Construction Economics and Building

Vol. 23, No. 3/4

December 2023

RESEARCH ARTICLE

Non-toll Revenue Potential to Increase Funding Sources for Toll Road Maintenance

Betty Susanti*, Edi Kadarsa, Mona Foralisa, Ika Juliantina

Department of Civil Engineering, Universitas Sriwijaya, Jalan Raya Palembang-Prabumulih KM. 32, Inderalaya, Ogan Ilir, Indonesia

Corresponding author: Betty Susanti, Department of Civil Engineering, Universitas Sriwijaya, Jalan Raya Palembang-Prabumulih KM. 32, Inderalaya, Ogan Ilir, Indonesia, bettysusanti@ft.unsri.ac.id

DOI: https://doi.org/10.5130/AJCEB.v23i3/4.8876

Article History: Received 01/08/2023; Revised 22/10/2023; Accepted 22/11/2023; Published 23/12/2023

Abstract

The purpose of providing toll road infrastructure through Public-Private Partnerships (PPP) is to ensure that the private sector generates sufficient revenue to manage road operations and maintenance effectively. However, in many countries, various practices of PPP have led to budget shortfalls for road operations and maintenance. This situation is often due to escalating construction costs and lower-than-expected traffic volumes. To address these financial challenges, this study aimed to implement asset commercialization schemes within toll road management. A specific case study was conducted on a section of the Indonesian Trans Sumatra toll road that faced rising construction costs and low traffic volumes. A quantitative approach was applied to assess potential non-toll revenue that could be generated through asset commercialization along toll road corridors. The commercialization opportunities considered included leasing land for advertisements, installing solar power plants, erecting communication towers, and establishing rest area businesses. The identification and analysis of these opportunities were closely tied to the type, quantity, and location of the asset. The results showed that asset commercialization schemes, particularly land leases for advertisements and rest area businesses, had potential to generate substantial revenue. It showed that by fully capitalizing on asset commercialization opportunities along toll road corridors, significant additional income could be generated to support road maintenance funding. The approach developed in this study could be applied to other toll road sections facing revenue deficits and budgetary challenges in maintaining their operations. This study could contribute to the growing body of knowledge on the commercialization of toll road assets.

Keywords

Asset Commercialization; Road Funding; Non-toll Revenue; Road Maintenance

Introduction

The responsibility for providing road infrastructure is primarily with the government. However, the growing demand and the increasing complexity of the infrastructure system needs to be consistent with the government’s financial capabilities. Public-Private Partnerships (PPP) has become an alternative approach to financing toll road infrastructure. The implementation of PPP in toll road provision aims to generate revenue for the private sector, ensuring the provision of quality road services during the operational and maintenance phases. However, many PPP projects in various countries have encountered deficits according to Castelblanco, et al. (2022), Cherkos and Jha (2020) and Endo, Gianoli and Edelenbos (2020). The main contributors to these deficits are rising construction costs and declining traffic volumes, leading to reduced toll road revenue (de Albornoz, et al., 2021; Lv, et al., 2021; Wraharjo, Susanti and Kadarsa, 2021). Consequently, a strategy is essential to increase revenue, ensuring adequate funding for road operations and maintenance activities.

Several quantitative approaches can improve the feasibility of private sector investment in toll road provision. These approaches include optimizing the concession period (Lu and Meng, 2023; Feng, et al., 2019; Jin, et al., 2019), optimization of toll rates and traffic capacity (Shi, An and Chen, 2020), estimating government support (Pellegrino, 2021; Wang, et al., 2019), and optimizing capital structure and financial variables (Chung, 2020; Liu, et al., 2020; Chen, et al., 2023). The government can also provide subsidies for socially beneficial but financially unprofitable PPP projects, such as Minimum Traffic Guarantee (MTG) and Minimum Revenue Guarantee (MRG) (Jin, Zhang and Song, 2020; Jin, et al., 2021; He, Shi and Li, 2022; Zhang, et al., 2021). However, it is essential to acknowledge that these arrangements need to be established during the concession agreement formulation phase, rather than toll operational phase. A toll road that faces inaccurate planning problems after being operational is exposed to significant risks, including rising construction costs and decreasing traffic volumes. The unpredictability of traffic volume on newly constructed toll roads creates a unique challenge, affecting the operational funding of the road (Jin, et al., 2020). Therefore, it becomes crucial to explore additional sources of non-toll revenue during the operational phase of toll roads in such conditions to ensure adequate funds for road operations and maintenance.

Improving revenue during the operation of infrastructure can be achieved through the commercialization of infrastructure assets. In the transportation sector, commercialization typically consists of renting an asset for advertising, as detailed in Czajkowski, et al. (2022), Hinton, Watson and Oviedo-Trespalacios (2022), and Faroqi, Mesbah and Kim (2019). The potential revenue generated from commercializing assets is substantial, especially through the rental and placement of advertisements on transportation assets such as buses, bus stops, trains, and stations. A study by Silverberg (1998) suggested that potential for alternative revenue in transportation agencies remained largely untapped, with limited exploration on the commercialization potential of transportation infrastructure assets. This situation persists today, as indicated by Jammalamadaka, et al. (2017), and Wraharjo, Susanti and Kadarsa (2022), demonstrating the minimal consideration of non-toll revenue as an additional income sources for toll roads beyond primary operational activities. A review by Hoeflich and Witt (2019) showed numerous potential sources of non-toll revenue, including land leases, advertisements, logo signs, service plaza naming rights, communication towers, 5G network antenna leases, electric charger stations, Truck Parking Information Management Systems, etc. Additionally, Perkasa, Utomo and Santoso (2023) showed that revenue from advertisements and land leases in rest areas could contribute to non-toll revenue.

