PPP projects, several factors come into play when considering risk management expertise, including the experience of the partnering entities, their ability to absorb risk impacts, their capacity to exploit risks for mutual benefit, and their bargaining power.

Experience of a partner: With a mean score of 3.96, this criterion ranked top of the group in terms of mean score ranking, however in terms of factor loading which can be interpreted as correlation of each criteria with the group ranked 2nd with a value of 0.779. The experience of a partner, whether it is a public authority or a private company, greatly influences their risk management expertise. A partner with prior experience in PPP projects brings valuable knowledge of potential risks, effective risk mitigation strategies, and best practices. They are better equipped to anticipate and address project-specific risks, drawing from lessons learned in previous ventures. This experience enhances their ability to navigate complexities, make informed decisions, and effectively manage risks throughout the project lifecycle.

Absorbing risk impact: This criterion ranked 1st in terms of factor loading with a value of 0.792, however ranked 3rd on mean score ranking with a value of 3.81 within the group. Risk management expertise in PPP projects includes the capacity to absorb and manage the impact of risks. Partners need to assess their financial strength, organizational resilience, and risk appetite to determine their ability to withstand the consequences of potential risks. A partner with robust financial resources and risk management systems is better positioned to absorb unexpected costs, delays, or other adverse events. This ability to absorb risk impacts reduces the potential negative consequences on the project’s overall objectives and ensures its long-term viability.

Exploiting Risks: With a factor loading of 0.777 this criterion ranked 3rd and on mean score ranking ranked last within the group. Risk management expertise in PPP projects extends beyond risk mitigation to also encompass the identification and exploitation of potential opportunities. Effective risk management involves recognizing risks that may present opportunities for value creation, innovation, or improved project outcomes. Partners with strong risk management expertise possess the capability to identify and assess these risks, develop strategies to exploit them, and derive mutual benefits from the project. This proactive approach to risk management can lead to enhanced project performance, increased efficiency, and better outcomes for both parties.

Bargaining power of a party: This criterion ranked 2nd in terms of mean score with a value of 3.86 and ranked last in factor loading with a value of 0.72 having least amount of correlation with the principle component withing the group. The bargaining power of a party in a PPP project can significantly influence risk management expertise. A partner with stronger bargaining power may have greater leverage to negotiate risk allocation, risk-sharing mechanisms, and contractual provisions that favor their risk management strategies. This includes negotiating favorable terms related to risk transfer, insurance coverage, dispute resolution mechanisms, and performance guarantees. The ability to assert bargaining power effectively can help optimize risk management arrangements and align them with the party’s risk appetite and capabilities.

In summary, risk management expertise in PPP projects encompasses the experience of partners, their ability to absorb risk impacts, their capacity to exploit risks for mutual benefit, and their bargaining power. By leveraging their experience, partners can apply effective risk management practices, anticipate challenges, and implement mitigation strategies. The capacity to absorb risk impacts ensures the project’s financial viability and resilience. Identifying and exploiting risks as opportunities can lead to improved project outcomes. Finally, effective bargaining power enables partners to negotiate risk allocation and contractual provisions that align with their risk management strategies. By considering these factors, partners can enhance their risk management expertise, increasing the likelihood of successful outcomes in PPP projects.

RACG2: Core risk management capability

Core risk management capability explained variance of 20.58% against an eigenvalue of 1.846 and combined with RACG1 explained 51.604% of cumulative variance. Furthermore, it ranks first amongst the group on mean score rank with a mean value of 4.04 representing high importance. It consists of three RAC, namely, RAC1 “Response to risk”; RAC8 “Minimize risk loss” and RAC5 “Low risk cost”. The risk allocation criterion in this group mainly relate to the efficiency of risk response in PPP projects. Response to the risk should be such that not only does it minimize the impact of the risk, but also does it in a cost-effective way. RAC 1 and RAC8 corresponding to high importance with values of 4.12 and 4.08 ranked 1st and 2nd within the group. RAC1 also achieved the highest value (0.824) of factor loading not only in this group but amongst all other criterion as well.