Indonesia is currently in the process of intensively constructing toll roads to enhance national transportation accessibility. Many of the existing toll road sections face challenges related to low traffic volume and inadequate planning, resulting in a limited budget for operations and maintenance (Wraharjo, Susanti and Kadarsa, 2021). Previous studies have identified potential revenue from asset commercialization based on practices in the transit sector. However, there is a need for a quantitative approach to calculate potential revenue from commercialization on toll roads. This study aims to analyse potential non-toll revenue that can be obtained through asset commercialization schemes. It contributes to existing explorations by developing a quantitative approach for calculating potential revenue from toll road asset commercialization and provides insights into how revenue generated from road asset commercialization can improve road maintenance funding.

Literature review

This section provides a literature review on asset commercialization in transportation infrastructure, along with an introduction to engineering economics concepts for calculating the Present Value (PV) of income and annual worth from investment activities.

Concept of Asset Commercialization in Transportation Infrastructure

Investing in toll road infrastructure demands substantial capital and comprises risks at every phase, starting from project planning to construction and operation, to maintenance. In general, the private sector’s return on investment comes after a prolonged period. According to Solak (2022), challenges related to toll road feasibility often arise from rising construction costs and decreasing revenue. Construction expenses make up a significant portion of the total investment, leading to a reduction in the private sector’s return due to increased costs. Issues also arise concerning toll road operating revenue, which primarily consists of toll collection from road users. The increase in construction costs and the decrease in toll revenue impact road maintenance funding and, consequently, toll road service quality.

Numerous schemes have been developed to improve the financial feasibility of toll road investments, including conventional and alternative approaches. These efforts need to be outlined and agreed upon in the toll road concession agreement but cannot be implemented during construction and operation. Rising construction costs and reduced traffic volume pose significant risks to the private sector. Additional measures are necessary to improve operating revenue beyond toll collection. One viable approach is through the commercialization of road infrastructure assets, as showed by Czajkowski, et al. (2022) and Faroqi, Mesbah and Kim (2019).

Asset commercialization is a strategy aimed at enhancing operational capability and capacity to meet cost recovery targets, as described by Li and Love (2019). In the transportation sector, asset commercialization takes the form of renting assets for advertising (Silverberg, 1998; Małecki, Jankowski and Szkwarkowski, 2019). A study by Litman (2022) assessed 18 funding options in the transportation sector, showing that advertising and station rentals could provide additional income to cover public transport operational costs. Another example from Xuto, et al. (2023) proposed that light rail transit (LRT) station advertisements could generate substantial revenue. Jin, et al. (2020) explored alternative revenue strategies in toll road industry.

Silverberg (1998) emphasized the significant revenue potential from advertisements, which many transportation agencies had yet to fully realize. While the willingness to pay (WTP) for advertisements was relatively high, investigation into revenue potential from advertising on transportation infrastructure asset was still evolving. Additionally, the study indicated that advertising management by third parties or marketing firms was considered more effective and efficient, allowing asset owners or managers to derive net income from leasing infrastructure asset.

Apart from advertisements, non-toll road revenue can be generated through the rental of assets for utility installations and rest area businesses. Hoeflich and Witt (2019) conducted a study that showed how the vacant land alongside toll road can be leased for various purposes, including installing communication towers, network antennas, power plants, and electric charging stations. This practice has already begun in Indonesia, with solar power plants and communication towers being installed. However, there is a lack of quantitative data regarding potential income from this asset commercialization scheme, primarily because leasing land for utility installations is relatively new. Another study by Sihombing (2017) suggested that land could also be leased for rest area businesses, particularly on inter-city roads with significant stretches. The recent explorations on asset commercialization through land leases along toll road rights-of-way (ROW) in Indonesia have focused on technical, social, and economic or financial aspects. Despite the implementation of road asset commercialization in some Indonesian toll road, little attention has been paid to revenue potential for financing road operations and maintenance. This implies that there is an urgent need for scientific evidence regarding the long-term revenue potential.

Financial Indicator of Asset Commercialization Revenue

Potential revenue from asset commercialization can be evaluated and calculated using the financial indicator known as PV. This approach offers an overview of the total revenue’s equivalent worth from the commercialization of toll road asset at present. Essentially, PV calculation includes converting or discounting all future revenue to its PV at a specific rate of return (Blank and Tarquin, 2012). The calculation of PV is based on the following equation:

PV = R0 + (R1/1+i) + (R2/(1+i)2) + … + (Rt/(1+i)t) (1)

where R = income in the analysis period (0th year (early year of analysis) to year t), i = discount rate, and t = analysis period

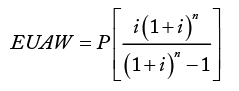

The present worth of the total revenue can be converted into an equivalent uniform annual worth (EUAW), providing an overview of the annual equivalent value of revenue from toll road asset commercialization during the analysis period. The calculation of EUAW is represented by the following equation:

(2)

(2)

where P = PV of revenue, i = discount rate, and n = analysis period

The two indicators are widely used in financial investment analyses, as recommended by Blank and Tarquin (2012), making them suitable for assessing income in toll road asset commercialization studies.