In the context of public-private partnerships (PPPs), risk response refers to the actions taken by project stakeholders to address and mitigate risks throughout the various phases of the project’s lifecycle. The goal of risk response in PPPs is to either avoid risks altogether or minimize the likelihood and impact of their occurrence.

Risk response in PPPs involves proactive measures aimed at identifying potential risks and implementing strategies to prevent them from materializing or to mitigate their consequences. This proactive approach is crucial because PPP projects often span long periods, involve multiple stakeholders, and carry inherent complexities and uncertainties.

One aspect of risk response in PPPs is risk avoidance. This approach seeks to eliminate or bypass risks by making strategic adjustments to project plans, designs, or methodologies. For example, if a particular risk is identified during the planning phase of a road infrastructure project, the project stakeholders might choose to alter the route to avoid environmentally sensitive areas or to mitigate potential geological risks.

Risk mitigation is another key component of risk response in PPPs. It involves implementing measures to reduce the likelihood or impact of identified risks. This can include the use of advanced technology, robust safety protocols, contingency plans, or alternative construction methods. For instance, in a PPP project involving the construction of a high-rise building, the project team might employ state-of-the-art fire suppression systems and emergency evacuation procedures to mitigate the risk of fire incidents.

Furthermore, risk transfer is a strategy commonly utilized in PPPs. It involves the allocation of specific risks to the party best equipped to manage them. For example, the private sector partner in a PPP project may assume certain construction or operational risks based on their expertise, experience, and access to specialized resources. This transfer of risks allows each party to focus on areas where they have a comparative advantage, leading to more efficient risk management.

It is important to note that risk response in PPPs requires a collaborative approach and clear contractual agreements. The responsibilities and obligations of each party regarding risk management should be clearly defined and communicated. This ensures that risk response measures are properly implemented and that there is a shared understanding of risk allocation and mitigation strategies.

By focusing on risk response throughout the lifecycle of a PPP project, stakeholders can enhance the project’s resilience, optimize performance, and safeguard the interests of all involved parties. Effective risk response contributes to a more sustainable and successful delivery of infrastructure projects under the PPP framework.

RACG3: Risk management strategy

“Risk management strategy” obtained 12.615% of the variance explained with an eigenvalue of 1.135 and consists of two subfactors, namely, RAC7 “Risk attitude”; and RAC2 “Risk foresight” with factors loadings of 0.810 and 0.750, respectively. The overall mean score of the group was 3.93 deeming this group important. These two criteria relate more with the approach and behaviour of risk management in an organization. Risk management approach can be traditional, agile, enterprise, resilience, collaborative or a combination of these. Similarly risk behaviour can be risk seeking, risk averse or risk neutral. Overall, these factors can greatly influence the way risk managers foresee and predict the risk probability and impact of a risk. The relevance of these items is also well-documented in literature (Akintoye, Beck and Hardcastle, 2008; Jin, Zhang and Yang, 2012; Nisar, 2007).

Risk management strategy in public-private partnership (PPP) projects involves the systematic approach adopted by parties to identify, assess, mitigate, and monitor risks throughout the project lifecycle. Several factors, including the risk attitude and risk foresight of a party, play a crucial role in shaping the risk management strategy in PPP projects.

Risk attitude: This criterion obtained the least mean score among all the criteria with a value of 3.52 and was considered least important in respondents’ opinions. Risk attitude refers to a party’s willingness to take on risks and their approach to managing them. Different parties may have varying risk attitudes, ranging from risk-averse to risk-seeking. A risk-averse party is cautious and prefers conservative risk management strategies, aiming to minimize potential negative impacts. On the other hand, a risk-seeking party is more willing to accept higher levels of risk in pursuit of potential rewards. Understanding the risk attitude of each party involved in the PPP project is essential for developing a risk management strategy that aligns with their preferences and objectives.

The risk attitude of a party influences various aspects of risk management, including risk allocation, risk-sharing mechanisms, and the level of contingency planning. For example, a risk-averse public authority may seek to transfer significant construction risks to the private partner through a robust contractual framework, while a risk-seeking private partner may be more willing to accept such risks in exchange for potential financial gains. By considering the risk attitude of each party, the risk management strategy can be tailored to strike a balance between risk mitigation and risk-sharing, ensuring a mutually acceptable approach.

Risk foresight: With a mean score of 4.34, this criterion ranked 1st among all of the criteria representing high importance. Risk foresight refers to the ability of a party to anticipate and identify potential risks that may arise during the course of the PPP project. It involves a proactive approach to risk management, whereby parties actively assess and analyze future uncertainties and emerging risks. Effective risk foresight requires a thorough understanding of the project’s context, the industry, and the specific risks associated with the project’s scope and objectives.

Parties with strong risk foresight capabilities engage in comprehensive risk assessments, scenario planning, and use predictive models to anticipate potential risks. By identifying risks in advance, parties can incorporate appropriate risk mitigation measures into the project’s design, planning, and contractual arrangements. This proactive approach helps to minimize the potential negative impacts of risks and enhances the overall risk management strategy.

Risk foresight also enables parties to make informed decisions about risk allocation, contractual provisions, and the selection of risk management tools and techniques. For example, if a party identifies a potential risk related to environmental regulations, they may incorporate strict environmental standards into the project’s requirements or engage in early stakeholder consultation to mitigate the risk of public opposition.

By considering both risk attitude and risk foresight, parties can develop a comprehensive risk management strategy in PPP projects. This strategy should encompass risk identification, risk assessment, risk allocation, risk mitigation measures, and ongoing monitoring and control. Effective risk management strategies align with the parties’ risk preferences, anticipate future risks, and enable proactive measures to minimize negative impacts. Through a well-defined risk management strategy, parties can enhance the project’s resilience, protect their interests, and improve the chances of successful project outcomes in PPP projects.

Conclusion

PPPs have been increasingly adopted by governments worldwide as a preferred procurement approach for public infrastructure projects. In such projects, private sectors are often required to take on many of the risks that have traditionally been borne by governments. Although risk transfer is a key factor in achieving value-for-money, its implementation has been criticized as contentious and challenging. As such, achieving the optimal allocation of risks is crucial to ensuring the success of PPP projects. The traditional approach of allocating risks through negotiation have been criticized for its lack of objectivity. This study investigated nine RAC identified from previous literature to determine capability-based risk management. Data was gathered thorough a questionnaire survey from PPP projects in New Zealand. Mean score tanking was utilized to understand importance ranking of criterion and factor analysis was used to understand the underlying relation among the criteria and resulted in three factor groupings. Core risk management capability of a party was found to be the most significant of groups with the highest eigenvalue and percentage of variance explained. Mean score analysis results show that three criteria namely risk foresight, response to risk and minimize risk loss were considered of high importance with values of 4.34, 4.12 and 4.08 respectively. Risk attitude was considered least important with a mean score value of 3.52. Risk group “risk management expertise”, comprising of four criteria explained most amount of variance (31.09%) with an eigenvalue of 2.79.

The research findings may be limited in their generalizability for several reasons. Firstly, the number of responses received was relatively low despite all efforts made to increase it. However, the sample size was considered adequate when compared to similar studies, and meaningful conclusions can still be drawn for future practice and reference. Secondly, the less common mode of PPPs in New Zealand, DBFMO, and the fact that survey participants were involved in various types of PPPs (such as transport, schools, and prisons) may limit the generalizability of the results to other regions of the world. Nevertheless, given the unique nature of PPPs in New Zealand, the research findings remain valuable for guiding future research and informing international policy practices. The results of this study provide a foundational framework that governments and private developers can employ to achieve more effective risk allocation. In addition, these findings will enable researchers to undertake similar empirical studies on the subject of capability-based risk allocation in other types of PPP projects be it in terms of the model employed such as BOT, BOOT etc or type of infrastructure delivered i.e. transport or power and social. Future research can also be focused on drawing comparisons between different types of PPP models based on the result from this study.