Methodology

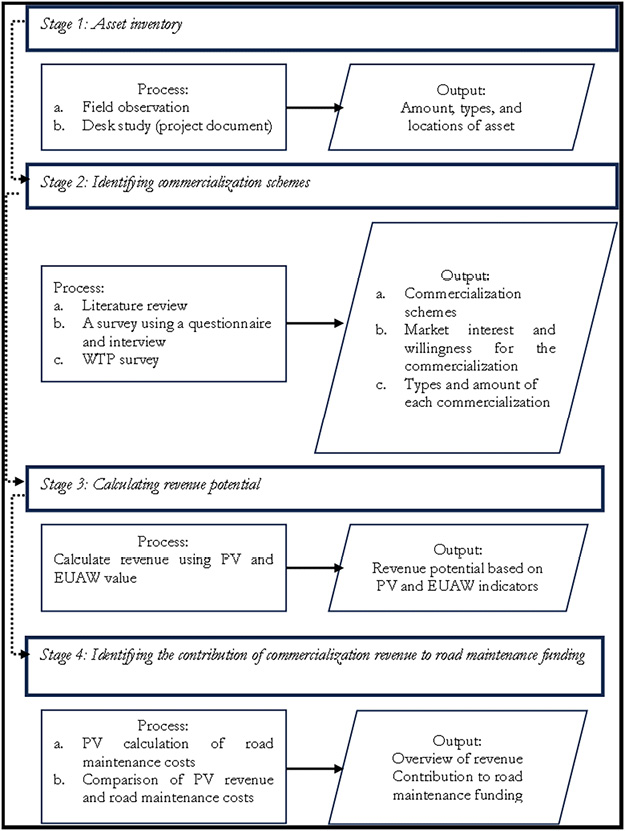

This study used a quantitative approach to calculate potential non-toll revenue generated from commercializing assets along toll road corridors. The case study focused on one toll road section that faced challenges of rising construction costs and reduced traffic volume compared to initial projections. The investigation was conducted in several stages, as seen in Figure 1. The initial stage consisted of asset inventory and the identification of suitable commercialization schemes for the targeted toll road sections. Asset inventory along toll road corridors was conducted through on-site surveys at the constructed toll road segments by examining project planning documents.

After the on-site observations, commercialization schemes were determined based on the conditions of toll road assets. These schemes consisted of various possibilities drawn from a literature review of commercialization in the transportation infrastructure sector. Commercialization potential was assessed in terms of advertisements, utility installations including power plants and communication towers, and opportunities for rest area businesses. The identification and analysis of commercialization potential were directly linked to the types, quantities, and locations of assets determined in the previous stage.

The subsequent stage comprised calculating potential revenue generated by each commercialization scheme. This calculation considered the interest and willingness of third parties to participate in toll-road asset commercialization. Considering the 40-year concession period, which includes a 5-year construction phase, revenue projections were calculated from the 6th year until the end of the concession period. The calculation used financial indicators such as PV and EUAW. Finally, this study assessed the contribution of asset commercialization revenue to road maintenance funding.

Result and Discussion

Case Study

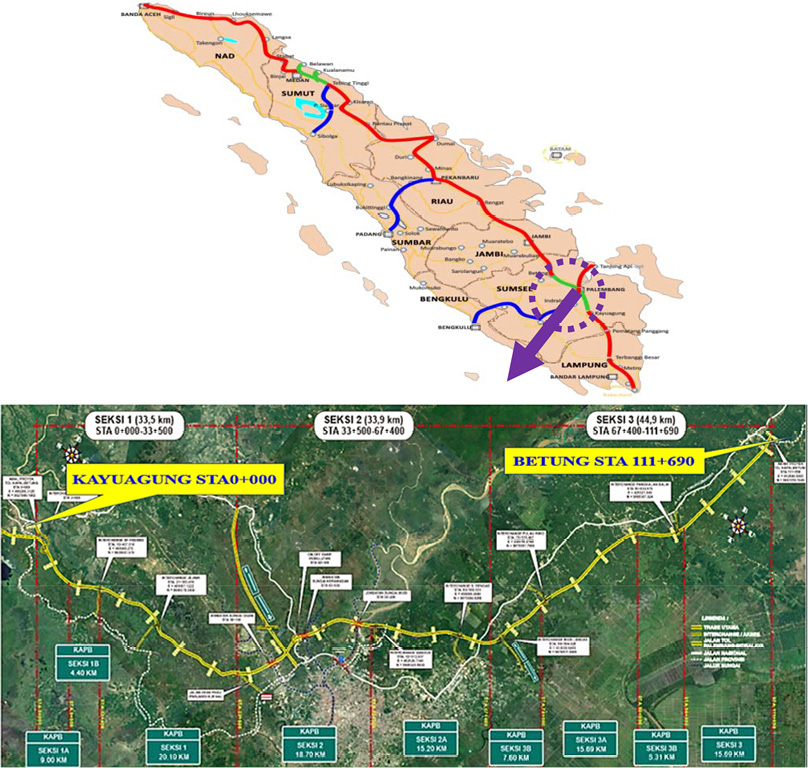

The case study focused on Kayu Agung-Palembang-Betung (KAPB) toll road section in the Province of South Sumatra, Indonesia, as shown in Figure 2. This section was part of the Trans Sumatra toll road network, covering the second-largest island in Indonesia with an area of 473,600 km2. KAPB toll road extended for a total length of 111.69 kilometers out of the Trans Sumatra toll road’s total length of 1,980 kilometers. It connected seven major cities, serving as crucial centers of national activities on Sumatra Island.

Figure 2. Trans Sumatra-Indonesia toll road map

Construction of KAPB toll road section began in 2017 and was scheduled for full operation by 2025. The construction was executed in two phases, with the first phase covering 42.5 kilometres and the second phase comprising 69.19 kilometres. Toll road’s location primarily traversed swampy terrain, characterized by soft soil layers and river crossings of varying widths. Initial planning did not provide detailed site information, leading to significant cost increase for soil improvement during construction and adjustments to the design of special-span bridges to expedite the construction process.