Acknowledgments

The authors express gratitude to the professionals from the industry who contributed to this study, as well as to the editors and anonymous reviewers for their valuable comments that enhanced the overall quality of this paper.

References

Akintoye, A., Beck, M. and Hardcastle, C., 2008. Public-private partnerships: managing risks and opportunities. John Wiley & Sons.

Akomea-Frimpong, I., Jin, X. & Osei-Kyei, R. 2020. A holistic review of research studies on financial risk management in public–private partnership projects. Engineering, Construction and Architectural Management. https://doi.org/10.1108/ECAM-02-2020-0103

Alonso‐Conde, A. B., Brown, C. & Rojo‐Suarez, J. 2007. Public private partnerships: Incentives, risk transfer and real options. Review of Financial Economics, 16, 335-349. https://doi.org/10.1016/j.rfe.2007.03.002

Ameyaw, E. E. & Chan, A. P. 2015a. Evaluation and ranking of risk factors in public–private partnership water supply projects in developing countries using fuzzy synthetic evaluation approach. Expert Systems with Applications, 42, 5102-5116. https://doi.org/10.1016/j.eswa.2015.02.041

Ameyaw, E. E. & Chan, A. P. 2015b. Risk ranking and analysis in PPP water supply infrastructure projects: An international survey of industry experts. Facilities, 33, 428-453. https://doi.org/10.1108/F-12-2013-0091

Ameyaw, E. E. & Chan, A. P. 2016. A fuzzy approach for the allocation of risks in public–private partnership water-infrastructure projects in developing countries. Journal of Infrastructure Systems, 22, 04016016. https://doi.org/10.1061/(ASCE)IS.1943-555X.0000297

Ameyaw, E. E. & Chan, A. P. C. 2015c. Risk allocation in public-private partnership water supply projects in Ghana. Construction Management and Economics, 33, 187-208. https://doi.org/10.1080/01446193.2015.1031148

Ammons, D. N. 2019. Productivity barriers in the public sector. Public Productivity Handbook. CRC Press.

Arndt, R. & Maguire, G. 1999. Private Provision of Public Infrastucture: Risk Identification and Allocation Project, Department of Treasury & Finance and Department of Civil Enfironmental ….

Babatunde, S. O., Perera, S., Zhou, L. & Udeaja, C. 2016. Stakeholder perceptions on critical success factors for public-private partnership projects in Nigeria. Built Environment Project and Asset Management, 6, 74-91. https://doi.org/10.1108/BEPAM-11-2014-0061

Bayliss, K. & Waeyenberge, E. V. 2018. Unpacking the public private partnership revival. The Journal of Development Studies, 54, 577-593. https://doi.org/10.1080/00220388.2017.1303671

Bing, L., Akintoye, A., Edwards, P. J. & Hardcastle, C. 2005. The allocation of risk in PPP/PFI construction projects in the UK. International Journal of Project Management, 23, 25-35. https://doi.org/10.1016/j.ijproman.2004.04.006

Carbonara, N., Costantino, N., Gunnigan, L. & Pellegrino, R. 2015. Risk management in motorway PPP projects: empirical-based guidelines. Transport reviews, 35, 162-182. https://doi.org/10.1080/01441647.2015.1012696

Chung, D., Hensher, D. A. & Rose, J. M. 2010. Toward the betterment of risk allocation: Investigating risk perceptions of Australian stakeholder groups to public-private-partnership tollroad projects. Research in Transportation Economics, 30, 43-58. https://doi.org/10.1016/j.retrec.2010.10.007

Cui, C., Liu, Y., Hope, A. & Wang, J. 2018. Review of studies on the public–private partnerships (PPP) for infrastructure projects. International Journal of Project Management, 36, 773-794. https://doi.org/10.1016/j.ijproman.2018.03.004

Froud, J. 2003. The Private Finance Initiative: risk, uncertainty and the state. Accounting, organizations and society, 28, 567-589. https://doi.org/10.1016/S0361-3682(02)00011-9