The cost increase became even more significant due to the additional work that was required to provide pedestrian bridge facilities at several locations. It was estimated that the total cost of completing the toll road construction would increase by up to 100% compared to the contract value. Another area that required improvement during the operational phase of KAPB toll road was the low traffic volume compared to the planned volume. Section 1 of KAPB road had been in operation since April 2020. The target was to first achieve an average traffic volume of 21,344 vehicles per day. However, by October 2023, the highest actual traffic volume reached only 9,553 vehicles per day. The average daily traffic during 2023 was 8,611 vehicles per day.

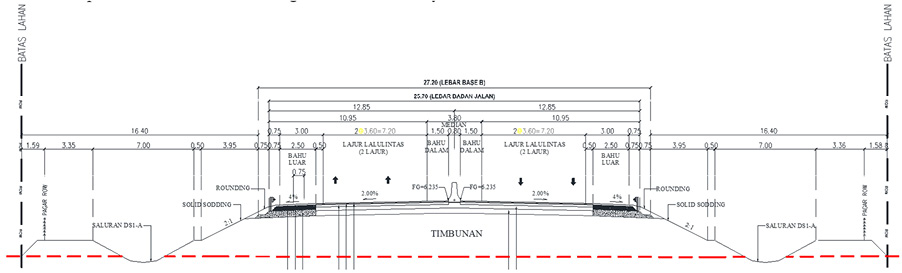

The typical construction of the KAPB toll road was shown in Figure 3, with ROW and traffic lanes having widths of 60 meters and 2 x 3.60 meters, respectively. The pavement width from Sta 0+000 to 42+500 was 25.70 meters, while from Sta 42+500 to 111+690, it was 29 meters. The outer shoulder width was 3 meters from Sta 0+000 to 42+500 and 2.5 meters from Sta 42+500 to 111+690. There were 15-17 meter-wide vacant lands on both the left and right sides of roadway.

Figure 3. Typical road transverse profile

This toll road section included various structural buildings such as pedestrian bridge overpasses, underpasses, bridges, and toll gates. The field survey from Sta 0+000 to 33+500 showed three pedestrian bridge overpasses, 11 bridges, four underpasses, and two toll gates. From Sta 33+500 to 111+690, there were 28 pedestrian bridge overpasses, four underpasses, five bridges, and three long-span bridges, along with 15 pedestrian bridge overpasses and seven toll gates. Additionally, there were two pairs or 4 units of rest areas along toll road.

Asset Inventory and Commercialization Schemes

The survey conducted along toll road and the study of project planning documents showed that vacant lands on roadsides and pedestrian bridges could have been used for commercialization. Interviews with toll road managers identified the types of asset and commercialization schemes that were applied to this toll road section, as shown in Table 1. Advertising schemes were implemented on the vacant lands on both sides of road, including installing advertisements on the walls of pedestrian bridges. Two advertising media options were considered, namely billboards and Videotron. Furthermore, the vacant lands on both sides of road were suitable for utility installations and rest area businesses.

A comprehensive survey consisting of structured interviews was carried out with 50 respondents, representing the marketing, ownership, or cooperation divisions of various companies, agencies, and organizations. The primary objective of these interviews was to gauge their interest in advertising on the KAPB toll road section. The survey results showed that property development firms, government and private banks, telecommunications network providers, the food and beverage industry, the cigarette industry, private educational institutions, hoteliers, restaurant owners, and political organizations showed a high level of interest in advertising on toll road.

A survey was conducted to assess interest in utility installations along toll roads. This survey targeted both state and regional government-owned enterprises and private companies included in power generation and telecommunications networks. Interviews with seven respondents, representing technical and marketing managers within these companies, indicated a strong interest in leasing land along the ROW of KAPB toll road. Potential for commercializing toll road assets also extended to the development of rest areas. In accordance with Regulation of the Minister of Public Works and Housing No. 28 of 2021, toll road agencies are mandated to establish rest areas at a minimum distance of 50 kilometres for Type A rest areas (large rest areas with comprehensive public facilities) and a minimum distance of 30 kilometres for Type B rest areas (smaller and less equipped than Type A). This regulation signified a promising opportunity for developing rest areas along toll roads. Structured interviews were conducted with 50 respondents, representing food retailers in South Sumatra Province, to measure their interest in establishing businesses within the rest area of KAPB toll road. Additionally, based on Government Regulation No. 17 of 2021 concerning toll roads, toll agencies needed to allocate at least 30% of the rest area for Small and Medium-sized Enterprises (SMEs). Therefore, the survey consisted of food retailers representing both SME and non-SME categories.

It should be acknowledged that land rental prices play a crucial role in determining income from asset commercialization. Therefore, identifying WTP value among third parties interested in renting the land is essential. Survey was conducted using a questionnaire distributed to 60 respondents, representing advertising management companies, food retailers, and firms engaged in power generation and telecommunications networks. The questionnaire was thoughtfully designed to include a range of WTP values for each commercialization scheme. Table 2 showed the values of WTP for various commercialization schemes. According to the table, the highest WTP was observed for land leases intended for solar power plants, while the lowest was associated with kiosk rentals at rest areas by SMEs. Land rentals for advertisements and non-SME kiosk rentals showed similar values.

| No. | Purpose | WTP of Land Rent (IDR/unit/year) |

|---|---|---|

| 1 | Billboards, sign boards | 30,000,000-40,000,000(a) |

| 2 | Videotron | 40,000,000-50,000,000(a) |

| 3 | SME kiosks at a rest area | 10,000,000-20,000,000(b) |

| 4 | Non-SME kiosks at a rest area | 30,000,000-40,000,000(b) |

| 5 | Solar power plants | 200,000,000-300,000,000(c) |

| 6 | Communication towers | 60,000,000-80,000,000(d) |

Notes: Data sources

a) Advertising service companies; b) Food retail business; c) State-and-regional-owned enterprises engaged in the energy development sector; d) State-and-regional-owned enterprises engaged in communication network providers

Revenue Potential

Revenue from asset commercialization was determined by combining WTP value and the number of advertisements, utilities and kiosks available for installation and rental in the rest area. To provide clarity, Table 3 showed the assumptions used in calculating asset commercialization revenue. WTP for each commercialization scheme was based on the median value within the range shown in Table 1. According to survey results from advertising service companies, during the initial phase of KAPB toll road asset commercialization, it was anticipated that only 10% of the maximum advertising capacity would be used. This percentage was projected to increase by 10% annually until it reached maximum capacity. Similarly, insights from toll managers indicated that kiosk rentals in the rest area were expected to reach only 50% during the initial period and would gradually increase by 10% until maximum capacity was reached. Furthermore, it was assumed that one utility unit would be installed during the initial phase of asset commercialization, with land rental rates for each commercialization scheme increasing by 10% annually.

Table 4 also showed the commercialization schemes for rest area businesses and land leases for utility installations. In this specific road section, there were four rest areas, and the feedback obtained from toll road managers suggested that each of the area could potentially accommodate approximately 20-30 tenants. Based on the existing operational conditions of the Trans Sumatra toll road, the area could realistically host only 20 tenants. In accordance with Government Regulation No. 17/2021, every toll road agency needs to allocate 30% of the rest area for Small and Medium-sized Enterprises (SMEs). Considering the assumption that each rest area could accommodate up to 20 tenants, this would translate to six slots available for SMEs, totalling 24 units. Additionally, there were 56 slots for non-SME tenants across all rest areas along this toll road. Toll road manager insights also showed that the rental rate for units within the area during the initial year of operation was expected to reach only 50%, with incremental annual increase of 10% till maximum capacity was achieved.

Interviews with toll road managers showed that land leasing for utility installations would include solar power plants and cellular towers. On this road section, it was feasible to construct a solar power plant with a 2-megawatt capacity alongside ROW. The vacant land adjacent to ROW could also be used for the installation of cellular towers. Each utility was anticipated to lease land for one solar power plant and one cellular tower. Insights from toll road managers suggested that land lease rates could increase by 10% annually.

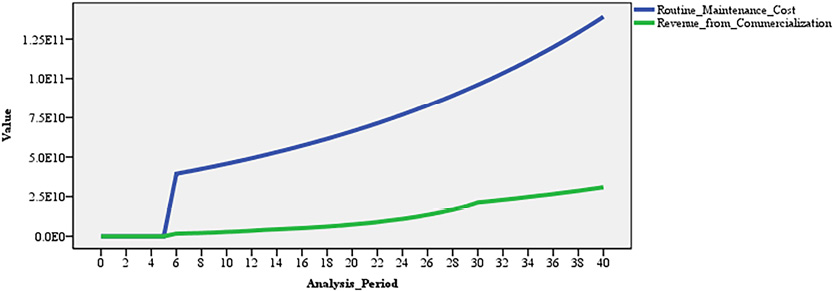

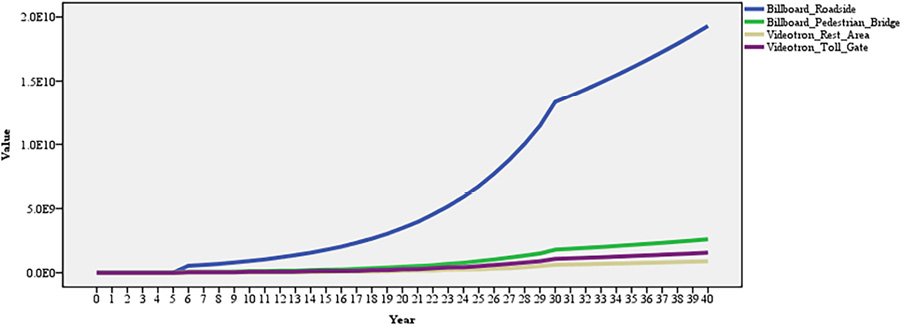

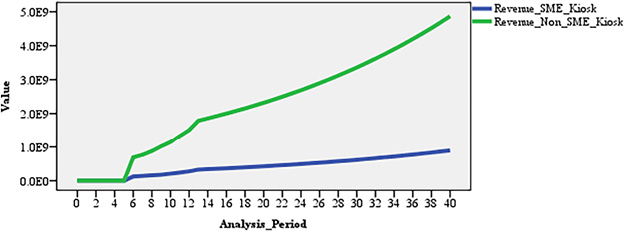

The concession period for this toll road spanned 40 years, comprising a 5-year construction phase for all sections and 35 years of operation. To be consistent with the initial operation period and toll road’s concession duration, revenue analysis period for commercialization was set to match the concession period, with revenue from commercialization assumed to commence when toll road operations began. The total revenue generated from commercialization was calculated using the PV indicator. Detailed results of revenue calculations from asset commercialization were shown in Figure 4.