Hartono, B., Ghifari, M. D. A. & Dianita, O. 2021. Risk Allocation Preferences in Indonesian Electricity PublicPrivate Partnership Projects: A Conjoint Analysis. IEEE Engineering Management Review. https://doi.org/10.1109/EMR.2021.3087809

Ibrahim, A. D., Price, A. D. F. & Dainty, A. R. J. 2006. The analysis and allocation of risks in public private partnerships in infrastructure projects in Nigeria. Journal of Financial Management of Property and Construction, 11, 149-164. https://doi.org/10.1108/13664380680001086

Irwin, T. 2007. Government guarantees: Allocating and valuing risk in privately financed infrastructure projects, World Bank Publications. https://doi.org/10.1596/978-0-8213-6858-9

Jin, X. H. & Doloi, H. 2008. Interpreting risk allocation mechanism in public-private partnership projects: An empirical study in a transaction cost economics perspective. Construction Management and Economics, 26, 707-721. https://doi.org/10.1080/01446190801998682

Jin, X. H. & Zhang, G. 2011. Modelling optimal risk allocation in PPP projects using artificial neural networks. International Journal of Project Management, 29, 591-603. https://doi.org/10.1016/j.ijproman.2010.07.011

Jin, X. H., Zhang, G. & Yang, R. J. 2012. Factor analysis of partners’ commitment to risk management in public-private partnership projects. Construction Innovation, 12, 297-316. https://doi.org/10.1108/14714171211244550

Kaluarachchi, Y. 2022. Implementing data-driven smart city applications for future cities. Smart Cities, 5, 455-474. https://doi.org/10.3390/smartcities5020025

Karim, A. & Alkaf, N. 2011. Risk allocation in public private partnership (PPP) project: a review on risk factors. International Journal of Sustainable Construction Engineering Technology, 2.

Ke, Y., Wang, S. and Chan, A.P., 2010. Risk allocation in public-private partnership infrastructure projects: comparative study. Journal of infrastructure systems, 16(4), pp.343-351. https://doi.org/10.1061/(ASCE)IS.1943-555X.0000030

Ke, Y., Wang, S., Chan, A. P. & Lam, P. T. 2010. Preferred risk allocation in China’s public–private partnership (PPP) projects. International Journal of Project Management, 28, 482-492. https://doi.org/10.1016/j.ijproman.2009.08.007

Ke, Y., Wang, S. & Chan, P. C. 2008. Revelation of the Channel Tunnel’s failure to risk allocation in Public-Private Partnership projects. China Civil Engineering Journal. 41, 97-102.

Ke, Y., Wang, S. Q. & Chan, A. P. C. 2013. Risk Misallocation in Public-Private Partnership Projects in China. International Public Management Journal, 16, 438-460. https://doi.org/10.1080/10967494.2013.825508

Lam, K. C., Wang, D., Lee, P. T. & Tsang, Y. T. 2007. Modelling risk allocation decision in construction contracts. International journal of project management, 25, 485-493. https://doi.org/10.1016/j.ijproman.2006.11.005

Li, B., Akintoye, A., Edwards, P. J. and Hardcastle, C., 2005. Critical success factors for PPP/PFI projects in the UK construction industry. Construction management and economics, 23(5), pp.459-471. https://doi.org/10.1080/01446190500041537

Li, J. & Zou, P. X. 2011. Fuzzy AHP-based risk assessment methodology for PPP projects. Journal of Construction Engineering and Management, 137, 1205-1209. https://doi.org/10.1061/(ASCE)CO.1943-7862.0000362

Lima, S., Brochado, A. & Marques, R. C. 2021. Public-private partnerships in the water sector: A review. Utilities Policy, 69, 101182. https://doi.org/10.1016/j.jup.2021.101182

Liu, Y., Sun, C., Xia, B., Liu, S. & Skitmore, M. 2018. Identification of Risk Factors Affecting PPP Waste-to-Energy Incineration Projects in China: A Multiple Case Study. Advances in Civil Engineering, 2018. https://doi.org/10.1155/2018/4983523

Loosemore, M. & McCarthy, C. 2008. Perceptions of contractual risk allocation in construction supply chains. Journal of professional issues in engineering education practice, 134, 95-105. https://doi.org/10.1061/(ASCE)1052-3928(2008)134:1(95)

Mazher, K. M. 2019. Risk assessment and allocation model for public-private partnership infrastructure projects in Pakistan. The Hong Kong Polytechnic University.