(a) Revenue from the land lease for advertisements

(b) Revenue from a land lease for utility installation

(c) Revenue from the land lease for rest area business

Figure 4. Revenue from toll road asset commercialization

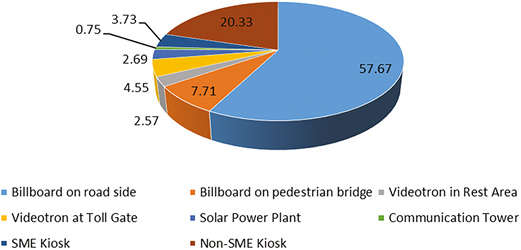

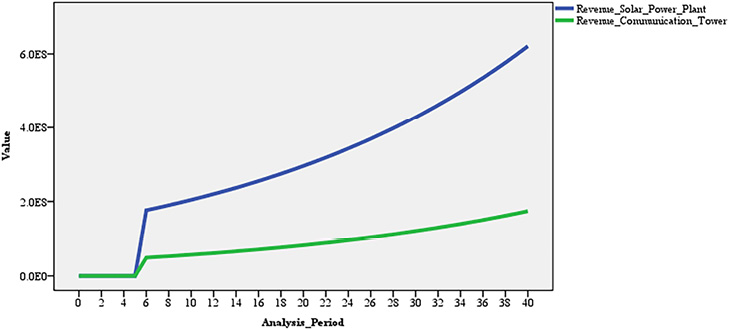

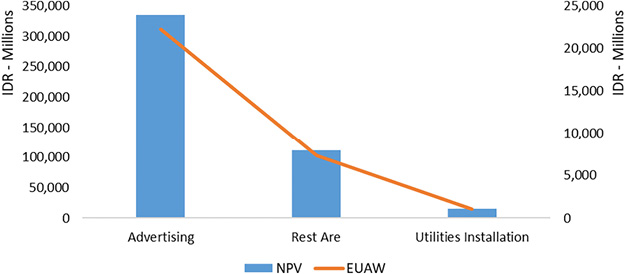

Revenue from commercialization, as calculated by PV, was then transformed into EUAW to represent the annual revenue in a consistent value. In line with PV outcomes, EUAW calculations reaffirmed that the highest revenue was derived from land leasing for advertisements, as shown in Figure 5. The land lease scheme for advertisements significantly contributed, accounting for 72.5% of the total revenue generated through asset commercialization, as shown in Figure 6. Advertisements using billboards positioned alongside the toll road became the primary revenue sources, contributing 57.7% of the total income from asset commercialization. While the remaining two commercialization schemes constituted only 27.5% of the total commercialization revenue, their financial significance could not be disregarded.

Figure 5. Comparison of PV and EUAW for various commercialization schemes

Figure 6. Percentages of revenue for various commercialization schemes

When translated into EUAW, the combined income from all commercialization schemes amounted to IDR 30,659,958,301 per annum. This substantial sum played a crucial role in offsetting the routine maintenance expenses of toll roads. Based on an annual routine road maintenance cost of IDR 500,000,000 per kilometre with a 10% annual increment, the income generated through asset commercialization could potentially cover more than 22% of the total road maintenance costs, provided that all advertisements and rest area businesses reached their maximum capacity, as seen in Figure 7.

Figure 7. Comparison of routine maintenance costs and commercialization revenue

Discussion

This study showed that the most significant revenue potential from toll road asset commercialization came from advertisements. This scenario was recorded primarily due to the greater number of advertising units that could be accommodated compared to other commercialization schemes. Despite the initial assumption of limited interest in advertisements, starting at only 10% and increasing by 10% annually, it showed the substantial revenue potential of advertisements. This study correlated with the discovery of Li and Love (2019), Mendelsohn (2015), and Simatupang, Ulinata and Diyanti (2021) emphasizing that advertising on transportation facilities and streets held potential for substantial additional income. Revenue generated from roadside advertisements could play an important role in maintaining road infrastructure (Czajkowski, et al., 2022).

The practice of leasing land for installing utilities such as solar power plants and cellular communication towers represented a common form of asset commercialization. Silverberg (1998) suggested that commercialization practices, including land leases along the ROW, were adopted by 63% of transit agencies. Leasing vacant land along ROW to other companies could generate a steady stream of passive income for toll road agencies. These results further corroborated studies conducted by Xuto, et al. (2023) and Bayraktar, et al. (2016), emphasizing that ROW leases for various utility installations offered additional income opportunities for transit agencies.

Obtaining quantitative data on income from asset commercialization on toll road was challenging, as there were limited references available. Insights from Indonesia’s largest state-owned toll road management company shed light on this matter. In 2019, PT. Jasa Marga reported non-toll revenue amounting to IDR 145,084,000,000, attributed to land rentals for advertisements and utilities. This income was generated from leasing land spanning 512 kilometres of toll road corridors, out of a total operational toll road length of 1,162 kilometres under PT. Jasa Marga’s management. This revenue closely paralleled potential income identified in this study, affirming that optimizing asset commercialization through land leases along toll road corridors could indeed yield substantial additional income. It should be acknowledged that the calculations adopted a pessimistic scenario regarding the Value of WTP and the number of units for each commercialization scheme. This implied that the actual potential revenue possibly exceeded the figures presented in the current study.

Among the various commercialization schemes explored, the leasing of non-SME kiosks in rest areas was distinct as a strategy with significant income-maximizing potential. Non-SME kiosk rentals contributed to an 84% increase in potential additional income compared to SME. This was mainly because WTP for non-SME rentals exceeded that of SME kiosks, and also offered a greater number of units. This discovery was in line with Tsamboulas, Evgenikos and Strogyloudis (2006) suggesting that rest areas or service areas held revenue-generating potential for the rest area managers.

Conclusion

In conclusion, this study introduced a quantitative approach for assessing potential revenue from toll road asset commercialization. Furthermore, it outlined innovative revenue strategies applicable to private sector contribution in managing toll roads facing financial feasibility challenges. These strategies were implemented during the operational and maintenance phases, addressing issues related to project cost and revenue estimation inaccuracies. The results showed that non-toll revenue generated through asset commercialization significantly contributed to funding the maintenance activities. Specifically, land leasing for advertisements and rest area businesses became lucrative commercialization avenues, making them a priority for augmenting income alongside toll collections. This quantitative approach could be adapted to assist other toll road sections facing similar financial feasibility issues.

Based on the limited scope of study on additional revenue potential for toll roads, further exploration was essential. Toll managers possessed valuable assets that various entities were willing to pay for, whether for advertising, utilities, or other ventures. This study primarily focused on renting vacant land along road corridors for asset commercialization. However, potential for asset commercialization could expand in situations where toll managers took a more active role in managing advertisements, rest areas and utility businesses. Another limitation of this study was the use of a deterministic approach in determining potential revenue from commercialization schemes. Further investigations using a probabilistic approach needed to be conducted in order to provide a better perspective of potential revenue prediction.

References

Bayraktar, M.E., Arif, F., Ponder, D., Prozzi, J. and Mahmoud, N.V., 2016. Opportunities for value extraction projects in highway rights-of-way and development of feasibility assessment tool. Journal of Construction Engineering and Management, [e-journal] 142(8), pp.1-13. https://doi.org/10.1061/(ASCE)CO.1943-7862.0001080

Blank, L. and Tarquin, A., 2012. Engineering Economy. New York: Mc-Graw Hill.

Castelblanco, G., Guevara, J., Mesa, H. and Hartmann, A., 2022. Social legitimacy challenges in toll road PPP programs: Analysis of the Colombian and Chilean cases. Journal of Management in Engineering, [e-journal] 38(3), pp.1-15. https://doi.org/10.1061/(ASCE)ME.1943-5479.0001010

Chen, J., Yu, J., Shen, Z., Song, M. and Zhou, Z., 2023. Debt financing and maintenance expenditure: Theory and evidence on government-operated toll roads in China. Economic Systems, [e-journal] 47(1), pp.1-17. https://doi.org/10.1016/j.ecosys.2022.101049

Cherkos, F.D. and Jha, K.N., 2020. Enabling successful application of PPPs in new (inexperienced) markets: Implications of PPPs’ success and failure in toll roads. Journal of Legal Affairs and Dispute Resolution in Engineering and Construction, [e-journal] 12(4), pp.1-13. https://doi.org/10.1061/(ASCE)LA.1943-4170.0000434

Chung, J.H., 2020. Debt/equity tradeoff model for revenue based DBFOM PPP transportation infrastructure: Case study of I-95 (VA) Express Lanes. Construction Research Congress 2020: Project Management and Controls, Materials, and Contracts. pp. 1177-1185. Tempe, Arizona: American Society of Civil Engineers (ASCE). https://doi.org/10.1061/9780784482889.125

Czajkowski, M., Bylicki, M., Budziński, W. and Buczyński, M., 2022. Valuing externalities of outdoor advertising in an urban setting – the case. Journal of Urban Economics, [e-journal] 130, pp.1-14. https://doi.org/10.1016/j.jue.2022.103452

de Albornoz, V.A., Soliño, A.S., Galera, A.L. and Álvarez, J.M., 2021. Bankrupt PPPs: Is it really so bad? Case study of R-3 and R-5 toll motorways in Spain. Transport Policy, [e-journal] 114, pp.78-87. https://doi.org/10.1016/j.tranpol.2021.09.007

Endo, K., Gianoli, A. and Edelenbos, J., 2020. Coming to financial close in PPPs: Identifying critical factors in the case of toll road projects in Indonesia. Public Works Management and Policy, [e-journal] 26(2), pp.1-29. https://doi.org/10.1177/1087724X20914627

Faroqi, H., Mesbah, M. and Kim, J., 2019. Behavioural advertising in the public transit network. Research in Transportation Business and Management, [e-journal] 32, pp.1-9. https://doi.org/10.1016/j.rtbm.2019.100421

Feng, K., Wang, S., Wu, C., Xia, G. and Hu, W., 2019. Optimization of concession period for Public Private Partnership toll roads. Inzinerine Ekonomika-Engineering Economics, [e-journal] 30(1), pp.24-31. https://doi.org/10.5755/j01.ee.30.1.19215

He , Y., Shi, L., and Li, Z., 2022. Early termination mechanism of Public–Private Partnership transportation projects with government guarantee. Journal of Infrastructure Systems, [e-journal] 28(4). https://doi.org/10.1061/(ASCE)IS.1943-555X.0000720

Hinton, J., Watson, B. and Oviedo-Trespalacios, O., 2022. A novel conceptual framework investigating the relationship between roadside advertising and road safety: The driver behaviour and roadside advertising conceptual framework. Transportation Research Part F: Traffic Psychology and Behaviour, [e-journal] 85, pp.221-35. https://doi.org/10.1016/j.trf.2021.12.002

Hoeflich, K. and Witt, K., 2019. The evolution of non-toll revenue sources . Kansas City, Missouri: HNTB.