Mazher, K. M., Chan, A. P. C., Zahoor, H., Ameyaw, E. E., Edwards, D. J. & Osei-Kyei, R. 2019. Modelling capability-based risk allocation in PPPs using fuzzy integral approach. Canadian Journal of Civil Engineering, 46, 777-788. https://doi.org/10.1139/cjce-2018-0373

Mazher, K. M., Chan, A. P. C., Zahoor, H., Khan, M. I. & Ameyaw, E. E. 2018. Fuzzy Integral-Based Risk-Assessment Approach for Public-Private Partnership Infrastructure Projects. Journal of Construction Engineering and Management, 144. https://doi.org/10.1061/(ASCE)CO.1943-7862.0001573

Nisar, T. M., 2007. Risk management in public–private partnership contracts. Public Organization Review, 7, pp.1-19. https://doi.org/10.1007/s11115-006-0020-1

Ng, A. & Loosemore, M. 2007. Risk allocation in the private provision of public infrastructure. International Journal of Project Management, 25, 66-76. https://doi.org/10.1016/j.ijproman.2006.06.005

Norusis, M., 2008. SPSS 16.0 statistical procedures companion. Prentice Hall Press.

OECD. 2012. Strategic transport infrastructure needs to 2030. Paris, France: OECD Publishing.

Osei-Kyei, R., Chan, A. P. and Ameyaw, E. E., 2017. A fuzzy synthetic evaluation analysis of operational management critical success factors for public-private partnership infrastructure projects. Benchmarking: An International Journal, 24(7), pp.2092-2112. https://doi.org/10.1108/BIJ-07-2016-0111

Osei-Kyei, R. & Chan, A. P. 2021. Model for Assessing the Success Index of Public-Private Partnership Projects. International Best Practices of Public-Private Partnership: Insights from Developed & Developing Economies. Springer. https://doi.org/10.1007/978-981-33-6268-0

Osei-Kyei, R., Narbaev, T., Atafo-Adabre, M., Chileshe, N. and Ofori-Kuragu, J. K., 2023. Critical success criteria for retirement village public–private partnership housing. Construction Innovation, 23(5), pp.1018-1037. https://doi.org/10.1108/CI-11-2021-0206

Osei–Kyei, R., Tam, V. & Ma, M. 2021. Risk Assessment of Retirement Village Public-Private Partnership Homes. Journal of Aging and Environment. https://doi.org/10.1080/26892618.2021.1932010

PMI. 2013. A guide to the Project Management Body of Knowledge (PMBOK guide). Newton Square, Pa. Project Management Institute.

Raisbeck, P., Duffield, C. & Xu, M. 2010. Comparative performance of PPPs and traditional procurement in Australia. Construction Management and Economics, 28, 345-359. https://doi.org/10.1080/01446190903582731

Rasheed, N., Shahzad, W., Khalfan, M. & Rotimi, J. O. B. 2022. Risk identification, assessment, and allocation in PPP projects: A systematic review. Buildings, 12, 1109. https://doi.org/10.3390/buildings12081109

Rasheed, N., Wahid, I., Shahzad, W. & Rotimi, J. O. B. Understanding the Factors Critical to Success of PPPs in New Zealand: Public and Private Sector Standpoint. Proceedings–New Zealand Built Environment Research Symposium, 2020. 13.