Jammalamadaka, P., Jarmarwala, Y., Zhou, L., Mokkapati, N. and Hirunyanitiwattana, W., 2017. Evaluation of traffic and revenue risks of toll roads and managed lane facilities. Advances in Public-Private Partnerships. pp.460-72). Austin, Texas: American Society of Civil Engineers. https://doi.org/10.1061/9780784480267.036

Jin, H., Liu, S., Li, J. and Liu, C., 2020. Imperfect information bargaining model for determining concession period of PPPs under revenue uncertainty. Journal of Legal Affairs and Dispute Resolution in Engineering and Construction, [e-journal] 12(2), pp.1-10. https://doi.org/10.1061/(ASCE)LA.1943-4170.0000382

Jin, H., Liu, S., Liu, C. and Udawatta, N., 2019. Optimizing the concession period of PPP projects for fair allocation of financial risk. Engineering, Construction and Architectural Management, [e-journal] 26(10), pp.2347-63. https://doi.org/10.1108/ECAM-05-2018-0201

Jin, H., Liu, S., Sun, J. and Liu, C., 2021. Determining concession periods and minimum revenue guarantees in public-private-partnership agreements. European Journal of Operational Research, [e-journal] 291(2), pp.512-24. https://doi.org/10.1016/j.ejor.2019.12.013

Jin, L., Zhang, Z. and Song, J., 2020. Profit allocation and subsidy mechanism for Public–Private Partnership toll road projects. Journal of Management in Engineering, [e-journal] 36(3), pp.1-10. https://doi.org/10.1061/(ASCE)ME.1943-5479.0000766

Li, X. and Love, P.E., 2019. Employing land value capture in urban rail transit Public Private Partnerships: Retrospective analysis of Delhi’s airport metro express. Research in Transportation Business and Management, [e-journal] 32, pp.1-13. https://doi.org/10.1016/j.rtbm.2020.100431

Litman, T., 2022. Local Funding Options for Public Transportation. Victoria, Canada: Victoria Transport Policy Institute.

Liu, H., Song, S., Hu, Y. and Yan, X., 2020. Monte-Carlo optimization model for dynamic capital structure adjustment in Chinese Public-Private Partnerships under revenue uncertainty. Transportation Research Part A: Policy and Practice, [e-journal] 142, pp.115-28. https://doi.org/10.1016/j.tra.2020.10.010

Lu, Z. and Meng, Q., 2023. Effects of asymmetric investment cost information on revenue-compensated build-operate-transfer highway contracts. Transportation Research Part B: Methodological, [e-journal] 172, pp.71-92. https://doi.org/10.1016/j.trb.2023.03.011

Lv, J., Lin, M., Zhou, W. and Xu, M., 2021. How PPP renegotiation behaviors evolve with traffic changes: Evolutionary game approach. Journal of Construction Engineering and Management, [e-journal] 147(5), https://doi.org/10.1061/(ASCE)CO.1943-7862.0002024

Małecki, K., Jankowski, J. and Szkwarkowski, M., 2019. Modelling the impact of transit media on information spreading in an urban space using cellular automata. Symmetry, [e-journal] 11(3), pp.1-21. https://doi.org/10.3390/sym11030428

Mendelsohn, P., 2015. Review of Roadside Advertising. Glasgow: Scottish Roads Research Board.

Pellegrino, R., 2021. Effects of public supports for mitigating revenue risk in Public–Private Partnership projects: model to choose among support alternatives. Journal of Construction Engineering and Management, [e-journal] 147(12), pp.248–61. https://doi.org/10.1061/(ASCE)CO.1943-7862.0002098

Perkasa, A.R., Utomo, C. and Santoso, E.B., 2023. A review of research methods on highest and best use for toll rest area. Materials Today, [e-journal] 85, pp.19-23. https://doi.org/10.1016/j.matpr.2023.05.247

PT. Jasa Marga (Persero), 2019. Annual Report. Jakarta: PT. Jasa Marga (Persero).

Shi, S., An, Q. and Chen, K., 2020. Optimal choice of capacity, toll, and subsidy for build-operate-transfer roads with a paid minimum traffic guarantee. Transportation Research Part A: Policy and Practice, [e-journal] 139, pp.228-54. https://doi.org/10.1016/j.tra.2020.06.023

Sihombing, L.B., 2017. Project finance and risk modelling using a system dynamic approach: a toll road project. Malaysian Journal of Industrial Technology, 2(2), pp.86-93.

Silverberg, B.R., 1998. Transit Advertising Revenue: Traditional and New Sources and Structures. Washington, DC: National Academy Press.

Simatupang, S., Ulinata, U. and Diyanti, G., 2021. Questioning the common of the street in relation to outdoor advertisements in it. IOP Conference Series: Earth and Environmental Science. 878, pp. 1-7. Jakarta: IOP Publishing. https://doi.org/10.1088/1755-1315/878/1/012015

Solak, A.O., 2022. Toll roads in Turkey: Private versus public. Case Studies in Transport Policies, [e-journal] 10(2), pp.1110-17. https://doi.org/10.1016/j.cstp.2022.03.019

Tsamboulas, D., Evgenikos, P. and Strogyloudis, M.A., 2006. The financial viability of motorway rest areas. Public Works Management and Policy, [e-journal] 11(1), pp.63-77. https://doi.org/10.1177/1087724X06292333

Wang, H., Liu, Y., Xiong, W. and Zhu, D., 2019. Government support programs and private investments in PPP markets. International Public Management Journal, [e-journal] 22(3), pp.499-523. https://doi.org/10.1080/10967494.2018.1538025

Wraharjo, M., Susanti, B. and Kadarsa, E., 2022. Financial feasibility analysis of cost and traffic volume: Case study on toll road investment project. Engineering and Applied Science Research, [e-journal] 49(3), pp.308-15. http://doi.org/10.14456/easr.2022.32.

Xuto, P., Anderson, R.J., Graham, D.J. and Hörcher, D., 2023. Sustainable urban rail funding: Insights from a century-long global dataset. Transport Policy, [e-journal] 130, pp.100-15. https://doi.org/10.1016/j.tranpol.2022.10.005

Zhang, S., Li, J., Li, Y. and Zhang, X., 2021. Revenue risk allocation mechanism in Public-Private Partnership projects: Swing option approach. Journal of Construction Engineering and Management, [e-journal] 147(1), pp.1-14. https://doi.org/10.1061/(ASCE)CO.1943-7862.0001952