Rybnicek, R., Plakolm, J. & Baumgartner, L. 2020. Risks in public–private partnerships: A systematic literature review of risk factors, their impact and risk mitigation strategies. Public Performance & Management Review, 43, 1174-1208. https://doi.org/10.1080/15309576.2020.1741406

Savrukov, A. N., Savrukov, N. T. & Kozlovskaya, E. A. 2020. Risk assessment of public-private partnership in Russia based on the fuzzy logic method. Voprosy Ekonomiki, 2020, 132-143. https://doi.org/10.32609/0042-8736-2020-10-132-143

Schieg, M. 2006. Risk management in construction project management. Journal of Business Economics Management, 7, 77-83. https://doi.org/10.3846/16111699.2006.9636126

Shrestha, A., Chan, T. K., Aibinu, A. A. & Chen, C. 2017. Efficient risk transfer in PPP wastewater treatment projects. Utilities Policy, 48, 132-140. https://doi.org/10.1016/j.jup.2017.03.003

Shrestha, A., Chan, T. K., Aibinu, A. A., Chen, C. & Martek, I. 2018. Risk Allocation Inefficiencies in Chinese PPP Water Projects. Journal of Construction Engineering and Management, 144. https://doi.org/10.1061/(ASCE)CO.1943-7862.0001457

Shrestha, N. 2021. Factor analysis as a tool for survey analysis. American Journal of Applied Mathematics and Statistics, 9, 4-11. https://doi.org/10.12691/ajams-9-1-2

Tang, L. & Shen, Q. J. 2013. Factors affecting effectiveness and efficiency of analyzing stakeholders’ needs at the briefing stage of public private partnership projects. International Journal of Project Management, 31, 513-521. https://doi.org/10.1016/j.ijproman.2012.10.010

Thomas, A. V., Kalidindi, S. N. & Ananthanarayanan, K. A. B. T. 2003. Risk perception analysis of BOT road project participants in India. Construction Management and Economics, 21.4, 393-407. https://doi.org/10.1080/0144619032000064127

Wahid, I., Shahzad, W., Rasheed, N. & Rotimi, J. O. B. 2023. Analysis of Theoretical Viewpoints Explaining the Performance Differentials of Construction Firms. International Journal of Construction Education and Research, 1-24. https://doi.org/10.1080/15578771.2023.2172108

Wang, Y. & Zhao, Z. J. 2018. Performance of Public–Private Partnerships and the Influence of Contractual Arrangements. Public Performance and Management Review, 41, 177-200. https://doi.org/10.1080/15309576.2017.1400989

Wibowo, A. & Kochendoerfer, B. 2010. Selecting BOT/PPP infrastructure projects for government guarantee portfolio under conditions of budget and risk in the Indonesian context. Journal of Construction Engineering and Management, 137, 512-522. https://doi.org/10.1061/(ASCE)CO.1943-7862.0000312

Wu, Y., Xu, C., Li, L., Wang, Y., Chen, K. & Xu, R. 2018. A risk assessment framework of PPP waste-to-energy incineration projects in China under 2-dimension linguistic environment. Journal of cleaner production, 183, 602-617. https://doi.org/10.1016/j.jclepro.2018.02.077

Xiong, W., Zhao, X., Yuan, J.-F. & Luo, S. 2017. Ex post risk management in public-private partnership infrastructure projects. Project Management Journal, 48, 76-89. https://doi.org/10.1177/875697281704800305

Xu, Y., Chan, A. P. C. & Yeung, J. F. Y. 2010. Developing a fuzzy risk allocation model for PPP projects in China. Journal of Construction Engineering and Management, 136, 894-903. https://doi.org/10.1061/(ASCE)CO.1943-7862.0000189

Xu, Y., Yang, Y., Chan, A. P., Yeung, J. F. & Cheng, H. 2011. Identification and allocation of risks associated with PPP water projects in China. International Journal of Strategic Property Management, 15, 275-294. https://doi.org/10.3846/1648715X.2011.617867

Zhang, L., Zhao, Z., Chai, J. & Kan, Z. 2019. Risk identification and analysis for PPP projects of electric vehicle charging infrastructure based on 2-tuple and the DEMATEL model. World Electric Vehicle Journal, 10. https://doi.org/10.3390/wevj10010004

Zhu, L., Yuan, J. & Du, J. 2007. The study of administration right of government base on PPP contract. Construction Economics, 10, 54-57.